On 2 October 2024, global non-executive directors participated in the Climate Scenario Game: Nature Risk in the Boardroom, a webinar organised by Chapter Zero, the Climate Governance Initiative and GARP Risk Institute. Attendees acted as the board of a fictional company, voting on critical decisions for four future dilemmas over the next six years. Expert panellists provided insights into the decision-making process and outcomes. This immersive exercise highlighted the urgency of addressing nature risks, equipping participants to tackle policy, legal, market, and reputational challenges within their own organisations.

There’s a direction of travel for both climate and nature, this isn’t cyclical, this is one way. The climate crisis is only going to get worse until we achieve net zero, and the nature crisis is only going to deepen until strong collective action is taken. So short-term decisions will probably come back to bite you. – Nigel Brook, Clyde & Co

Key takeaways for board directors from the session

- Climate and nature risks are inevitable, and inaction carries high costs.

- Nature and climate issues will only accelerate in future, and early adoption of frameworks like the Taskforce on Nature-related Financial Disclosures (TNFD) can give companies a competitive edge.

- There is no single solution; long-term planning must be rooted in science, regional realities, and a deep understanding of the market dynamics, both locally and globally.

We want to encourage companies and boards to be leaders in these topics, and inevitably the price of that leadership in certain settings will be strategy alteration. We want to allow companies to feel comfortable with altering strategy where they have new information. – Tim Smith, Norges Bank Investment Management

Setting the scene

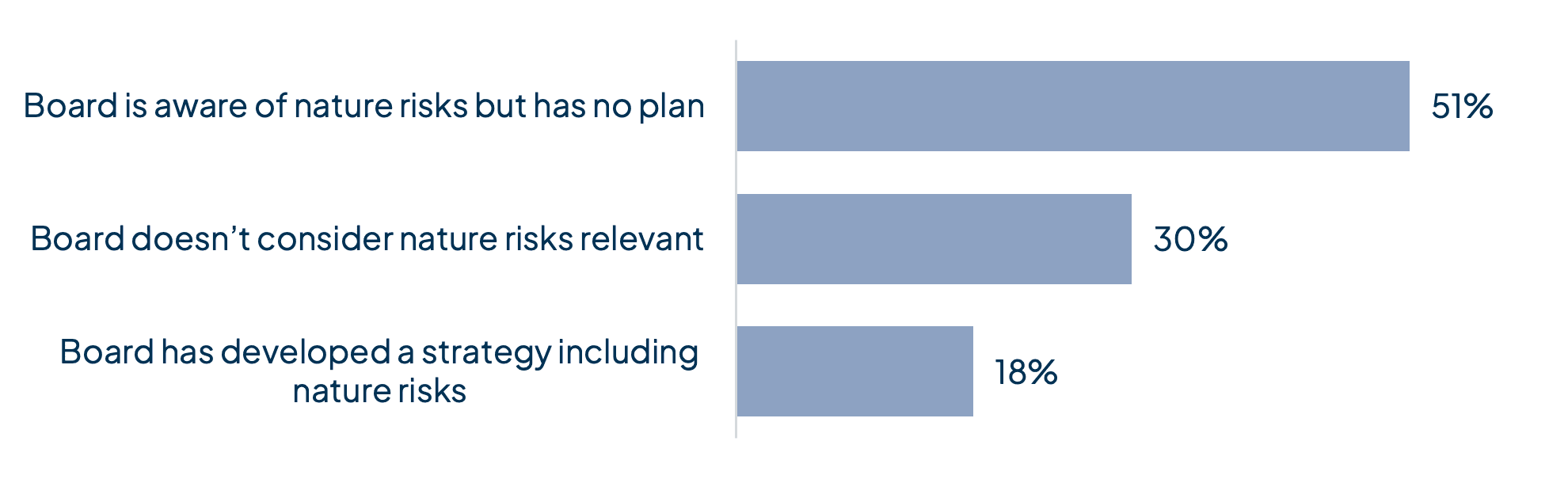

An initial poll provided information on the current approach to nature risk from members of the audience:  Four-in-five (82%) do not have a nature risk plan. Whilst many are aware of nature risks but have no plan (51%), others do not consider nature risks to even be relevant to their company (30%).

Four-in-five (82%) do not have a nature risk plan. Whilst many are aware of nature risks but have no plan (51%), others do not consider nature risks to even be relevant to their company (30%).

