This briefing highlights the key outcomes from this year’s United Nations Climate meeting, COP29. Termed 'the finance COP', this briefing covers how COP outcomes may impact board directors, and the resulting conversations directors should be having in the boardroom. You can also view the recording of our post-COP wrap-up webinar where an expert panel explore the key discussion points from COP29 and how to take these learnings into the boardroom.

COP29: Sizing up climate finance gaps and national ambition levels

From 11 to 22 November 2024, leaders from nearly 200 nations met in Baku, Azerbaijan for COP29 – the second largest-ever UN climate summit. Billed the ‘finance COP’, COP29 negotiations centred on progressing a new climate finance goal to support developing countries in delivering international commitments to address climate change.

UN Secretary-General, António Guterres, opened the negotiations with a direct call to action, stating that global emissions must be cut by 9% every year and that by 2030 they must fall 43% from 2019 levels. Guterres also set out how the gap between climate adaptation requirements and supporting finance could reach up to $359 billion USD a year by 2030, and that developed countries must double adaptation finance to at least $40 billion USD a year by 2025 in order to fill this gap.

Further setting the scene, the World Meteorological Organization (WMO) released its State of the Climate 2024 on the opening day of COP29, reporting that 2024 is on track to be the warmest year on record. The state of global affairs heading into negotiations, including the result of the US election and the potential precedent set for a deceleration of US climate policy, brought into focus the real risks facing Paris Agreement ambitions. A central theme across this year’s negotiations was taking stock of how a 1.5°C Paris-aligned future is still within reach.

Key outcomes of the negotiations include:

- Agreement of the New Collective Quantified Goal (NCQG) to triple climate finance to developing countries, representing an increase to $300 billion USD annually by 2035. This was a heavily negotiated issue, with the final amount coming out well below the $1.3 trillion requested by some developing countries.

- Agreement on international carbon market standards. Approval of Paris Agreement Article 6 standards in relation to bilateral agreements between countries (Article 6.2), carbon crediting mechanisms (Article 6.4), and adoption of non-market approaches (Article 6.8), which focus on other types of cooperation that can be used to incentivise and scale carbon finance. This agreement is an initial step and many details are still to be worked through.

- A degree of progress on Loss and Damage financing. Negotiations saw the signing of key documents for the Fund for responding to Loss and Damage, with first official contributions pledged.

- Updated Nationally Determined Contributions (NDCs) announced: A limited number of updated NDCs were announced, signalling countries’ commitment to more ambitious emissions reductions targets.

- Remaining countries’ new NDCs are due by March 2025 and can be found via Climate Watch’s NDC Tracker as they are announced.

- A related outcome is the Baku Declaration on Global Climate Transparency, which offers a platform for signatory countries to submit their Biennial Climate Transparency Report (BTR) and National Inventory Report (NIR) by 31 December 2024. Efforts to better standardise national transparency reporting present benefits to the private sector, in terms of providing clearer signals of climate ambition and the policy interventions needed to deliver it – which may help set COP30 negotiations up for evidence-based assessment of Paris Agreement progress.

- Failure to agree how to carry forward the COP28 UAE dialogue and the commitment to transition away from fossil fuels – shunting the decision to COP30 in Brazil next year.

- Part of the COP29 Presidency’s ‘Action Agenda’, the COP29 Global Energy and Storage Grids Pledge commits signatory countries to increasing global energy storage capacity by six times above 2022 levels, reaching 1,500 gigawatts by 2030.

