COP30: scaling implementation pathways

From 10 to 21 November 2025, leaders from nearly 200 nations met in Belém, Brazil for COP30. This year’s negotiations emphasised ‘implementation over ambition’, focusing less on ‘what the world must do, rather on how to make it all happen.’ This objective faced a number of challenges, including protest demonstrations, an evacuation due to a fire at the summit venue, and the largest-ever share of fossil fuel lobbyists at any COP sessions. Wider geopolitical tensions also shaped negotiations, underscored by the notable absence of the world’s largest economy, the United States.

Despite these headwinds, in a global context in which emissions are reaching record highs – as set out in the 2025 Global Carbon Budget report – and the gap between climate policy ambition and implementation continues to widen, the need for accelerated, collective climate action is more evident than ever. Echoing this very message, UN Climate Change Executive Secretary, Simon Stiell, closed the negotiations with an assertion that despite progress made, calls for more accelerated action cannot be ignored, urging the international community to hold firm in the belief that “markets are moving, a new economy is rising, while the old polluting one is running out of road.”

Key Messages for Board Directors – COP30 Takeaways

- Make collaboration a board priority: Global climate plans agreed at COP30 will only succeed through strong partnerships. Boards should actively champion alliances with governments, industry peers, and financial institutions to accelerate implementation.

- Stress-test your strategy for higher climate risks: The world is heading for 2.3–2.5°C warming, well above the Paris goal of 1.5°C. Boards must ensure scenario planning reflects this reality, incorporating physical risk exposure and resilience measures into long-term business strategy.

- Stay ahead of tightening regulation: COP30 reinforced that governments have a legal duty to regulate private sector emissions. Boards should monitor evolving climate laws and prepare for stricter accountability requirements across jurisdictions.

- Position for new finance flows: COP30 set a $1.3 trillion annual climate finance target by 2035. Boards should consider, particularly in the financial sector, where their businesses can help to drive investment in clean energy, resilient agriculture, adaptation and nature-based solutions; while aligning with emerging financial architecture.

- Embed nature into corporate strategy: Nature was a central COP30 theme. Boards should integrate nature-related risks and opportunities into capital planning and ESG frameworks, anticipating new disclosure standards and investor expectations.

- Lead the fossil fuel transition: The shift to clean energy is irreversible. Boards should treat fossil fuel phaseout as a strategic opportunity—mapping dependencies, setting clear timelines, and investing in low-carbon alternatives to futureproof business models.

- Double down on data and transparency: COP30 highlighted the need for robust climate data and credible reporting. Boards should ensure their organisations can meet rising disclosure standards and demonstrate measurable progress on transition plans.

- Invest in partnerships and skills for transformation: Delivering on COP30 goals requires whole-of-economy change. Boards should prioritise workforce upskilling and strategic partnerships that unlock innovation and resilience.

- Champion information integrity and governance: COP30 introduced global commitments to combat climate misinformation. Boards should strengthen internal governance to ensure climate-related communications are accurate, science-based, and aligned with emerging standards.