The Scenario: Nature Risk in the Boardroom

Participants were asked to vote on four nature-related dilemmas as board members of EatWell Plc, a fictional global food and beverage company, often praised for its strong climate leadership, as it strives to achieve its net zero goals. The panel of experts guided the audience through decisions impacting biodiversity and climate.

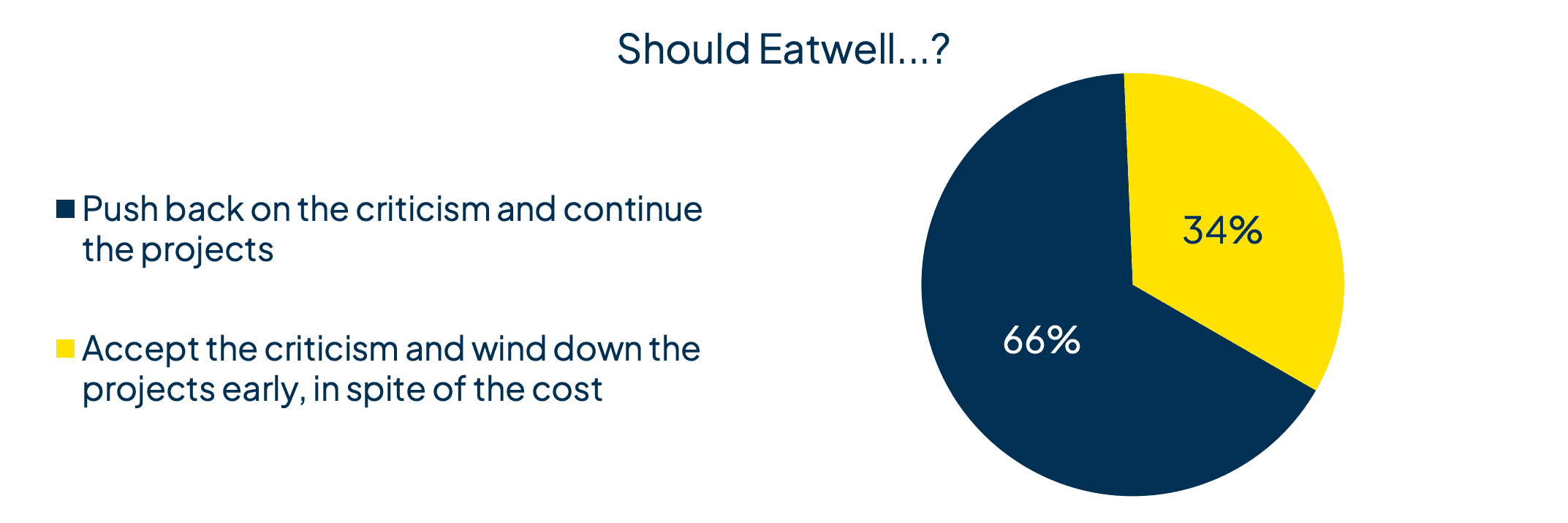

Dilemma 1: Environmental Impact of Insetting Projects

EatWell has invested heavily in carbon offsetting projects within its own value chain (known as ‘in-setting’). In 2024, ecologists raised concerns about EatWell's projects, criticising the narrow focus on carbon sequestration despite significant investment. The board had to decide whether to continue these projects or wind them down in response to the environmental criticism.

Poll Results

Key Takeaways from Dilemma 1

- Whilst criticism is difficult to navigate, it can spark important discussions in the boardroom about the holistic approach needed to tackle nature and climate action.

- Many offsetting projects, whilst reducing carbon emissions, may have negative impacts of biodiversity which cannot be ignored in pursuit of carbon sequestration.

- It is crucial to integrate nature into climate strategies to avoid unintended consequences. Companies should adapt their strategies based on emerging evidence, ensuring that their offsetting efforts contribute positively to both climate and nature objectives.

- If nature risks are not proactively addressed, a company may be exposed to potential legal liabilities and reputational damage.

I know climate change is very complex, but nature is even more complex. Science is absolutely critical and companies should be more connected to science when making decisions on nature. - Roberto Silva Waack, Marfrig, Wise Plasticos and Synergia & Arapyau