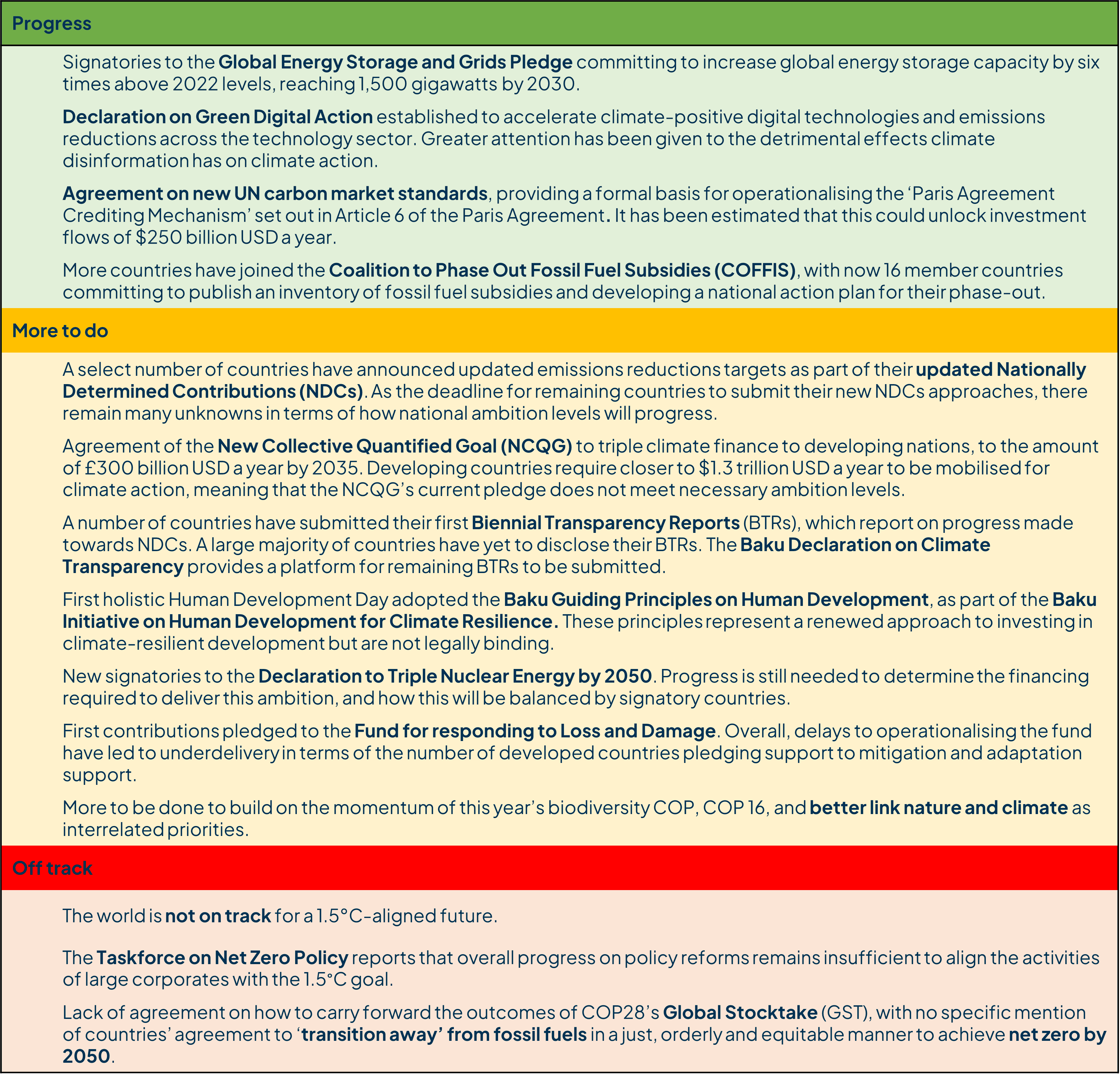

COP29 Scorecard: Progress at a glance

The scorecard offers a summary of the most relevant announcements or actions taken at COP29. Please see the ‘Further Reading’ section for policies and announcements relating to the scorecard outcomes.

Key messages for board directors

- Untangling global climate finance – in terms of what forms it takes, when it is needed, how it is evaluated, where it flows, and who is most responsible for delivering it –remains a critical and significant challenge.

- Tensions throughout COP29 negotiations have centred around many of these unresolved issues in global climate finance policymaking. Despite ongoing political debates, there is a real opportunity for board directors to proactively support their organisations’ expenditure and investment decisions that mobilise private sector capital for climate action, and that also help to demonstrate needed reforms to international finance architecture.

- The agreement of the NCQG and the commitment to triple climate finance includes a focus on securing efforts from the private sector to “work together to scale up finance to developing countries,” to the amount of $1.3 trillion USD per year by 2035. Considering that historic blended finance mobilisation ratios measure $1 of public finance to 40 cents of private capital, greater public-private partnership may lead to more balanced finance flows.

- Board directors should consider how their organisations’ approaches to mobilising private finance align with the forms and levels of investment from public finance institutions. The first global net-zero alliance comprising public finance institutions, the Net-Zero Export Credit Agencies Alliance (NZECA), published its Target-Setting Protocol - the first tool aimed at enabling export credit agencies and export-import banks to set net zero targets and accelerate climate action. Such tools aim to mobilise private finance through instruments like guarantees or co-investments, which help to de-risk investing in emerging markets and technologies.