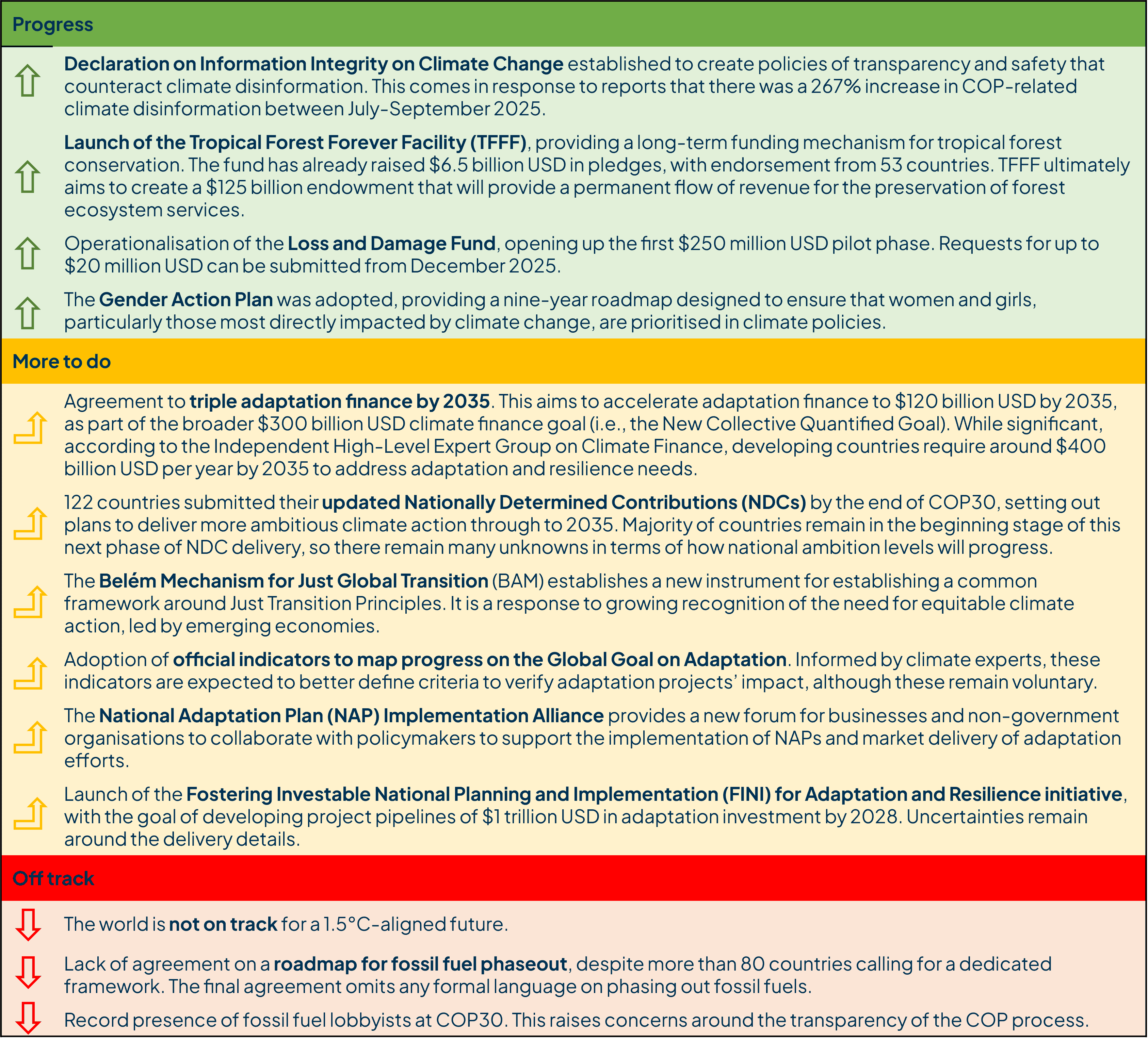

COP30 Scorecard: Progress at a glance

The scorecard offers a summary of the most relevant announcements or actions taken at COP30. Please see the ‘Annex’ section for policies and announcements relating to the scorecard outcomes.  Takeaways from COP30 and their relevance for board directors

Takeaways from COP30 and their relevance for board directors

Driving climate progress through multilateral cooperation and public-private partnerships

1. Countries’ ambition levels took centre stage at COP30. While over 120 refreshed 2035 Nationally Determined Contributions (NDCs) were confirmed, the world remains on track for 2.3-2.5C of warming by 2100, representing a significant potential overshoot of the Paris-aligned 1.5°C threshold. New emissions scenarios present new challenges for businesses and their value chains.

- Board directors should consider the long-term impacts of higher emissions trajectories in their scenario analysis – ensuring that strategies are responsively accounting for heightened physical risks in line with the latest climate science.

2. This year’s International Court of Justice advisory opinion on countries’ climate obligations remained a topic of discussion at COP30, particularly its judgement that in setting legally-binding NDCs, governments are not only responsible for reducing their own emissions, but also have a “due diligence to regulate private actors under their jurisdiction.” This principle influenced negotiations, reinforcing calls for stronger accountability and regulatory alignment between public and private sector action.

- Board directors should ensure they are informed on the evolving legal context, as part of wider strategic commitments to improving policy responsiveness and engagement.

3. Evidence of more ambitious business action in line with the ratcheting up of national policy offers cause for optimism. In its COP30 Report, the Taskforce on Net Zero Policy affirms that stabilising global temperature increase to 1.5°C remains within long-term reach – even if temporarily exceeded – but that this requires urgent whole-of-economy transformation. The Exponential Roadmap Initiative (ERI), partner of the Race to Zero coalition, calls for policymakers to “use their NDCs as an invitation for private sector partnerships.”

- Boards have a real opportunity to showcase leadership and commitment to decarbonisation, and to consider collaborating with governments to identify opportunities for joined-up thinking and implementation of climate plans.

4. COP30 brought further dialogue on scaling up finance to reach the broader New Collective Quantified Goal (NCQG) target of $1.3 trillion USD for developing countries by 2035. The COP29 and COP30 presidencies published the Baku to Belém Roadmap to $1.3T, outlining key actions governments, financial institutions and others can take to mobilise capital for climate mitigation and adaptation in developing countries, in recognition of “the importance of all sources playing their part and the value of finance working better together as a system.”

- Boards should reflect on their strategic approach to partnerships, in order to identify opportunities to work with governments, cities, and regions on practical solutions that advance both climate progress and long-term business value. Understanding collective finance priorities may help ensure that businesses are positioning themselves to capture market opportunities.

5. Trade entered formal negotiations for the first time at COP30. The Integrated Forum on Climate Change and Trade (IFCCT) was launched to support inter-country dialogue on how to bridge the gap between climate policy and trade policy. The International Institute for Sustainable Development (IISD) explains, “The priority should be ensuring that trade policy becomes a lever for climate ambition, not a loophole or a source of new divides.”

- The IFCCT signals a clear convergence between trade and climate policy, and boards should prepare for how this will shape the regulatory and commercial environment as the multilateral framework takes shape. Businesses operating globally should monitor future developments to ensure emerging climate-trade priorities are accounted for in board-level planning.