Dilemma 2: New Environmental Laws

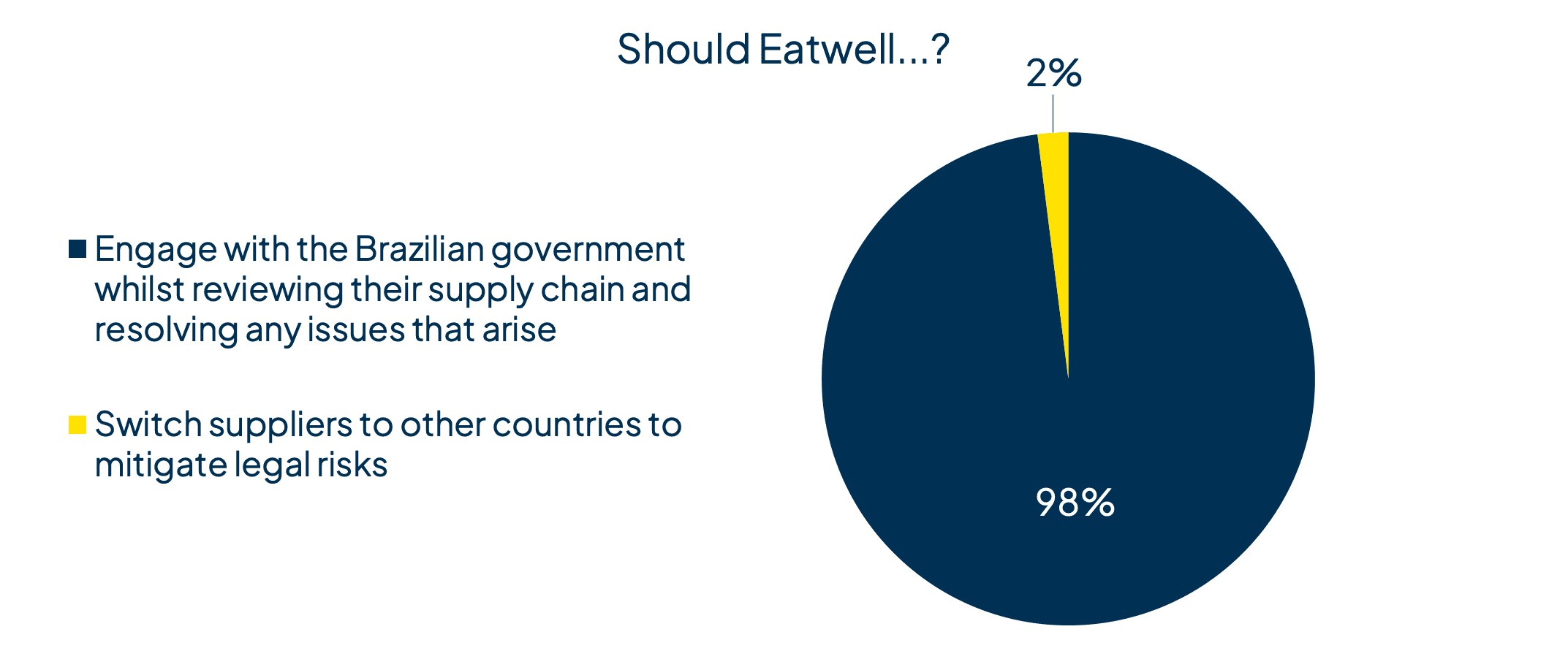

In 2026, Brazil's new environmental laws disrupt major supply chains, including EatWell's. A competitor's lawsuit sparked protests, raising concerns about EatWell's own suppliers. The board had to decide whether to continue operations in Brazil, despite potential legal risks, or to switch suppliers to mitigate those risks.

Poll Results

Key Takeaways from Dilemma 2

- It is critical to stay ahead of regulatory changes by aligning business practices with emerging environmental standards.

- Environmental regulations are expanding globally, and so switching to suppliers in another country may not be a viable long-term solution.

- Companies should work with regulators and stakeholders to review their supply chain and build more resilient operations.

- Failure to adapt could result in financial penalties, legal issues and damage to the company’s reputation.

There’s a risk of this sort of legislative change spreading to other countries. When we look at legislative or regulatory change globally, we see a lot of topics emerge quickly within industries or regions. They often don’t exist in isolation for very long. – Tim Smith, Norges Bank Investment Management