- Board directors are well-positioned to identify potential vulnerabilities that exist in organisations’ current value chains. Greater transparency of finance flows is critical to understanding how to address barriers and inefficiencies in transitioning towards climate-aligned business models.

- The approval of new international carbon markets standards has a range of implications for businesses. Official rules were adopted for the Article 6.4 (a UN-mandated central carbon market) and Article 6.2 (decentralised emissions trading by countries) mechanisms of the Paris Agreement, including a standard for the development and assessment of methodologies for carbon removal activities.

- With greater clarity on definitions and principles, there is expected to be “fresh demand for carbon credits” and increased movement in carbon trading between countries.

- These developments offer board directors an opportunity to reflect on strategic positioning on carbon markets for their organisations, to identify where practices could be introduced or adapted to improve alignment with new UN-backed operating standards.

- There are linkages to transition planning in accounting for the role of carbon offset and removal technologies in achieving corporate climate objectives—particularly as recent research finds that over 80% of carbon credits issued by more than 2,000 projects have a much lower climate impact than they claim.

- Various organisations have pushed back against the new rules, due to concerns that they “conceal many problematic fundamental and technical issues that remain unresolved.” Continued debates around how these rules are operationalised in practice are likely going forward, and board directors may wish to stay informed on how these play out.

- Further information on carbon markets policy is available in the Climate Governance Initiative’s Carbon Pricing Navigator.

- Increased business ambition and action on climate – both in terms of emissions reduction and resilience – was an important focus at COP29.

- The MSCI Sustainability Institute’s Net-Zero Tracker finds that companies are on course to deliver an emissions reduction trajectory tied to a 2.8°C scenario, with almost two-thirds of listed companies (62%) significantly overshooting the 1.5°C ambition of the Paris Agreement. This could result in listed companies burning through their share of emissions budgeted for the 1.5°C ambition by November 2026.

- Such data points to a clear imperative for organisations to reflect on emissions reduction budgets and timescales. Board directors should consider how existing corporate climate transition planning is set to deliver on real-world emissions reductions, and whether the organisation’s ambition levels must be raised.

- Negotiations highlighted the new International Transition Plan Network (ITPN) as a means through which “to encourage the emergence of national and international approaches to transition planning and to serve as a platform for partnerships that support the creation of new frameworks and strategies for private sector transition plans.” Created following the conclusion of the Transition Planning Taskforce, board directors may consider how this platform can provide useful direction to strategic discussions on credible transition planning.

- There are signs of progress, with the 2024 update of the Race to Resilience campaign showing that climate adaptation action plans now cover 2 billion people, with organisations across 164 countries participating in the campaign. Emphasis remains on scaling up these efforts, with the new pledge to increase the resilience of 3.2 billion people by 2030.

- COP29 emphasised effective implementation of international standards as key to advancing corporate climate governance.

- The International Organization for Standardization (ISO) unveiled new international ESG guidance at COP29, ISO ESG Implementation Principles, to support compliance with disclosure requirements and improve ESG reporting and communications. The guidance particularly targets improving ESG reporting and practices for SMEs, considering that these constitute a significant portion of the world’s businesses and are disproportionately impacted by climate change.

- Board directors may consider how ISO’s principles currently fit within organisational ESG practices, and whether there are opportunities to better embed these principles at the strategic level.

- With ESG regulations having reportedly risen 155% in the last decade globally, guidance on how to better harmonise existing ESG principles and approaches can be of real benefit for organisations looking to improve consistency and reliability across their climate reporting.

Looking to the year ahead

Significant attention has been paid to COP30, which will take place in Belém, Brazil in November 2025, as this represents a "critical milestone" by which all countries will have submitted their updated NDCs. The choice in Brazil as a host country is also significant, offering an opportunity to bring global attention to the challenges unfolding regionally, including the ecological tipping points facing the Amazon rainforest which present risks to the global community, leading to it being coined ‘the nature COP’.

