The Commonwealth Climate and Law Initiative (CCLI) has partnered with the Climate Governance Initiative (CGI) to prepare this briefing for the CGI network.

This briefing provides board directors with a concise but comprehensive overview of nature-related risks and their implications for corporate governance. It covers emerging legal expectations, including recent litigation trends and legal opinions that clarify how directors’ duties apply in the context of nature risks. The briefing also explores disclosure requirements and the growing range of business opportunities linked to effective nature-related risk management.

It is designed for board directors who need to understand how nature-related risks may impact their companies and their own legal responsibilities. Failure to manage these risks appropriately could result in reputational damage, regulatory scrutiny, or even litigation. Directors should come away with a clear understanding of their legal duties relating to nature risks, and steps to take to fulfil those duties. To support this, the briefing includes practical questions directors can use to guide boardroom discussions and inform their oversight of management.

The World Economic Forum’s Principles for Effective Climate Governance provide guidance to mobilise boards on the climate crisis. This briefing supports these principles by demonstrating the requirement for boards to mobilise on the twin climate and nature crises, particularly in relation to board accountability.

You can download a pdf version of this briefing here.

Key takeaways for board directors

- Nature loss and ecosystem collapse are foreseeable, financially material risks over mainstream investment and corporate planning horizons. Board directors should start integrating nature considerations into corporate decision-making; the scale of the risks in the long term is determined by decisions made today.

- Lawyers around the world are starting to recognise that the materiality of nature-related risks supports consideration of these risks by directors in fulfilment of their statutory corporate law duties. It is equally important that directors consider nature-related commercial opportunities as well as risks.

- Mandatory nature-related disclosures are expected to increase, driven by international targets like the Global Biodiversity Framework (GBF). It is likely that states will use the TNFD Recommendations or the International Sustainability Standards Board (ISSB) standards when enacting disclosure regimes. It will therefore be helpful for board directors to be familiar with these disclosure frameworks and standards and their relevance for the organisation.

- Nature-related cases against corporates and financial institutions are being brought under corporate due diligence legislation, under tort law, shareholder rights and anti-money laundering law. It may be easier to prove liability in nature-related claims by attributing an action to a loss, in comparison to climate which often relies on attribution science.

