Carbon Pricing in Europe

The EU Emissions Trading System is one of the oldest and largest carbon pricing mechanisms in the world, covering emissions from power, industry, aviation and shipping. Although the system has faced some issues since its inception in 2005, it now demands high carbon prices covering one of the world’s largest economies. Businesses covered by the EU ETS are now fairly familiar with the system, but planned ‘ETS II’ expansions would further increase the system’s scope to cover buildings, road transports, and some other industries not currently covered by the ETS. The EU has also pioneered a carbon border adjustment mechanism which means imports will begin paying the same carbon price as domestically produced EU goods from 2026. A number of EU member states have implemented additional carbon pricing measures, including Finland, which was the first country to implement a carbon tax.

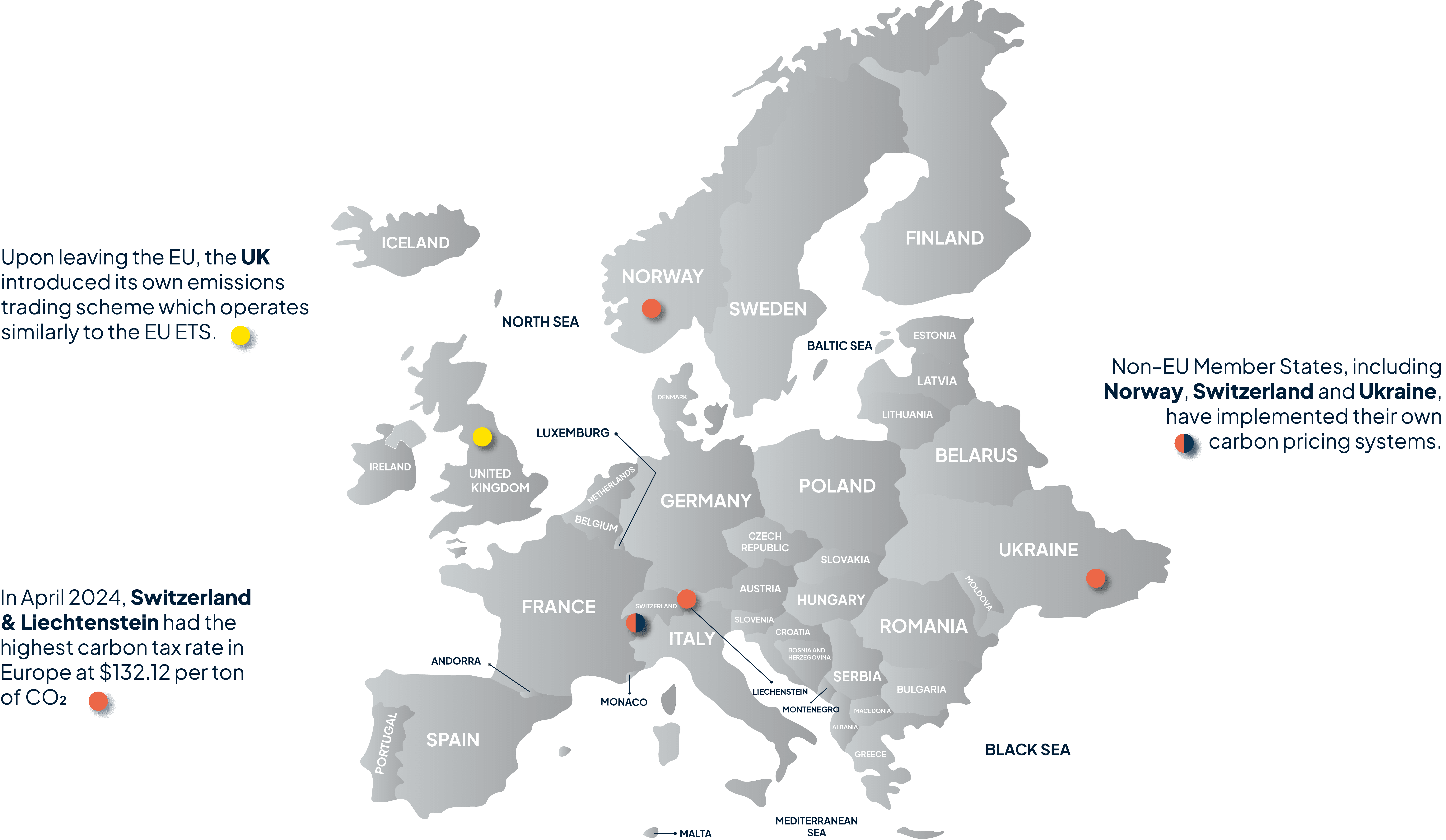

Non-EU Member States, including Norway, Switzerland and Ukraine, have implemented their own carbon pricing systems. Upon leaving the EU, the UK introduced its own emissions trading scheme which operates similarly to the EU ETS. The UK Carbon Price Support, established when the UK was still subject to the EU ETS, complements emissions trading with an additional carbon tax on fossil fuel electricity generation. This tax is set at a rate to ensure that, when added to prices paid through emissions trading, electricity generators in the UK pay a minimum price known as the Carbon Price Floor. Importantly, emissions trading systems can be ‘linked’ to allow trading between different jurisdictions. The EU and Swiss systems have been linked since 2020. System linkage does not need to be limited to other European countries – there have been discussions about linking the EU ETS with similar mechanisms in New Zealand and California. Finally, the EU’s experience operating the EU ETS for almost two decades has helped inform the development of other systems, including China’s ETS.

Europe’s carbon pricing mechanisms have grown to cover a wide range of sectors,

and have implications beyond the continent’s borders. Businesses outside of Europe may be impacted by these measures if they have supply chains in Europe, if they export goods into the EU which will be covered by CBAMs, or if their jurisdiction considers linking to the EU ETS. While national contexts mean carbon pricing is applied differently around the world, the development of carbon pricing in Europe could also be seen as a loose roadmap for how other systems might change in the future.