Unlocking finance: Private capital driving climate and nature solutions

1. Nature was a central pillar of this year’s negotiations, accentuated by COP30’s setting in the Amazon region and record levels of participation by Indigenous Peoples. The nature priority was reflected in key outcomes including the commitment to triple adaptation finance by 2035 and the operationalisation of the Loss and Damage fund. The Fostering Investable National Planning and Implementation (FINI) for Adaptation and Resilience initiative was also launched, with the goal of developing a pipeline of $1 trillion USD in adaptation investment by 2028, with 20% coming from private investors. The Expert Group on Climate Finance estimates that loss and damage costs could reach $150–300 billion per year by 2030, reinforcing the need for innovative approaches to unlocking finance at scale.

- Boards should understand how and where the international financial architecture is changing, to determine where they are best placed to deliver impact through commercially viable adaptation opportunities.

- Board directors can draw on the tools and guidance emerging from COP30 to better articulate the financial value of nature-positive capital allocation to their executive teams.

2. Advancements were made in determining the voluntary indicators to track progress against the Global Goal on Adaptation, offering public and private sector actors a clearer sense of how to prioritise action.

- Board directors should consider how progress indicators may influence finance decisions going forward, and how new, better-defined accountability metrics may be accounted for and assured.

- Boards should explore opportunities to engage with policymakers to strengthen their businesses’ adaptive capacity to respond to extreme weather events. This may help to inform more comprehensive understanding of both a business’s dependencies and impacts on ecosystem services.

3. The We Mean Business coalition’s Nature at COP30 Advocacy Toolkit for Business highlights growing support for an integrated nature and climate agenda, and the imperative for boards to embed nature-related risks and opportunities into strategy and capital planning.

- Board directors play a key role in advocating for stronger recognition of the nature-climate connection as core to futureproofing business strategy.

Strong commitment to fossil fuel phaseout despite lack of roadmap

1. COP30 signalled broad consensus that the transition away from fossil fuels is well underway, with the flagship Mutirão text declaring the global shift towards a low-carbon economy is “irreversible and the trend of the future.” The text also recognises that investments in renewable energy now outpace fossil fuels, leading to faster and cheaper deployment. Despite this, the final agreement fails to mention fossil fuel phaseout or outline a roadmap for transitioning, which is characterised as a significant setback of this year’s COP. During the negotiations, the We Mean Business Coalition penned a letter to the COP30 Presidency, reaffirming calls for a “redirection of public finance and policy support away from fossil fuels to low-carbon energy.” Co-signed by more than 80 nations – representing one third of global fossil fuel imports – and 70 organisations representing thousands of businesses, the letter emphasised that a “robust, credible roadmap would help countries and businesses plan the shift to clean energy, strengthen energy security and reduce costs for consumers,” and that “there is hope that a roadmap for a fossil fuel transition could be agreed outside of the UN process.”

- Board directors should consider how their businesses can proactively align with, and help to build, industry consensus in reducing fossil fuel dependence. This will not only help to futureproof business models but may help ensure that the multilateral system developed at COP30 does not fall behind real economy progress in transitioning to low carbon technologies.

2. The Exponential Business Roadmap 5.0 launched at COP30, offers a reminder that businesses should be focused on delivering exponential action to bring down emissions, the time for incremental action has passed.

- Boards’ scenario analysis should assess what the accelerating shift away from fossil fuels means for their operating model and transition timelines, so that they can ensure that it is framed as a strategic opportunity for their businesses to lead energy systems change. This requires being critical about carbon-intensive dependencies that remain within the value chain and taking decisive steps to phase them out or replace them with low-carbon alternatives in line with industry expectations.

- Industry responses to COP30 have highlighted that while emerging markets face greater proximity to climate risks than capital-rich economies, this positions them to unlock substantial opportunities for transformation. Board directors overseeing emerging market businesses should consider how to capitalise on policy, investment, and innovation flows directed towards high-potential transition economies.

Data measurement and standards accountability: Closing the ambition–action gap and driving investment at scale

1. The Systematic Observations Financing Facility (SOFF) launched its 2025 Action Report at COP30, highlighting growing recognition that the data gap is a core bottleneck for adaptation and resilience. The Declaration on Information Integrity on Climate Change was announced at COP30, establishing international commitments to combat climate disinformation and promote evidence-based action.

- Increased focus on climate information accountability emphasises that boards should prepare their businesses for greater data and reporting scrutiny, sharpening how impact is evidenced and communicated.

2. The development of consistent and credible sustainability standards was another key connecting thread across negotiations. 63% of the COP30 Presidency’s 117 Plans to Accelerate Solutions (PAS) recognise the maturity of standards as “a critical lever for unlocking progress.” In the days leading up to COP30, the International Sustainability Standards Board (ISSB) confirmed that it will create formal standards for reporting nature-related risks and opportunities, building on the existing Taskforce on Nature-related Financial Disclosures (TNFD) framework.

- A shift towards standardised nature-related disclosures creates new expectations which board directors should account for.

