Carbon Pricing Basics

Carbon pricing makes the invisible impact of business activities on the climate visible on the balance sheet. It therefore makes low-carbon and negative carbon choices more attractive, helping to combat climate change.

Many business activities emit greenhouse gases (GHGs). Although the science is clear about the negative impacts of these emissions in contributing to climate change, the cost to society (known as the external cost) is not generally factored into the price of goods and services. In other words, climate change is a ‘negative externality’ - a cost borne by society but not reflected in market prices.

One way of addressing negative externalities is by intervening to put a price on the harmful impact caused by that externality. This gives a market signal to take appropriate action, in this case to reduce greenhouse gas emissions. This is the basic rationale putting a price on carbon.

Carbon pricing usually involves assigning a price per tonne of carbon dioxide or equivalent greenhouse gas (tCO2e). In compliance carbon markets, governments ensure emitters pay this price. Businesses can also price carbon internally, by choice, which is explored in more detail in the section Carbon pricing and the board.

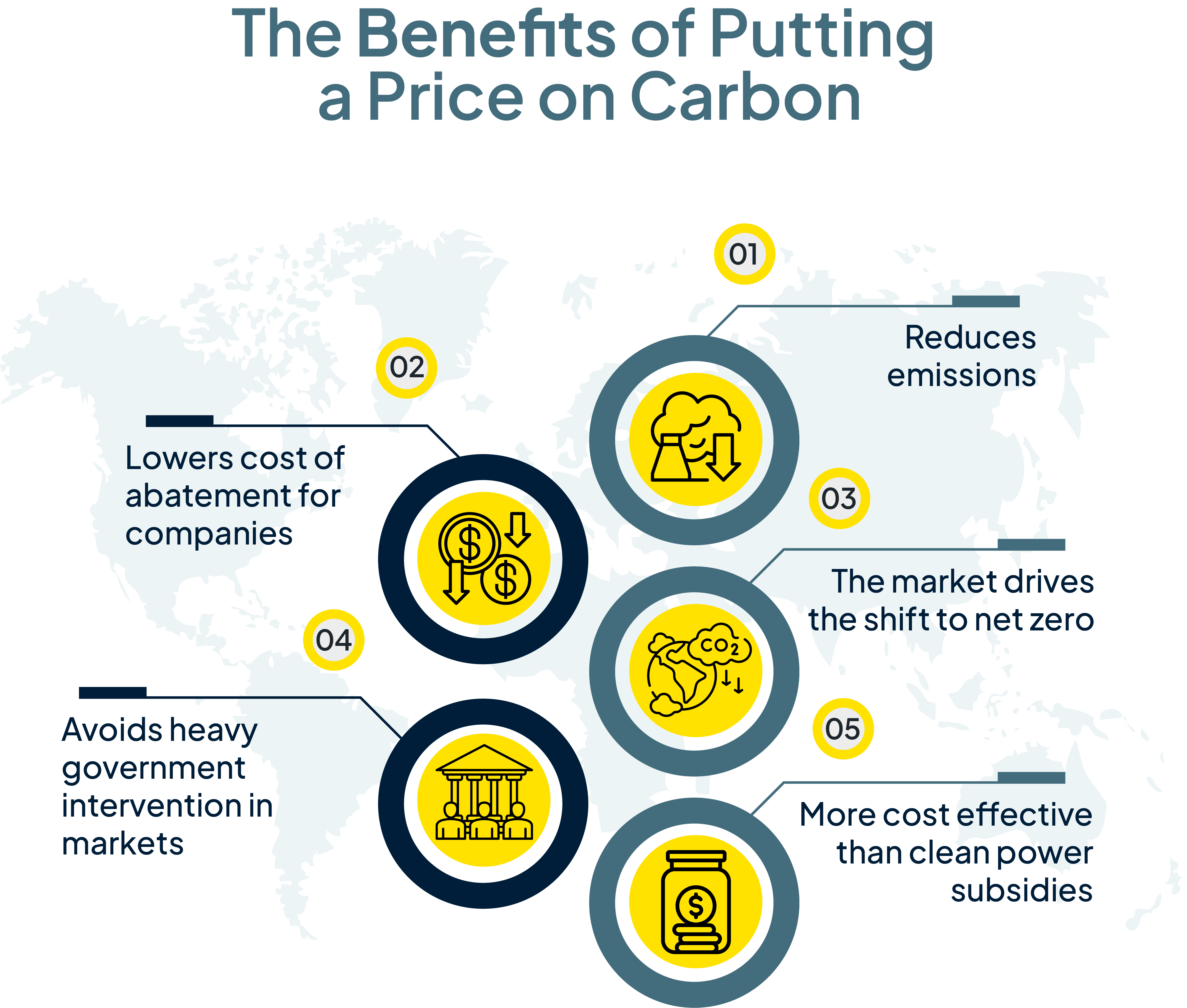

Carbon pricing is proposed as an economically efficient intervention to reduce greenhouse gas emissions – those companies that can make reductions most easily will shift to low-carbon alternatives most quickly.

quickly.

In theory, carbon pricing drives emissions reductions at the lowest marginal cost of abatement as market actors will seek to choose the cheapest options possible to avoid paying the carbon price. As a market mechanism, carbon pricing has the benefit of facilitating a market-driven shift to net zero rather than directly controlling business behaviour, which would be the case with command-and-control regulation.

While not sufficient to tackle climate change on its own, many consider carbon pricing to be the single most effective policy lever for reaching climate targets and accelerating the transition to a net zero economy. Evidence indicates that existing carbon pricing schemes have reduced emissions without a significant economic cost, , and has been highly effective when combined with other policy interventions, but analysis of the impacts of actual carbon pricing schemes remains relatively limited when compared to its strong theoretical backing. A 2021 study looking at Germany’s and Britain’s power sectors found carbon pricing to have a superior cost-effectiveness to subsidizing wind or solar power in these two countries.

The following sections deal with compliance carbon markets. It explores the ways that governments price carbon, considerations in setting a carbon price, some of the key challenges and opportunities facing carbon markets today, and the concept of carbon border adjustments, and other cross border mechanisms, designed to address competitiveness concerns.