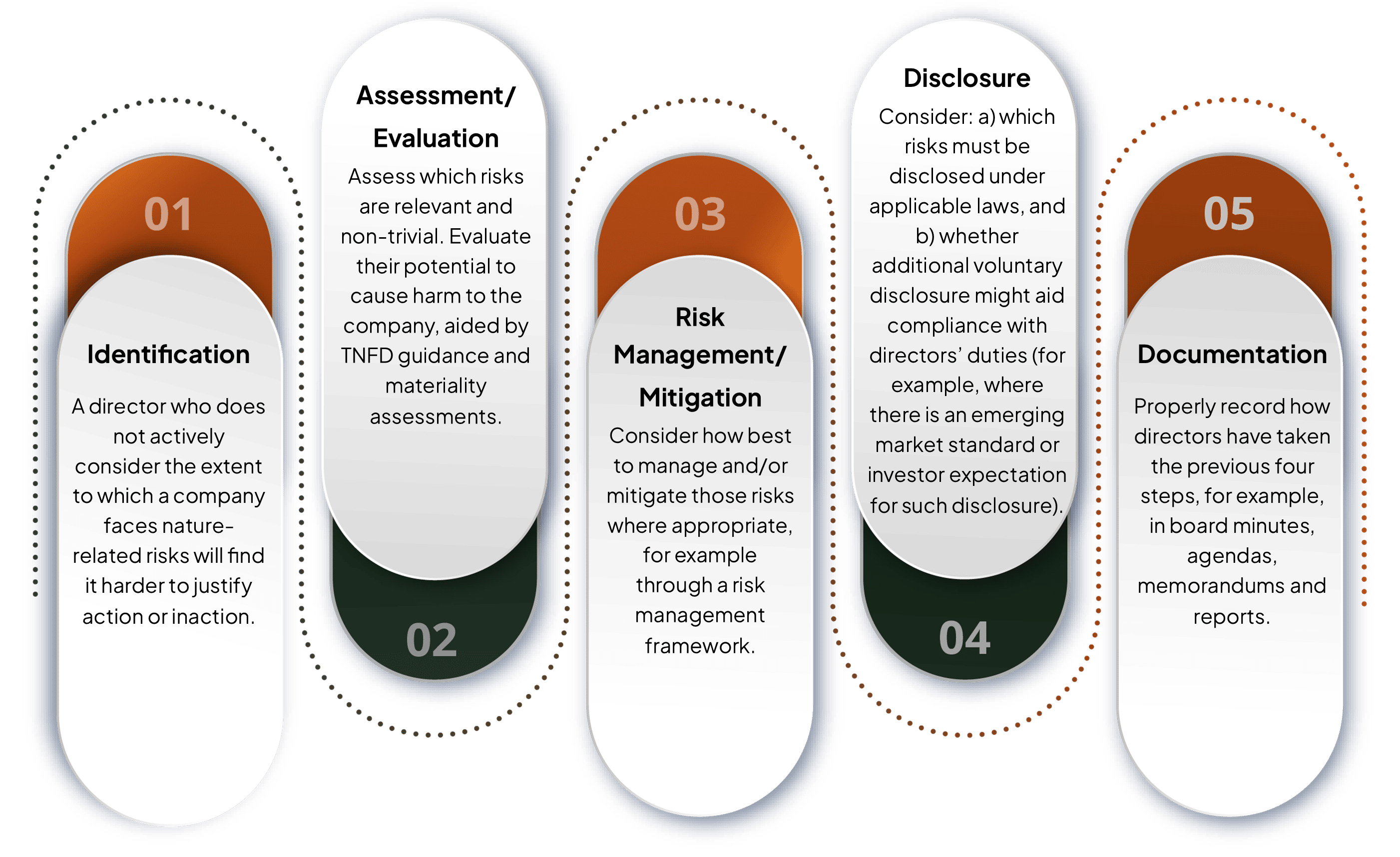

- Directors can take 5-steps to minimise allegations they have breached their legal duties relating to the management of nature risks:

- identify nature risks;

- assess and evaluate which risks are material;

- manage and/or mitigate those risks;

- disclose risks as required (mandatorily or voluntarily); and

- document how the steps have been taken.

Nature-related risks: a growing concern

Although environmental, social and governance (ESG) risks, including nature-related risks, have become increasingly politicised on the global stage, they continue to pose material financial risks to businesses, investors, governments, and society as a whole. These risks are real and are already materialising:

- More than half of the world’s total GDP is moderately or highly dependent on nature and its services. Despite this, biodiversity - the variability among living organisms - is being lost at an increasing rate. The average size of wildlife populations has declined by 73% between 1970 and 2020 and we are using natural resources 1.7 times faster than ecosystems can regenerate them. If left to continue at current rates, biodiversity loss could cost the global economy USD 2.7 trillion annually by 2030.

- In the World Economic Forum’s Global Risks Report 2025, biodiversity loss and ecosystem collapse were ranked as the second most severe risk over 10 years. The proximity of these risks is growing in recognition; they experienced one of the largest increases in ranking by the Forum across all risks, moving from No. 37 in 2009 to No.2 in 2025. But there is equal evidence to show that biodiversity loss and ecosystem collapse pose more immediate risks to business.

- Studies undertaken by central banks in the UK, EU, Netherlands, Malaysia, France, Brazil and across Africa have found their national financial sectors to have high levels of exposure to companies that are highly or very highly dependent on one or more ecosystem services. Other studies have taken place in relation to Lithuania, the Philippines, Georgia and Mexico. In July 2024, the Financial Stability Board published a report on nature-related risks, which highlighted that biodiversity loss and nature risks may have profound effects on the real economy and, in turn, the financial system.

A December 2023 study by BloombergNEF and the Taskforce on Nature-related Financial Disclosures (TNFD) examined 10 instances of companies suffering material financial losses from poorly handled interactions with nature. Some of these are summarised in the table below.

| Company | Type of nature-related risk | Details |

| Physical risks arising from nature-related dependencies

| The construction of Tesla’s Berlin-Brandenburg Gigafactory faced month-long delays in 2022 resulting from environmental campaigners and local authority investigations as to whether the area’s declining groundwater would be able to sustain the facility’s operations. Investors interpreted these delays as a threat to the company’s aggressive expansion plans, worsening falls in the firm’s share price and posing questions over the viability of its long-term operations in the region. |

| Transition risks arising from nature-related impacts manifesting as legal and policy risks

| These companies - being a chemicals producer, plastics manufacturer and mining major respectively - each released harmful materials into watercourses near their operations. This resulted in over USD 10 billion in legal liabilities, revocation of production permits and obstacles to planned equity transfers.

|

| Transition risks arising from nature-related impacts manifesting as market and reputational risks

| These companies – being an oil and fats manufacturer and meat producer respectively – were financially impacted due to deforestation links. In the case of JBS, ongoing criticism of its practices in the Amazon imperilled its long-planned listing in the US, jeopardising up to USD 20 billion in unlocked value and access to capital. |

Key takeaway for boards: Nature-related risks are already translating into real financial consequences - from delayed operations and legal liabilities to reputational damage and constrained access to capital. Boards must take a forward-looking approach, actively identifying and addressing both physical (e.g., water availability) and transition risks (e.g., evolving investor expectations). Boards should ensure the company strategy addresses current and emerging nature-related issues.