Looking to the year ahead

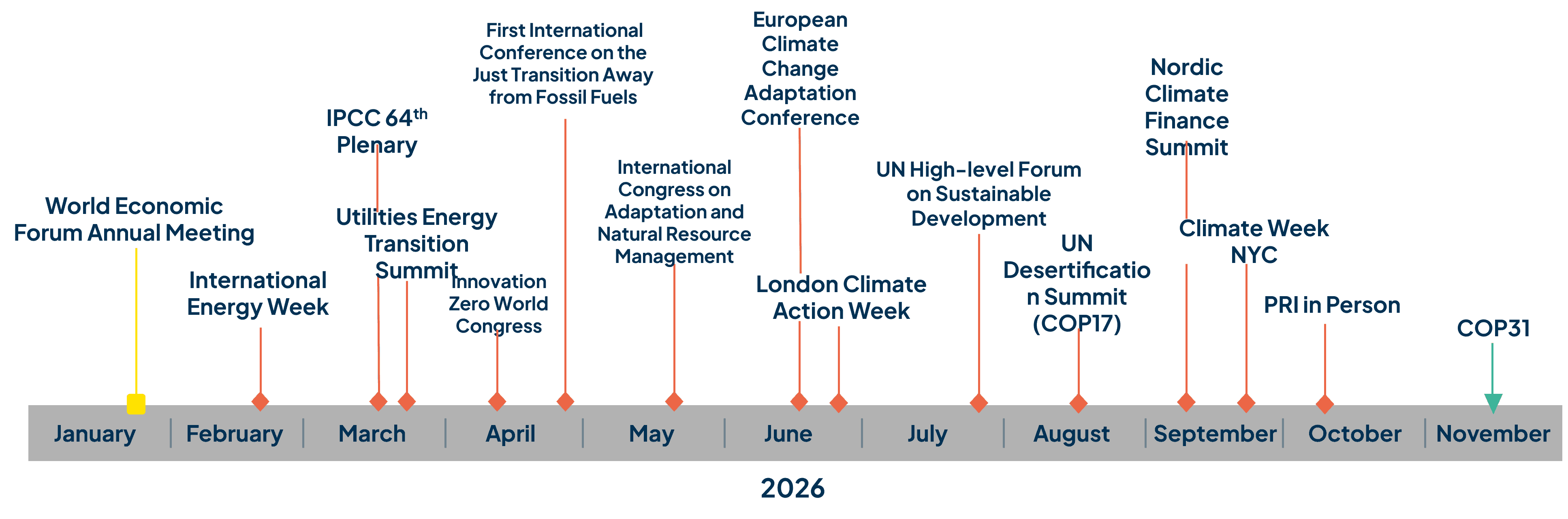

It was agreed that next year’s COP31 will be held in Antalya, Türkiye, but with Australia acting as president of negotiations. This unusual arrangement is the result of concessions made by Australia, following its bid for an Australia-Pacific summit. A pre-COP31 event is still set to be held in the Pacific region.

It was also confirmed that COP32 will be held in Ethiopia in 2027, representing the first-ever COP hosted by one of the least-developed countries.

In the lead up to COP31, there are a number of events that will continue to set the stage for the global negotiations. Board directors may consider following the outcomes from climate-related events in 2026 shown in Figure 1: Figure 1: Key international climate events in 2026

In summary, COP30 offers an opportunity for board directors to reflect on their businesses’ data-driven risk management, to evaluate whether they are in a position to leverage data to demonstrate real impact and transition delivery. Directors should encourage their organisations to explicitly include adaptation-related scenarios in risk assessments, particularly for operations exposed to climate risks, which can now be more effectively mapped against emerging metrics. COP30’s focus on sticking to the climate science and upholding information integrity encourages board directors to examine their own climate expertise, and that of their boards, to determine any existing gaps or vulnerabilities, and the steps necessary to address these.

In summary, COP30 offers an opportunity for board directors to reflect on their businesses’ data-driven risk management, to evaluate whether they are in a position to leverage data to demonstrate real impact and transition delivery. Directors should encourage their organisations to explicitly include adaptation-related scenarios in risk assessments, particularly for operations exposed to climate risks, which can now be more effectively mapped against emerging metrics. COP30’s focus on sticking to the climate science and upholding information integrity encourages board directors to examine their own climate expertise, and that of their boards, to determine any existing gaps or vulnerabilities, and the steps necessary to address these.

Recording: Key takeaways from COP30 for the boardroom

Watch the recording of our post-COP wrap-up webinar where an expert panel explore the key discussion points from COP30 and how to take these learnings into the boardroom.

ANNEX: Outcomes of COP30 and further reading

The Belem Package

Leading outcomes of COP30 negotiations are encapsulated in the Belém Package, a suite of 29 decisions approved by consensus on topics spanning just transition, adaptation finance, trade, gender, and technology. Key outcomes include:

- Agreement of the Global Mutirão decision, reaffirming the Paris Agreement 1.5°C target, as well as the New Collective Quantified Goal (NCQG) of mobilising at least $1.3 trillion per year by 2035 for climate action. The decision acknowledges, for the first time in a COP text, that there is likely to be an “overshoot” of 1.5°C threshold, launching two initiatives in response:

- The Global Implementation Accelerator to prioritise actions with the greatest potential for scale and speed

- The Belém Mission to 1.5°C to help countries deliver their NDCs and adaptation plans

- Call for a tripling of climate adaptation finance by 2035, as laid out in a draft text on matters relating to the Global Goal on Adaptation. As part of the pledge, a set of voluntary global adaptation indicators were adopted, based on expert advice submitted ahead of COP30.

