Every tonne of carbon is a cost to society because it causes climate change. However, this cost is invisible in commercial markets. Invisible that is, unless it is explicitly factored in, for example, by government regulation, or by companies choosing to reflect it in their balance sheets and decision making processes.

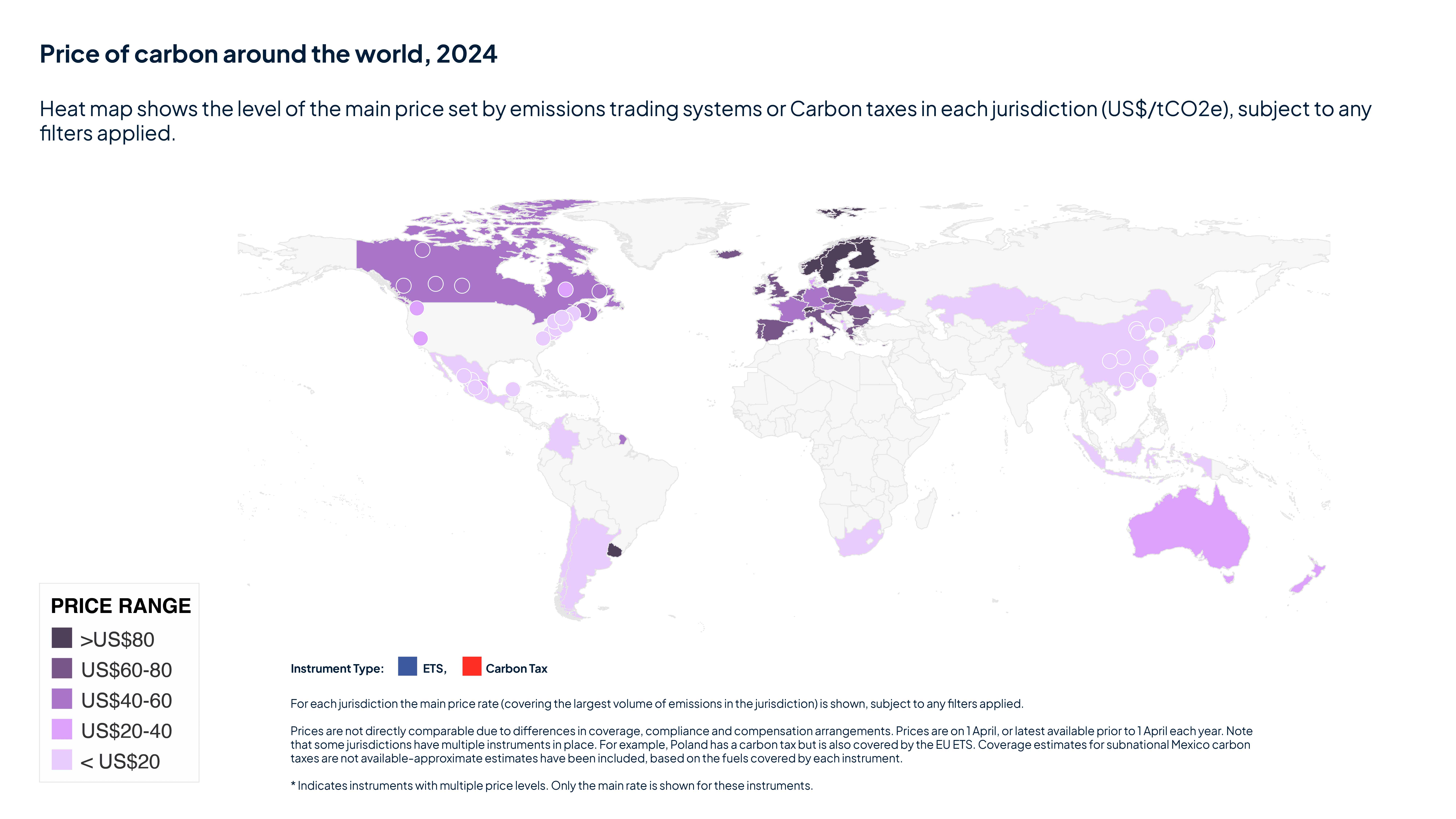

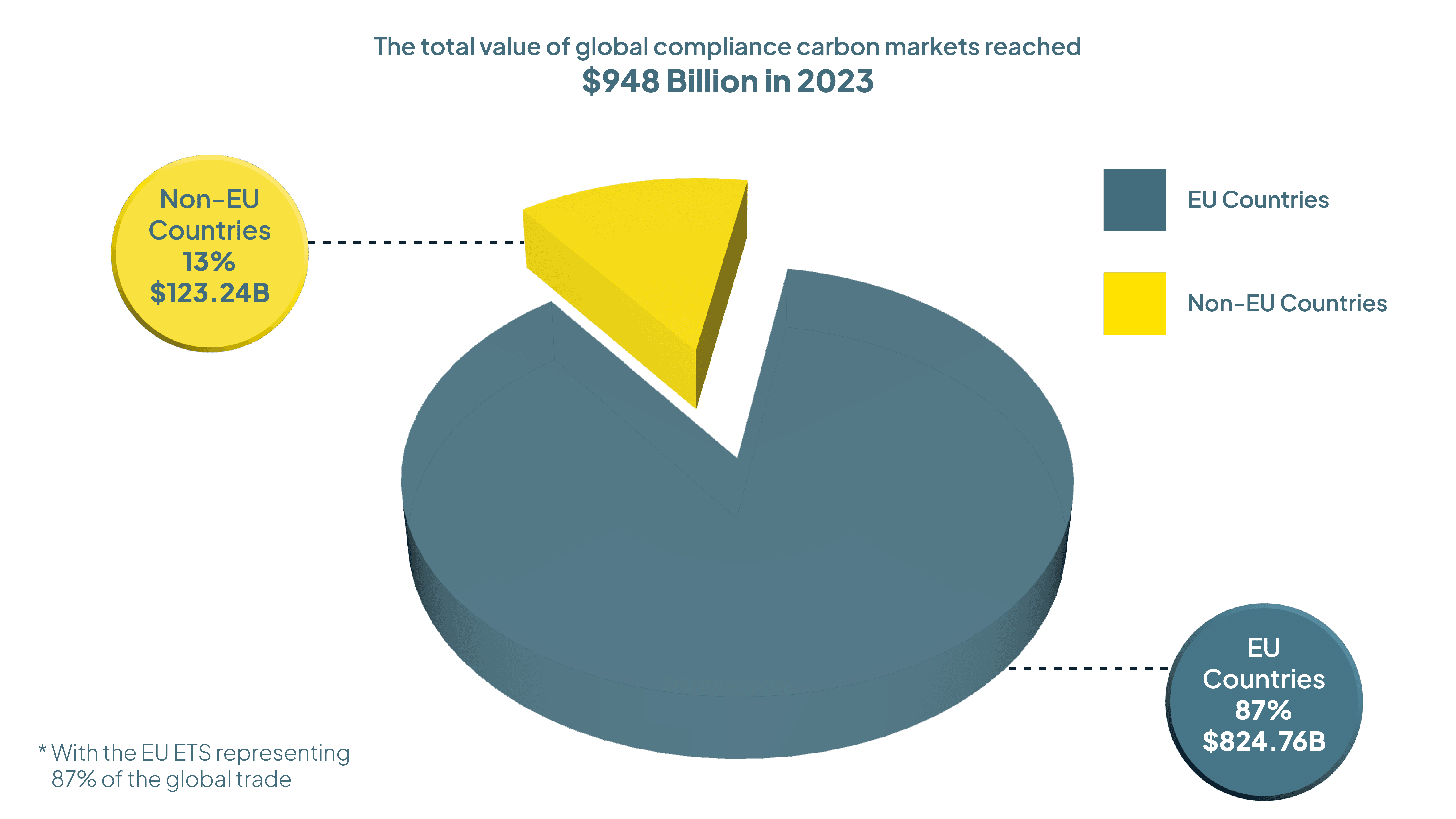

Over 100 national or subnational governments have now put a price on carbon, and this number is growing each year. As the cost of carbon increases and pricing mechanisms expand to cover more sectors, climate change has become a concrete financial risk, and opportunity, to countless businesses. Even more organisations are indirectly impacted through their supply chains, and efforts to price carbon on a global scale are ramping up.

Businesses are also starting to take the lead. Microsoft, for example, prices carbon internally at $15 per tonne, and at $100 per tonne for business travel. It has used the revenue generated to purchase renewable energy and sustainable aviation fuel, as well as carbon credits, to meet its aim of being a “carbon negative, water positive, zero waste company” by 2030.

More and more businesses are taking similar action, not just to reduce their greenhouse gas (GHG) emissions but to prepare for regulatory carbon pricing that is growing in scope, size and complexity. By understanding carbon pricing, boards can ensure that their businesses are resilient to policy developments in this area and positioned to implement effective internal carbon pricing policies, creating a competitive advantage over less-prepared peers.