Directors' duties and nature-related risks

Generally, directors everywhere owe two core duties when discharging their functions (phrased differently in different countries):

- The duty to promote the success of the company (also described as the duty of loyalty).

- The duty of care (also described as skill, diligence and competence).

Directors exercise these duties in strategic planning, oversight of foreseeable and material risks, and attesting to disclosure and financial reports. Directors’ duties evolve over time because the law commonly assesses the directors’ standard of care and loyalty by reference to the current market, social and regulatory context. This evolving context can raise the standards expected of directors. What may have been considered a reasonable decision 10 years ago might not be reasonable today.

A number of recent legal opinions clarify the position of nature-related risks with respect to directors’ duties (see Figure 1). Even though the legal opinions are jurisdiction-specific, it is likely that similar conclusions will be drawn in other countries.

Nature-related disclosures

Nature-related disclosure requirements and frameworks exist globally, both mandatory (e.g., the EU Deforestation-free Products Regulation) and voluntary (e.g., Taskforce on Nature-related Financial Disclosures (TNFD)).

Mandatory nature-related disclosures are expected to increase, driven by international commitments under the Global Biodiversity Framework (GBF). The GBF, adopted as part of the legally binding Convention on Biological Diversity, sets out global goals and targets, including Target 15, which calls on governments to take measures to encourage and enable businesses to regularly monitor, assess, and transparently disclose their risks, dependencies, and impacts on biodiversity.

It is likely that when governments implement disclosure regimes to achieve Target 15, they will use the TNFD recommendations or International Sustainability Standards Board (ISSB) standards (see Figure 2). The TNFD — an international market-led and science-based initiative supported by national governments, businesses and financial institutions worldwide — has established a set of nature-related disclosure recommendations, with over 500 organisations managing USD 17.7 trillion in assets reporting in line with them. In addition, the ISSB — an international, independent standard setting body within the International Financial Reporting Standard Foundation — has produced standards that are being adopted by jurisdictions representing over half the global economy by GDP. Importantly, the ISSB plans to conduct research on disclosures relating to the risks and opportunities associated with biodiversity, ecosystems, and ecosystem services. When undertaking this research, the ISSB will consider how to build on the TNFD recommendations.

Whilst few countries have adopted mandatory corporate nature-related disclosures, the EU is an exception. Its Corporate Sustainability Reporting Directive (CSRD) requires in-scope companies to disclose information on the risks and opportunities relating to certain ESG factors, which include biodiversity and ecosystems (ESRS E4). Although it’s worth noting that the final scope of the CSRD will be dependent on ongoing revisions to EU sustainability legislation (the so called ‘Omnibus’) which aim to simplify and align requirements under a range of EU rules (FAQs here) and reduce reporting burdens (especially for SMEs).

Litigation risk: relevant updates

Current litigation landscape: To date, no nature-related cases have been brought directly against directors, but claims are emerging in diverse ways that may still pose legal risks to companies and their boards. For the purpose of this section, nature-related litigation does not include climate litigation.

Themes in nature-related litigation: The Network for Greening the Financial System — a coalition of central banks and supervisors — reports that nature-related litigation is:

- Aimed at safeguarding nature and its ability to provide the ecosystem services on which humanity depends.

- Wide-ranging, covering topics such as biodiversity loss, deforestation, protecting vulnerable species, ocean degradation, plastic pollution and the rights-based claims.

- Used by activists, lawyers, and NGOs as a tool to influence policy and regulatory outcomes, as well as to change corporate and societal behaviour.

A range of claimants are bringing cases against states, public entities, corporations, and financial institutions. Litigation against states and public bodies can have knock-on effects for corporations and financial institutions. For example, setting legal precedents that might affect private actors, trigger policy changes, and reviews of permitting processes may all result in increased compliance costs, risk management and business uncertainty.

Cases against corporates and financial institutions are brought under corporate due diligence legislation, under tort law, shareholder rights and anti-money laundering law (see Figure 3).