Dilemma 3: Challenges in the Insurance Market

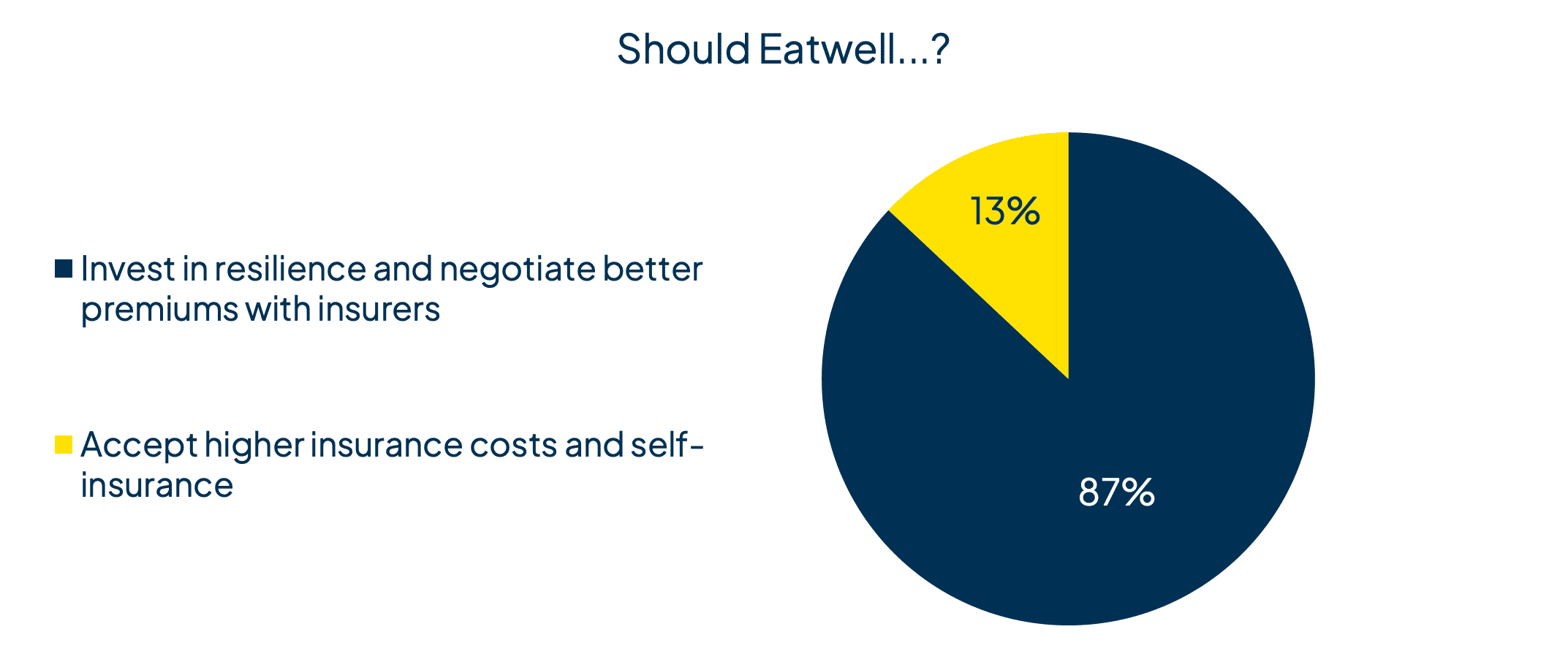

By 2028, worsening climate crises driven by interconnected issues like heatwaves, floods, droughts, and biodiversity loss, have caused repeated business disruptions for EatWell. Frequent insurance claims have led insurers to demand either steep premium increases or self-insurance for the first £15 million of future claims. The board faced a choice between investing in supply chain resilience and negotiating with insurers or accepting higher insurance costs.

Poll results

Key Takeaways from Dilemma 3

- As climate-related crises become more frequent and severe, businesses are increasingly confronted with rising insurance costs. Thus, it is critical to invest in long-term resilience.

- Companies that prioritise resilience not only strengthen their ability to withstand future environmental shocks but also become more attractive to insurers.

- The cost of inaction is steep. Without proactive steps, companies risk facing either unaffordable premiums or losing access to insurance altogether.

- The role of insurers is evolving and may present an opportunity to companies. Rather than being risk underwriters, insurers may become strategic partners, helping businesses model future climate impacts and invest in resilience projects.

The insurance market’s appetite for these kinds of cover may diminish over time, expressed as increased premium, the restrictions of the terms, and ultimately withdrawal from a market. Customers who invest in resilience may be more attractive to insurers, who might be willing to ride the resilient risk. - Nigel Brook, Clyde & Co