- Launch of the Tropical Forest Forever Facility (TFFF), with $6.7 billion USD being pledged. The TFFF has so far been endorsed by 53 countries, including 19 potential sovereign investors.

- Failure to adopt a roadmap to phase out fossil fuels, despite 29 nations threatening to block progress without commitment. The COP30 Presidency announced an interim pledge to bring forward two voluntary roadmaps – on transitioning away from fossil fuels and deforestation – to present at the next COP.

- Creation of the Belém Action Mechanism for a Global Just Transition (BAM), a new instrument designed to establish a common framework and vocabulary around just transition principles; BAM is set to enable greater knowledge sharing, partnership-building, and capacity-building on just transition cooperation.

- Adoption of the Belém Declaration on Hunger, Poverty, and Human-Centered Climate Action, a landmark commitment endorsed by over 40 countries to give greater priority to human-centered measures of adaptation and climate finance focused on generating opportunities for vulnerable populations.

- Operationalisation of the Loss and Damage Fund, opening up its first-ever call for funding requests.

- Launch of the Bioeconomy Challenge, a three-year challenge to mobilise large-scale investment for nature-based growth by 2028. More than 63 organisations from over 20 countries have already expressed interest.

- Launch of the Gender Action Plan, providing a tool to ensure that policies are designed to support gender-responsive climate action and reinforce a just transition. Launch of the Declaration on Information Integrity on Climate Change, calling on governments to create policies of transparency and safety for climate information and public access to climate data.

More context behind our COP30 Scorecard

Climate finance

- The Loss and Damage Fund (FRLD) was operationalised at COP30, launching its first call for financing requests.

- The FRLD’s first projects are part of a $250 million USD pilot phase, referred to as the Barbados Implementation Modalities (BIM). Requests for up to $20 million USD can be submitted for six months from 15 December 2025.

- Established at COP28, the FRLD is worth just over $431 million USD. According to The Loss and Damage Collaboration, at least $724.43 billion a year in loss and damage finance is needed – suggesting that current financing levels are underdelivering the necessary funding.

- The Global Mutirão goal to triple adaptation finance by 2035 was agreed by consensus.

- At COP29, higher-income countries agreed to provide $300 billion annually by 2035 in climate finance for developing nations – known as the New Collective Quantified Goal (NCQG). The new tripling goal could mean that $120 billion of that $300 billion could be earmarked for adaptation.

- COP30 saw the launch of a major new blended forest finance mechanism, the Tropical Forest Forever Facility (TFFF). It has already raised $6.7 billion USD for its first phase, with pledges from major economies including Brazil, Norway, Germany, Indonesia, and France. The fund is structured to pay for forest conservation, with the ultimate goal of raising $125 billion USD in public and private investment in the fund.

- Importantly, at least 20% of the funding is earmarked for Indigenous Peoples and Local Communities (IPLCs), recognising their critical role in forest stewardship.

- The Fostering Investable National Planning and Implementation (FINI) for Adaptation and Resilience initiative was launched, with the goal of developing project pipelines of $1 trillion USD in adaptation investment by 2028, 20% of which is expected to come from private investors. It also calls for a 25% increase in pre-arranged adaptation finance.

- Host nation, Brazil, committed to scaling the J-REDD+ Coalition to reduce emissions from deforestation and enhancing forest carbon stocks at scale, outlining capacity to raise between $3-6 billion USD per year by 2030.

- Complementary to the TFFF, this initiative is in direct support of the Forest Finance Roadmap, which was introduced at New York Climate Week 2025, and has since been endorsed by 34 governments.

- Thirteen countries and one region released plans to develop country platforms through the Green Climate Fund (GCF)’s readiness program, “creating integrated investment frameworks that translate national climate strategies into bankable pipelines.”

- A Country Platform Hub was also announced, to bring together strategic thinking and link countries to existing technical assistance, research, and financing. As part of the COP30 Multilevel Governance Solutions Acceleration Plan (PAS), the Hub will be backed by seed funding of almost $4 million USD to finance early activities.

- Countries announced new contributions to the Climate Investment Fund’s new Accelerating Resilience Investments and innovations for Sustainable Economies (ARISE) programme, with Spain and Germany committing $100 million USD in funding to help developing countries adapt to climate risks and impacts.

- It was confirmed at COP30 that the Earth Investment Engine surpassed its $5 billion USD target, with over $10 billion USD mobilised for nature-based solutions.

- The initiative’s founder, Ambition Loop, finds that the world must increase annual nature-based solutions investment to $542 billion USD by 2030, a 2.7x increase from the current baseline.

Nature

- In the days leading up to COP30, the International Sustainability Standards Board (ISSB) confirmed that it will create formal standards for reporting nature-related risks and opportunities, building on the existing Taskforce on Nature-related Financial Disclosures (TNFD) framework.