Future trends and implications for boards: We expect to see more types of ‘tracing’ cases. This is because causation in biodiversity and deforestation claims can be easier to establish by supply chain tracing in comparison to establishing causation in damages-based climate claims, which rely on attribution science. In addition, it is expected that there will be a growth of rights-based nature and climate-nature nexus cases (e.g., ‘forest carbon grabbing’), and corporate responsibility cases, including shareholder actions against directors for breach of duty, greenwashing and linked to due diligence and disclosures.

Threatened or initiated litigation can have far-reaching consequences, even if unsuccessful. Nature-related litigation can be expected to generate nature-related financial risks in three ways (see Figure 4).

Shareholder activism: Shareholder activism related to climate issues is also prevalent, with the start of a shift in focus to nature. Investors filed a record number of biodiversity resolutions in 2024 - 18 biodiversity and deforestation-related shareholder resolutions were filed in 2024 (although some sources report higher), up from 12 in 2023 and 9 in 2022. Resolutions focus on issues such as deforestation in supply chains, deep-sea mining, water use, pesticides in agriculture, and biodiversity impact assessment. Whilst support for these resolutions has dropped sharply, it is anticipated by industry experts that there will be a rising focus on shareholder resolutions focused on nature impacts or risk reporting.

The business case: business opportunities from managing nature-related issues

In addition to managing nature-related risks, it is important that directors consider the commercial opportunities that arise as well. The identification and management of dependencies and impacts on nature can lead to business opportunities. Nature-related opportunities can emerge in two key ways:

- when organisations avoid, reduce, mitigate or manage nature-related risks (e.g., minimising resource exploitation); or

- through the strategic translation of business models, products, services and investments that halt or reverse nature loss (e.g., nature-based solutions).

BloombergNEF has profiled 12 instances of companies that are realising financial gain by mitigating the drivers of nature loss – being land- and sea-use change, natural resource exploitation, climate change, pollution, and invasive alien species.

Some of these examples are summarised in the table below.

| Company | Driver of nature loss mitigated | Details |

| Perfect Day (food technology) | Reducing pressure on land-use | Company reached USD 1.6 billion valuation with an animal-free whey protein that cuts the need for land-intensive livestock in dairy production. |

| Ecolab (science based solutions) | Minimising resource exploitation | Company sells equipment and services to optimise industrial water use and drive efficiency gains, generating USD 4 billion in annual revenue and adjusted earnings growth of 35% year-on-year. |

| PTx Trimble (software) | Reducing pollution | The joint venture sells technology enabling more precise pesticide application. Its majority owner’s annual revenue increased by USD 600 million. |

| Forico (forestry) | Reducing climate change | The company produces sustainable eucalyptus forestry for wood fibre and keeps natural forests for biodiversity uplift and carbon sequestration. The company was acquired for USD 670 million after nine years. |

| Wilder Harrier (food products) | Reducing invasive alien species | The company manufactures pet foods from an invasive silver carp species and sustainable insect protein sources. Has raised USD 3.2 million in seed funding. |

Key takeaways for boards: Understanding how your business and the economy depends on and impacts nature can unlock significant opportunities for value creation. Forward-looking companies are already capturing commercial benefits - from developing nature-positive products and services to improving resource efficiency, accessing new markets, and strengthening long-term resilience. Boards should integrate nature considerations into strategy and innovation pipelines, helping position the business for sustainable growth, stakeholder alignment, and competitive advantage in a transitioning economy.

Conclusion: How can directors minimise allegations of breach of duty?

Directors should take proactive steps to embed nature into corporate governance and risk oversight. This starts with understanding how the company depends on and impacts nature and identifying where these connections could pose material financial, operational, or reputational risks. Factoring nature into strategic decisions and enterprise risk and opportunity management is essential to future-proof the business amid accelerating ecological decline and growing scrutiny from regulators, investors, and stakeholders.

A UK Legal Opinion published in March 2024 recommends five steps directors could take to minimise allegations of breach of duty (see Figure 5). This guidance is useful for directors across the world, particularly in sectors that have a high dependency on nature.

Managing nature-related risks is no longer optional. It is a core component of responsible, forward-looking governance. Directors who engage with these issues will be better placed to meet their legal duties, protect long-term value, and position their companies for resilience in a rapidly changing operating environment.

Questions to ask in the boardroom

In May 2025 the TNFD, in partnership with the CCLI, Chapter Zero, Competent Boards and Green Finance Institute, launched its Asking Better Questions on Nature: For board directors. Directors should use this guide and ask the following 12 questions at board meetings and to company management to identify and assess the information needed to ensure nature-related issues are integrated into governance, strategy, risk management, and capital allocation. The questions should be read in the context of the full guide.

Gaining an overview of nature’s relevance to our business

- How and where does our business depend and impact on nature?