According to Amir Sokolowski, global director for climate change at CDP: “While there are other strategies to do so, failure to use this [carbon pricing] tool could imply that companies may be failing to adequately plan for the medium- to long-term realities of the cost of carbon.”

Carbon Pricing Checklist for Board Directors

Understanding carbon pricing

- Understand the basic rationale for putting a price on carbon

- Gain insight into the different types of policy and business instruments that may be used to price carbon.

- Understand national and international carbon pricing trends including new mechanisms, and carbon price increases.

Business implications

- Assess the likely business impacts of regulatory compliance carbon pricing, voluntary carbon pricing and internal carbon pricing

- Understand how carbon pricing can help your company to decarbonise and make better business decisions

- Consider how pricing mechanisms abroad or potential carbon border adjustments may influence value chains

Be prepared to discuss carbon pricing in the boardroom

- Ensure that your board and business is ready for new and evolving carbon pricing policies building the implications into medium to long-term strategic planning and transition risk analysis

- Check whether your business has set an internal or ‘shadow’ carbon price to manage climate-related transition risks and whether it is in line with recommendations as highlighted in the ‘Carbon pricing and the Board’ section of this briefing.

- If an internal carbon price has not been set, encourage the board to explore this as part of its climate net zero strategy and consider what you would like this to achieve, what price-level and mechanism for internal carbon pricing is appropriate, and how you will report on it to stakeholders.