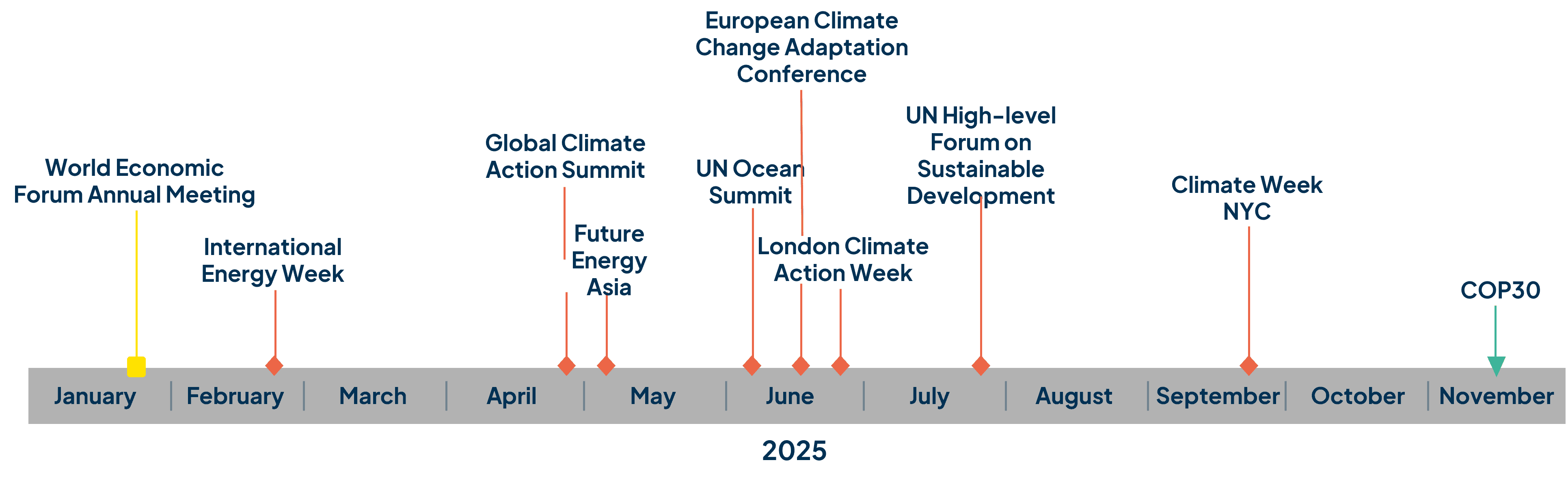

In the lead up to COP30, there are a number of events that will continue to set the stage for the global negotiations. Board directors may consider following the outcomes from climate-related events in 2025 shown in Figure 1:

Further reading: More context behind our COP29 Scorecard

Climate finance

- There was significant contention surrounding the New Collective Quantified Goal, which has been agreed to replace a target set in 2009, when developed countries pledged to provide $100 billion USD annually by 2020. The final agreement has been criticised for a number of reasons including:

- The general quantum of finance of $300 billion by 2035 “does not meet the scale of what developing countries need to pursue a low-carbon economy” as continuously highlighted in UNEP’s Adaptation Gap Report series.

- There is a failure to include a firm target to prioritise grants over loans. Overall, the text insufficiently focuses on the quality of finance, proposing a shift away from debt financing, but not providing “any mechanisms to make these things happen now.”

- In terms of delivery timescales, the previous target was missed by two years (i.e. the investment amount was set for 2020 but was only met in full in 2022). This has raised concerns around the new goal’s deliverability. UNFCCC Executive Secretary, Simon Steill, summarises “it only works – if premiums are paid in full, and on time.”

- A number of details are left to be determined in the “Baku to Belem Roadmap to $1.3 trillion”.

- The Global Alliance for Banking on Values (GABV) has announced that 25 of its member banks have endorsed the Fossil Fuel Non-Proliferation Treaty initiative, marking the first collective endorsement by financial institutions. The Treaty proposes a global binding plan to end the expansion of new coal, oil and gas projects and transition away from fossil fuel-based systems.

- Contributions pledged to the Fund for responding to Loss and Damage, bringing the total pledged funding to $720 million USD. COP29 President, Mukhtar Babayev, explains, “This progress will allow us to finally turn pledges into real support. That means that funding will be able to flow in 2025.”

- Major multi-development banks (MDBs) released the Common Approach to Measuring Climate Results: Update on Indicators, estimating that they will raise $120 billion USD annually in climate finance for developing countries by 2030. This is set to include $42 billion USD for countries’ adaptation to extreme weather impacts. Additionally, MDBs aim to mobilise an extra $65 billion USD from private sector investments for developing countries by 2030. While this is an increase from the $75 billion USD raised in 2023 and $60.9 billion USD in 2022, it is substantially lower than what developing countries are reported to need annually.

- Announcement of up to $500 million USD in concessional funding to support the Financing Asia’s Transition Partnership (FAST-P), the blended finance initiative launched at COP28. The partnership aims to mobilise up to $5 billion USD from public, private, and philanthropic partners for transition opportunities in Southeast Asia.