- How do our dependencies and impacts on nature give rise to potential financial and non-financial risks?

- How do our dependencies and impacts on nature generate potential opportunities for the organisation?

- What is the interplay between our nature- and climate-related dependencies, impacts, risks and opportunities?

Integrating nature into decision making

- How are we assessing and measuring our potentially material nature-related dependencies, impacts, risks and opportunities? What data are we using and generating?

- How are we engaging with our value chain and Indigenous Peoples, Local Communities, affected and other stakeholders to understand their views with respect to our nature-related issues?

- How does management integrate nature into short- and long-term decision-making?

Understanding the external context: Market, standards, regulations and investor expectations

- How do we expect our understanding of nature-related issues to change over time in our sector and in the markets and locations in which we operate?

- Are we up to date with shifting regulatory developments, both voluntary and mandatory, industry standards and investor expectations across the jurisdictions in which we operate?

Organisational competence on nature-related issues

- Does the board and senior management team have the requisite skills and experience to adequately manage the organisation’s nature-related issues?

- Are the organisation’s skills and capabilities on nature-related issues, including assessment and learning, being institutionalised for the long term?

Board reflection

- Are we confident that we are fulfilling our legal duties in relation to nature across the jurisdictions in which we operate? What evidence do we have that we are doing so?

Technical Terms

Taskforce on Nature-related Financial Disclosures is a market-led and science-based initiative supported by national governments, businesses and financial institutions worldwide. The TNFD’s recommendations and guidance provide the building blocks to help businesses and financial institutions better understand their nature related impacts, dependencies, risks and opportunities.

Nature-related issues is the collective term for an organisation’s dependencies and impacts on nature, and the risks and opportunities they give rise to. For definitions of nature-related opportunities, impacts, risks and opportunities, see the TNFD Glossary.

Material information is information that, if omitted, misstated or obscured, could reasonably be expected to influence decisions that primary users of general purpose financial reports make on the basis of those reports, which include financial statements and sustainability-related financial disclosures and which provide information about a specific reporting entity. See here for more information.

Global Biodiversity Framework is a legally non-binding international agreement, adopted at COP15 of the Convention on Biological Diversity in December 2022, which sets out a pathway for a world living in harmony with nature by 2050. Among the Framework’s key elements are 4 goals for 2050 and 23 targets for 2030. See more here.

International Sustainability Standards Board is a global standard-setting body under the International Financial Reporting Standards (IFRS) Foundation. The ISSB develops and approves sustainability disclosure standards that aim to provide a global baseline for sustainability reporting, helping companies to disclose information about their sustainability-related risks and opportunities. The ISSB's goal is to ensure that sustainability information is comparable, relevant, and decision-useful for investors and other stakeholders. See more here.

Ecosystem services are the contributions of ecosystems to the benefits that are used in economic and other human activity. See more here.

EU Omnibus is a package of legislative proposals introduced by the European Commission to simplify and modernize EU regulations, particularly in the areas of sustainable finance, due diligence, and investment. The primary goal is to reduce administrative burdens on businesses, enhance EU competitiveness, and attract investment. See more here.

Double materiality has two dimensions, namely: impact materiality and financial materiality. Impact materiality refers to an organisation’s most significant impacts on the economy, environment, and people, including impacts on their human rights. Financial materiality refers to the sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s prospects. Whether an entity is required to disclose information on a double or single materiality (being financial materiality only) basis depends on the regulatory requirements in the jurisdiction. For example, the ISSB standards adopt a single materiality approach, whereas the EU’s Corporate Sustainability Reporting Directive and the Chinese Sustainability Disclosure Standards adopt a doble materiality standard.

Attribution science encompasses a range of research aimed at linking human activities to observed changes in the climate system and corresponding impacts on natural and earth systems. For more information, including its use in litigation, see here.

Important note

This briefing is provided to directors in the Climate Governance Initiative network for educational purposes only. This document is not, and is not intended to be, legal advice. The CCLI, its founders, and partner organisations make no representations and provide no warranties in relation to any aspect of this document, including regarding the advisability of investing in any particular company or investment fund or other vehicle. While we have obtained information believed to be reliable, we shall not be liable for any claims or losses of any nature in connection with information contained in this document, including but not limited to, lost profits or punitive or consequential damages. While efforts have been made to ensure that this document is accurate and free from errors and omissions, this document should not be, and is not intended to be, relied upon for any purposes and readers are advised to conduct their own research and analysis and obtain their own legal advice.

This briefing was prepared by climate and biodiversity lawyer, Jasmin Fraser. For any questions, please contact her at [email protected].