Dilemma 4: Hard Commercial Decisions on Unsustainable Products

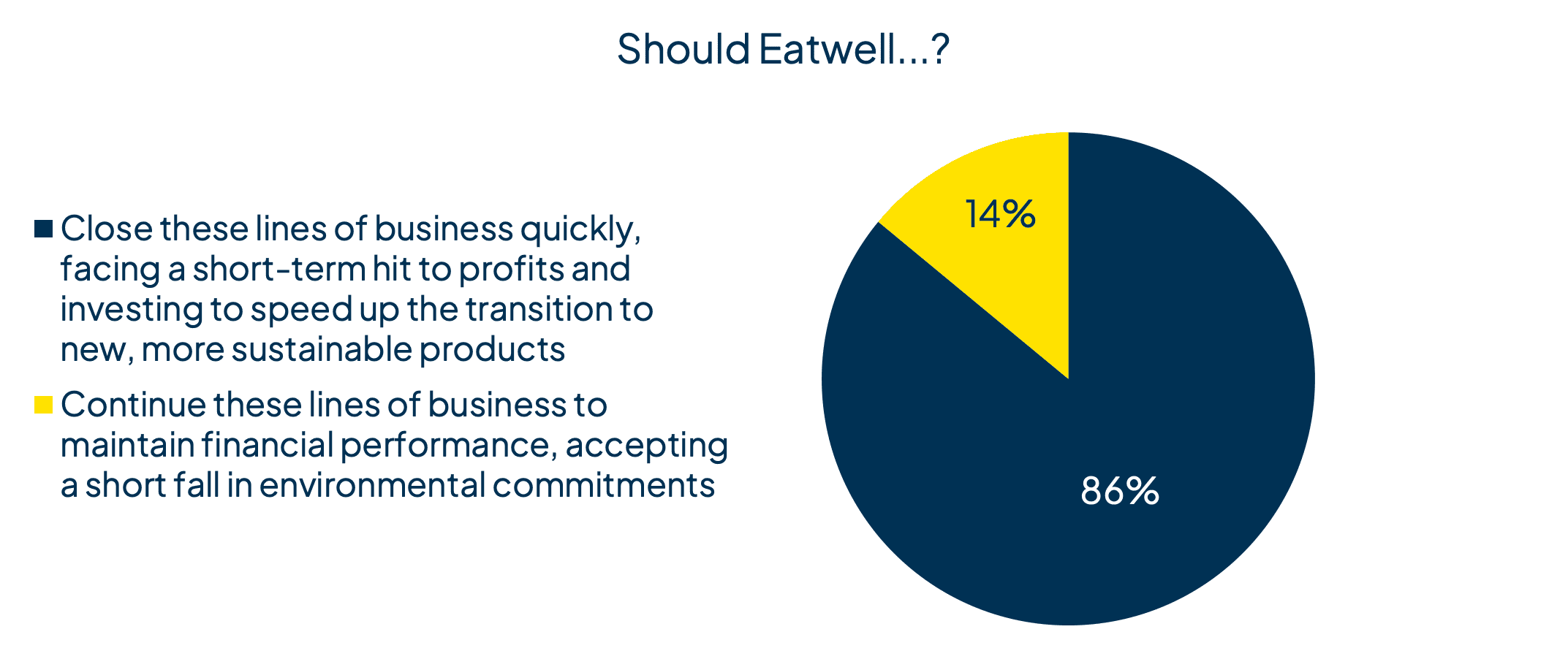

By 2030, nature and climate priorities are closely linked, with mandates like TNFD becoming mandatory. EatWell re-evaluates its reliance on nature and identifies several unsustainable yet profitable product lines. Following a major ecocide case against a supplier, the board must decide whether to continue or quickly close these environmentally harmful product lines.

Poll Results

Key Takeaways from Dilemma 4

- Delaying tough decisions can result in more significant long-term costs, both financially and reputationally.

- Companies that continue to defend unsustainable products risk alienating shareholders and damaging their brand’s credibility.

- Companies that take a forward-looking approach by investing in new product areas can not only stay ahead of regulatory risks but also reshape consumer demand by marketing sustainable products as desirable.

- The transition away from unsustainable products is complex, particularly on a global scale. Businesses must embrace this complexity, recognising that regional strategies may be necessary to navigate the broader sustainability transition.

The major risk is over-simplifying these issues. It is complex, you have to embrace the complexity. You will have to generate multiple solutions that depend on the opinions of different stakeholders. Engagement with social enterprises is crucial. Be very attentive to the context and the dynamic of the market. Try to avoid overly simple global solutions. - Roberto Silva Waack, Marfrig, Wise Plasticos and Synergia & Arapyau

There is going to need to be a shift in production and consumption if we are going to achieve net positive and it won’t necessarily be popular. However, the nature-positive transition will also create new opportunities in new technologies, products and business models. These are inevitable changes, get ahead if you want to survive. – Karen Ellis, WWF UK