- Launch of GAIA, an $1.48 USD billion blended finance platform to increase available climate finance for high-impact climate action projects in up to 25 emerging markets. 70% of the platform will support adaptation projects, with 25% of funds will be invested in least developed countries.

- Climate Investment Funds (CIF) will launch the Capital Markets Mechanism (CCMM), a new £58 billion finance scheme for building clean energy projects in less developed countries, on the London Stock Exchange. In a statement, CEO of CIF explains, “CCMM will mobilise private capital at scale and direct it to high-impact clean energy and clean technology investments.” In a similar statement, the President of the African Development Bank explains that this is the “first time a multilateral climate fund will use the strength of its balance sheet to unlock urgently needed climate finance.”

- A report from Christian Aid was launched, Putting our money where our mouth is: why we need public climate finance, which finds that less than 3% of private climate finance is reaching low-income countries as of 2022. The report stresses the need for increased public finance, particularly in the form of grants aimed at adaptation and loss and damage needs.

Energy

- COP29 Global Energy Storage and Grids pledge launched to achieve a global target of 1,500 gigawatts of energy storage by 2030, in alignment with the goal of tripling renewables by 2030.

- Launch of a continental Energy Efficiency Programme by the African Energy Commission (AFREC), to support Africa’s continental market transformation to higher efficiency lighting and appliances. This aims to support the implementation of Minimum Energy Performance Standards (MEPS) in national policy.

- Launch of the Global Alliance for Pumped Storage (GAPS) to support over 30 governments and international agencies to accelerate the deployment of pumped storage hydropower.

- The Latin America Energy Organization (OLADE) announced a Regional Target for Energy Efficiency and a regional agreement on No More Coal-Fired Power Plants.

- Commitment to develop one terawatt of renewable capacity in the Mediterranean region by 2030 through the TeraMed initiative, with investments that could reach $700 billion USD and create three million new jobs in the solar industry.

- COP29 Hydrogen Action Declaration launched to expand political support for clean hydrogen scale-up, as part of COP28’s promise to triple renewable energy capacity.

- IRENA report, Delivering the UAE Consensus: Tripling renewable power and doubling energy efficiency by 2030, sees a significant shortfall of $1.5 trillion USD each year between 2024 and 2030 in investments in renewable capacity. IRENA estimates that a total investment of $31.5 trillion USD is needed to meet the renewable energy goals of the UAE Consensus.

- Six more countries joined the Declaration to Triple Nuclear Energy by 2050, which was signed at COP28. This brings the total number of signatories to 31.

- IAEA Director General, Rafael Grossi, says “Tripling global nuclear capacity by 2050 would require yearly investments of about $150bn. That sounds like a lot. But to put it into perspective, it is just a tenth of what is needed every year to triple renewable capacity by 2030.”

- The Oil & Gas Decarbonization Charter, launched at COP28, published its first report, 2024: A Baseline for Action, finding that 69% of the 54 companies that are currently signed up to the Charter claim to have established ambitions to reach net-zero Scope 1 and 2 emissions by or before 2050.

Carbon markets

- There was approval of the Article 6.4 mechanism of the Paris Agreement, agreeing rules for a UN-administered global carbon market which were adopted by the mechanism’s Supervisory Body in October 2024. Negotiators hope that the new market will form ‘the gold standard for emissions trading’.

- The secretariat of the UNFCCC is hiring companies to create a registry to track ownership of Article 6.4 tradable carbon credits. An interim version of the registry is expected to be ready in December 2024.

- Some organisations have voiced concerns about the introduced rules, including Carbon Market Watch, who believe a key issue to be in terms of how these new rules account for projects’ so-called reversal risks (i.e. where stored carbon leaks back into the atmosphere).

- Rules adopted for Article 6.2 which regulates bilateral carbon trading between countries.

- Decision on the Paris Agreement’s Article 6.8 work program, which provides Parties with opportunities for non-market-based cooperation to implement mitigation and adaptation actions.

Transport

- The International Transport Forum – an OECD body that represents 69 governments – called on all countries to include plans for sustainable transport with just transition in the next round of NDCs, launching the international Guide to Integrating Transport into Nationally Determined Contributions. The guidance suggests that while 98% of NDCs mention transport, only 33% include an emissions reduction target for the sector.