- This announcement comes as TNFD confirms that voluntary market adoption of the TNFD recommendations has reached 733 organisations, representing over $22 trillion USD in assets under management.

- Launch of the National Adaptation Plan (NAP) Implementation Alliance which aims to accelerate collaboration between organisations supporting the implementation of countries’ NAPs and mobilise public and private investment in national adaptation initiatives.

- Renewed commitments to halt and reverse forest loss and land degradation by 2030, set out in the Intergovernmental Land Tenure Commitment, which aims to recognise and secure 160 million hectares of land tenure in tropical forest countries, complemented by a renewed $1.8 billion USD Indigenous Peoples and Local Communities’ Land and Forest Tenure Pledge.

- Increased support for the Call to Action on Integrated Fire Management and Wildfire Resilience, now backed by 62 countries.

- The ENACT Partnership, coordinated by the International Union for Conservation of Nature (IUCN), launched its Nature-based Solutions Accelerator Pathways Report, highlighting concrete pathways to scale up the adoption of nature-based solutions, as well as case study examples of transformational change.

- There were a number of developments relating to oceans stewardship, including:

- 17 countries joined a Blue NDC Challenge, pledging to include ocean-climate solutions in their national climate plans

- Launch of the One Ocean Partnership, a commitment to catalyse $20 billion USD by 2030 to support the regenerative blue economy and generate 20 million jobs.

- Five “Ocean Breakthroughs” and a corresponding Plan to Accelerate Solutions, linking marine conservation, ocean renewables, aquatic food, shipping, and tourism with climate goals.

Energy

- Mission Efficiency, a global coalition hosted by Sustainable Energy for All, launched its Plan to Accelerate Doubling Energy Efficiency (PAS). The PAS is a roadmap that brings together over 30 international partners and over 50 coordinated actions to advance national, regional, and sectoral strategies for doubling energy efficiency by 2030.

- The Utilities for Net Zero Alliance (UNEZA) announced an increase in commitments to energy transition investment of more than 25% to nearly $150 billion USD annually. There has been significant investment shift towards power grids and networks, with the coalition of 73 members now foreseeing a project pipeline worth $1 trillion USD by 2030.

- A total of 33 countries now endorse the COP28 declaration to at least triple global nuclear capacity by 2050. There have also been more signatories to the Financial Institutions Statement of Support, reinforcing the investment community’s commitment to developing nuclear energy innovation. More than 140 nuclear industry companies have now endorsed the accompanying industry pledge.

- The “Belém 4x” pledge to quadruple sustainable fuel production and use (including biofuels, biogases, synthetic fuels, and hydrogen) by 2035 was announced by Italy, Japan, India, and Brazil. Now backed by 23 countries, the initiative is set to be implemented through the “Future Fuels Action Plan”. Actions to advance the plan have included/will include:

- Launch of Hydrogen Action Plan

- Launch of policy recommendations for Future Fuels investment by CEOs and private sector leaders from across the energy and maritime sectors

- Launch of the new carbon management glossary

- Launch of the Green Public Procurement Factsheet

- Launch of a new report on Green Public Procurement and Ecolabels

- Launch of the ASEAN Power Grid Financing Initiative, pledging more than $12 billion USD to strengthen regional electricity connectivity in Southeast Asia.

- The Inter-American Development Bank Group introduced a Power Transmission Acceleration Platform for Latin America and the Caribbean, supported by €15 million EUR from Germany to expand and modernise regional grid infrastructure.

- Six Pacific nations have pledged to be 100% reliant on renewable energy by 2030 – Fiji, Mauru, the Marshall Islands, Tuvalu, Samoa, and Vanuatu. Regional leaders have agreed to establish a Pacific Energy Commissioner to coordinate the transition.

- The 3DEN (Digital Demand-Driven Electricity Networks) initiative was expanded, with 14 new projects across seven African countries and Brazil, mobilising $28.6 million USD. These projects will integrate AI, smart meters, and “digital twin” technologies to optimise grid performance.

- UNEP, one of the project’s joint leaders, stresses that digitalisation could save $1.2 trillion in grid efficiency by 2050.

Carbon markets

- COP30 saw progress on the operational details of Article 6.4 of the Paris agreement – the Paris Agreement Crediting Mechanism (PACM). Supervisory groups made developments on how international carbon credits will be generated, transferred, and tracked under a regulated system. There were also a number of clarifications to the cooperative approaches between countries through the international transfer of mitigation outcomes (ITMOs) under Articles 6.2.

- Attempts to dilute permanence and other technical (baseline and leakage) rules in Article 6.4 of the Paris Agreement were averted at COP30. A group of NGOs published a joint letter setting out recommendations for ensuring that all land-based activities are not excluded from the carbon-trading market. These recommendations were reflected in a draft text. The next major debates are scheduled for 2026.

- There were also reports that market intelligence provider MSCI is preparing to launch a credit rating system for Paris Agreement Article 6 transactions, in effort to foster greater consistency across a global market that remains voluntary and “uncapped” by design. Demand scenario modelling finds that transactions supported by Article 6 could drive up to half of global carbon credit demand through 2040.

