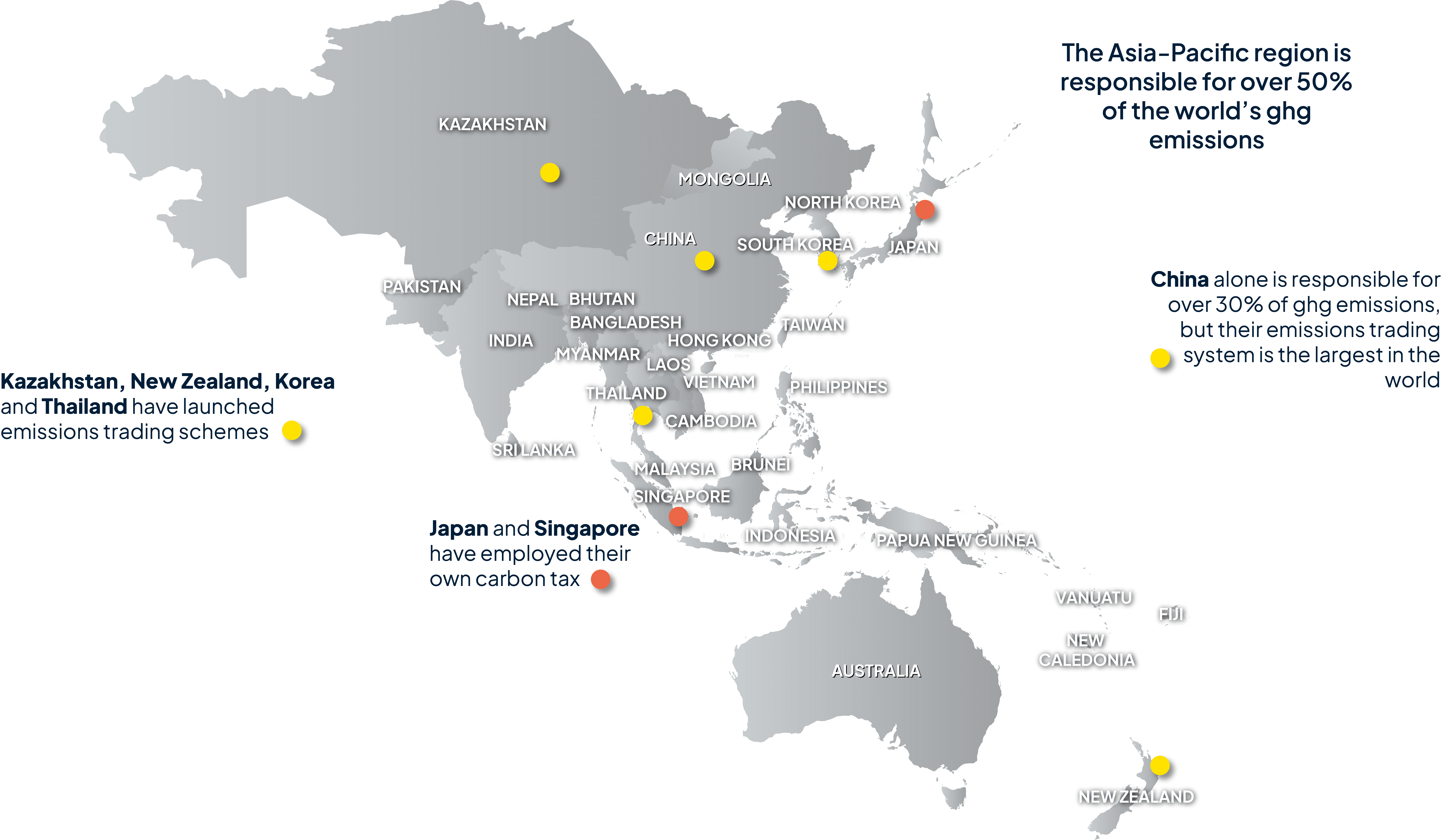

Carbon Pricing in Asia-Pacific

With the world’s most populous and some of the fastest-growing economies, the Asia-Pacific region is responsible for over 50% of the world’s ghg emissions, with China alone responsible for over 30%. As of April 2023, there were six direct carbon pricing initiatives implemented at the national level in Asia and the Pacific - with Japan and Singapore employing a carbon tax while Kazakhstan, New Zealand, Korea and Thailand have launched emissions trading schemes. China’s emissions trading system is the largest in the world, and while prices are currently relatively low, they have been rapidly growing since the introduction of the National (mandatory) ETS in July 2021, with the price of carbon dioxide per tonne exceeding 100 yuan for the first time in 2024. China’s National ETS currently covers the fossil-fuel power sector, but planned expansions would see the system cover a wider range of sectors by end-2024. Furthermore, in January 2024, the China Certified Emissions Reduction (CCER) scheme that covers six greenhouse gases was relaunched for the Voluntary Market accessible to all enterprises, promoting further emission reductions across sectors. Given China’s importance as a manufacturing hub, carbon pricing is likely to impact many companies outside of its borders.

Outside of China, Asian jurisdictions have taken different approaches to pricing carbon. Singapore has a modest carbon tax, currently at S$5/tonne, but the government has signalled that prices should reach S$50-80 by 2030. Indonesia has started to roll out a hybrid ‘cap-and-trade-and-tax' scheme which will introduce emissions trading alongside a carbon tax to price excess emissions. In 2023 Japan introduced an emissions trading system, though prices are significantly lower than other highly developed countries covered by a carbon pricing system. The majority of Asian countries, however, have not yet introduced carbon pricing. Cooperation in the region is growing - China working to link its carbon markets with other Southeast Asian countries – thereby reducing fragmentation and bolstering effectiveness. (https://climatepromise.undp.org/news-and-stories/africa-needs-carbon-markets).

In Australia, carbon pricing has had a mixed history. In 2011, Australia became a relatively early adopter of carbon pricing when it established an emissions trading scheme under the Clean Energy Act with plans to link with the EU ETS. However, after facing significant political opposition it was repealed only three years later in 2014. A more limited pricing system which applies to the power sector operates similarly to an emissions trading scheme, was introduced in 2023. New Zealand has had an emissions trading scheme since 2008, with some discussions since then about linking with the EU ETS.

The Asia-Pacific region’s importance to the global economy means that carbon pricing changes are likely to impact many businesses. While carbon prices remain relatively low, and most jurisdictions do not have carbon pricing mechanisms, there is a trend towards the introduction of new mechanisms, and existing pricing systems in Asia are likely to grow in scope and magnitude.