Tourism

- The World Sustainable Hospitality Alliance (WSHA) has launched Universal Sustainable Key Performance Indicators (KPIs), as part of the COP29 Declaration on Enhanced Climate Action in Tourism. These KPIs establish a structured framework for the hospitality sector to measure and report on ESG metrics.

Net zero transition

- Additional countries have joined the international Coalition on Phasing Out Fossil Fuel Incentives Including Subsidies (COFFIS). With now 16 member countries, the initiative aims to shift public financial flows to clean energy, which is critical to the COP28 decision to ‘transition away’ from fossil fuels. Greater commitment to phase-out is significant considering that fossil fuel subsidies reached a record $1.5 trillion USD in in 2022.

- As part of the Ministerial Forum on Green Good Governance, the Islamic World Educational, Scientific and Cultural Organization (ICESCO) launched the Green Innovators Initiative, which aims to develop a framework guideline for anticipating regional climate risks and strengthening the infrastructure for mitigation. Regional cooperation may help improve nature outcomes in the region, as it is reported that biodiversity in this region is under increasing pressure, with about 20% of species threatened with extinction.

- Recognition of the 11 countries that submitted their Biennial Transparency Reports (BTRs), which are a key component to the Enhanced Transparency Framework laid out in the Paris Agreement. At COP29, all countries were urged to submit their BTRs by 31 December 2024.

- Launch of a new series of ‘Baku Priority International Actions’ to cut carbon, developed in response to the Breakthrough Agenda Report 2024 produced by the IEA and UN Climate Change High-Level Champions. Launched at COP26, the Breakthrough Agenda is currently supported by 59 countries, representing over 80% of global GDP, and by over 100 initiatives working to enhance collaboration within major emitting sectors. Priority actions include:

- Increased spending on clean energy demonstration projects by governments and companies

- Establishment of an international function to improve the verification of different standards and their compatibility with international climate goals

- Reassessment of cross-border and regional power interconnection opportunities

- Approval of the Mitigation Work Programme, a non-binding process to enhance climate mitigation. Importantly, the final version makes no mention of COP28’s landmark decision to shift away from fossil fuels, despite earlier versions having done so.

- Launch of the Green Purchase Toolkit from the World Business Council for Sustainable Development (WBCSD), Center for Decarbonization Demand Acceleration (CDDA) and the Industrial Transition Accelerator (ITA). The toolkit provides practical guidance on businesses’ procurement of low-carbon products and an overview of innovative market mechanisms such as collaborative buyers alliance procurements and green market makers. The WBCSD summarises, “Businesses need the solutions to activate their contracts for near and net zero products and services. This toolkit empowers them with mechanisms which convert their demand signal into action and drives the building of the 700 plants needed to produce the low-carbon materials required to decarbonize industry by 2030.”

Digitalisation

- First-ever ‘Digitalisation Day’ and high-level session on “Green Climate Action” to consider how digital innovation can be integrated into climate strategies and climate monitoring tools.

- Launch of the Declaration on Green Digital Action to accelerate climate-positive digitalisation and emission reductions across the Information and Communication Technology sector.

- The Climate Action Against Disinformation (CAAD) and climate experts published an open letter, Governments Should Act Now to Curb Climate Disinformation. The letter calls for the adoption of a universal definition of climate disinformation and governments’ implementation of the UN’s Principles for Information Integrity as two decisive actions to help address the threats posed by climate disinformation.

Food, Water & Agriculture

- Launch of Baku Harmoniya Climate Initiative for Farmers: Empowering Farmers for Climate Resilience. As part of the FAST partnership with the Food and Agriculture Organization (FAO), the initiative focuses on knowledge sharing and coordinating financing for farming communities around the world, particularly in developing countries.

- Over 30 states have signed the Reducing Methane from Organic Waste Declaration, declaring their commitment to set sectoral targets to reducing methane from organic waste within their future NDCs. This currently includes 7 of the 10 largest organic waste methane emitters globally, which is significant considering that global methane emissions are now 5.17% higher than the 2020 baseline, despite the global goal set at COP26 to reduce methane emissions at least 30% by 2030.

- Baku Dialogue on Water for Climate Action launched, providing a platform for collaboration on solutions for the water crisis. In its endorsement of the initiative, the WMO commits to helping countries to “develop early warning systems and innovative response measures to water-related hazards.”

Recording: Key takeaways from COP29 for the boardroom

Watch the recording of our post-COP wrap-up webinar where an expert panel explore the key discussion points from COP29 and how to take these learnings into the boardroom.