- The Indigenous Peoples and Local Communities Engagement Forum launched its Carbon Market Engagement Strategy, opening consultations to shape the reform of carbon markets. The Forum is currently hosted by the Integrity Council for the Voluntary Carbon Market (ICVCM).

- The Coalition to Grow Carbon Markets increased support of its Shared Principles on the use of high-integrity carbon credits, with endorsement from 11 governments. The principles establish six pillars for businesses’ use of carbon credits:

- Use credits in addition to direct decarbonisation

- Ensure rigorous quality standards

- Uphold fair value and social benefits

- Maintain transparent reporting

- Make accurate, substantiated claims

- Actively support market development

- The Open Coalition on Compliance Carbon Markets saw development at COP30, with the voluntary commitment gaining endorsement from 18 countries. Developed under the leadership of Brazil’s Ministry of Finance, the coalition is set to enable countries to collaborate in defining best practices for Monitoring, Reporting, and Verification (MRV), establishing common accounting standards, and ensuring the integrity of carbon offset mechanisms.

Health

- As part of the part of the Belém Health Action Plan (BHAP), the Global Plan to Strengthen Climate-Resilient Health Systems was announced, a $300 million USD pledge from the Climate and Health Funders Coalitions of more than 35 philanthropies. BHAP has received endorsements from 30 countries and 50 civil society partners.

- The COP30 Special report on health and climate change finds that 3.3-3.6 billion people already live in highly climate-vulnerable regions, with hospitals now facing a 41% higher chance of damage from extreme weather than in 1990. Without rapid decarbonisation, the number of health facilities at risk could double by 2050. Despite this, the report finds that only 54% of national health adaptation plans assess risks to hospitals.

- UNEP and partners launched the Food Waste Breakthrough initiative to cut food waste in half by 2030 and cut up to 7% from methane emissions. The initiative involves a four-year, $3 million USD project to implement innovative projects.

Net zero transition

- In its updated 2025 NDC Synthesis Report released just prior to COP30, UNFCCC finds that 113 Parties submitted their statutory 2035 climate plan updates. The report finds that the latest round of NDCs will cause global emissions to drop 10% by 2035 from 2019 levels. This is potentially an underestimate, as nations continued to submit new NDCs during COP30, bringing the total to 122 countries.

- The London Stock Exchange Group (LSEG) published its COP30 Net Zero Atlas, providing additional data on countries’ NDCs, finding that collectively, G20 commitments for 2035 align with a projected temperature increase of 2.2–2.3°C, which represents a decrease from 2.4°C under NDCs 2.0), although still significantly short of Paris Agreement goals.

- By the end of COP30, 131 countries submitted their first Biennial Transparency Report (BTR), another requirement under the Paris Agreement to report information about emissions and progress towards their NDCs every two years.

- The Exponential Business Playbook 5.0 was launched at COP30. The resource offers a comprehensive framework for business action, outlining steps to halve emissions in supply chains by working with suppliers.

- The Climate High-Level Champions released a progress report from the Race to Resilience campaign, which announced that nearly 438 million globally have become more climate resilient, supported by over $4 billion USD in adaptation finance.

- Launch of the Belém Declaration on Global Green Industrialization, providing a framework for countries, particularly developing economies, to place green industrialisation at the heart of their economic strategy. Over 11 countries and 20 international organisations have joined the initiative.

- Recent analysis from the Mission Possible Partnership tracks a positive acceleration in financing for clean industrial developments, with $140 billion USD in clean industrial projects nearing final investment decisions. Emerging economies represent one-third of new projects, and two-thirds of the $2 trillion USD global investment opportunity.

- A group of 24 Countries signed a Belém declaration on the just transition away from fossil fuels, which reaffirms that the “best available science must guide the implementation of the transition,” calling for the phaseout of fossil fuel subsidies as soon as possible.

- In effort to keep phaseout discussions alive, the governments of Colombia and the Netherlands have announced that they will co-host the first international Conference on the Just Transition away from Fossil Fuels in April 2026. This will be followed by a second convening led by Pacific nation-states.

- Seven countries (i.e. UK, Canada, Germany, France, Norway, Kazakhstan, and Japan) signed a statement pledging to achieve ‘near zero’ methane emissions across the fossil fuel sector.

- In assessing progress made towards the Global Methane Pledge launched at COP26, the Global Methane Status Report 2025 finds that national methane plans to date could deliver the largest sustained decline in methane emissions ever, if fully implemented. While optimistic, the report cautions that stronger measurement, reporting, and finance are urgently needed to continue to drive ambition in hard-to-abate sectors.

- The Super Pollutant Country Action Accelerator launched a Plan to Accelerate Solutions (PAS), in aim of helping 30 developing countries cut dangerous super pollutant gases by 2030. The Accelerator will start out with $25 million USD for seven pioneer countries: Brazil, Cambodia, Kazakhstan, South Africa, Indonesia, Nigeria, Mexico.

- COP30’s Standards Pavilion represented “one of the largest-ever standards coalitions to engage collectively at a UN climate conference”. International Standards Organization (ISO) standards featured strongly across several of COP30’s Plans to Accelerate Solutions (PAS) including:

- The Harmonization of global carbon accounting plan hosted by the ISO-GHGP (Greenhouse Gas Protocol) partnership to determine routes to aligning the two accounting frameworks

- The draft Plan to Accelerate Creation and Adoption of Transition Plans for Financial institutions

- The Plan to Accelerate Renewable and Low-Emissions Hydrogen (Hydrogen PAS)

- Brazil and Germany were announced as co-chairs of the Coalition for High Ambition Multilevel Partnerships (CHAMP). To date, 77 countries and the European Union have endorsed CHAMP.

- COP30’s PAS of Multilevel, Multisectoral, and Participatory Governance Model was established as the implementation instrument of the CHAMP Coalition. It aims for 100 national climate plans and NDC implementation plans to officially include multilevel governance structures and mechanisms by 2028.

- A Global Initiative for Jobs & Skills for the New Economy was launched to help close the skills gap in the net zero transition, with 20+ countries and 40 institutions pledging to embed green skills in national plans by 2028.

- The initiative builds on new research from the International Climate Initiative which shows that the climate transition could create an estimated 375 million new jobs over the next decade.

- The Global Circularity Protocol (GCP) for Business was announced, providing action steps and metrics for businesses to reduce waste and instil circular economy principles in their strategy. With the support of over 150 experts and 80 organisations, the voluntary science-based framework is already being piloted by businesses.

- Earlier analysis from the World Business Council for Sustainable Development (WBCSD) finds that the GCP could enable 100-200 billion tonnes of cumulative material savings by 2050 and could reduce arable land occupation by up to 2.9% —while unlocking $4.5 trillion USD in economic growth.

- Launch of the Principles for Taxonomy Interoperability – developed with the Sustainable Business COP, the IDFC, and finance ministries – representing the first step towards a common language in climate finance. The Sustainable Finance Taxonomy Mapper was also launched, providing a digital tool to navigate and analyse sustainable finance taxonomies across jurisdictions.

Tourism

- Launch of the fourth Eco Invest Brazil auction to foster investment in bioeconomy and sustainable tourism projects, with a focus on the Amazon. The programme has already mobilised over $75 billion BRL in blended finance investment from international investors and multilateral organisations. There will be a deadline in early 2026 for interested financial institutions to submit proposals.

Digitalisation

- Launch of the Declaration on Information Integrity on Climate Change, which calls on governments to create policies of transparency and safety for journalists, scientists, and environment advocates, as well as to ensure public access to climate data. Twelve countries have so far signed the declaration, which also encourages the private sector to adopt responsible and transparent advertising practices. Since June 2025, the initiative’s associated Global Fund has received over 450 proposals from nearly 100 countries.

- In the lead up to COP30, research from the Coalition Against Climate Disinformation (CAAD) found that there was a 267% surge in COP-related disinformation between July and September 2025.

- The Green Digital Action Hub (GDA Hub) was launched, providing a platform to support technology-based climate solutions in 82 countries. The initiative stems from the COP29 Declaration on Green Digital Action, and looks to tackle the environmental impact of AI and other digital technologies.

- The UAE and Brazil unveiled the world’s first open-source AI model for agriculture, AgriLLM, and AIM for Scale, with the goal of reaching 100 million farmers with digital climate tools by 2030.

Buildings, Land use & Agriculture

- The International Institute for Sustainable Development (ISSD) published the 2025 Land Gap Report at COP30, raising concern that countries are relying too heavily on land-based carbon removal in the NDCs, “to such an extent the achieving these targets is both unrealistic and potentially damaging to human and natural systems.”

- The Intergovernmental Panel on Climate Change (IPCC) process, the World Meteorological Organization (WMO) and the Food and Agriculture Organization of the UN (FAO) hosted an event on how climate science can drive safer agrifood systems, highlighting the evidence and expertise needed to deliver sectoral transition. Particular reference was made to the need to capture agrifood priorities in the ongoing IPCC Seventh Assessment cycle (AR7) – a key input into international negotiations to tackle climate change.

- The FAO also released landmark analysis on Agrifood Systems in National Adaptation Plans, finding that despite being universal priorities, countries’ agrifood ambitions are undermined by funding gaps – with agrifood systems only receiving 20% of adaptation funds, when they require 54% of adaptation finance overall.

- The Low-Emission Ammonia Fertilizer (LEAF) initiative was launched, to scale adoption of low-emission ammonia-based fertilizers.

- In its Public-Private Action Statement, LEAF sets priorities for closing the cost gap and activating demand for investment; boosting investor confidence through standards and market-based mechanisms; and advancing public-private collaboration.

- In support of this effort, the global CEO-led initiative, the Hydrogen Council, has published the Roadmap to Scale Low-Emission Ammonia Fertilizers.

- The COP Action Agenda on Regenerative Landscapes (AARL) announced a quadrupling in investment since 2023, with $9 billion USD in commitments to support regenerative practice. This investment is projected to cover 210 million hectares, reaching 12 million farmers in over 90 commodities and 110 countries by 2030.

- Endorsed by 30 countries, the Buildings Breakthrough Agenda presented the first climate-aligned building standards at COP30, with the aim of making resilient, low carbon buildings the worldwide standard by 2030.