Key messages for board directors

- Transition plans provide comprehensive information on the strategies (technical, financial, governance, etc.) that an organisation will follow to achieve its net zero targets and contribute towards a climate-resilient economy. These must be credible, include interim goals and be transparent to stakeholders.

- Board directors play an important role in setting ambitious net zero goals. They should also ensure that transition plans are aligned with, and embedded into, the business strategy. This alignment will help organisations to remain competitive and resilient in the face of climate and financial risks.

- Following the deliberate global expansion of climate and nature disclosure, transition planning is expected to become part of voluntary and mandatory requirements for organisations across the world, with guidance and frameworks from the Glasgow Financial Alliance for Net Zero (GFANZ) and the UK’s Transition Planning Taskforce (TPT) taking the first steps.

Introduction

Many businesses and financial institutions across the world have committed to, or intend to set, net-zero goals. More than one-third of publicly traded companies already have these targets in place(1), which are increasingly validated by the Science Based Targets initiative (SBTi). The number of organisations setting science-based net-zero targets doubled in 2023(2), amounting to 4,523 companies globally.

Transition planning is a vital process in which the organisation establishes actionable pathways to achieve its net-zero goals. However, there is a disparity between setting the targets and establishing plans to achieve them. From over 18,000 organisations that disclose environmental metrics via CDP (the global disclosure standard for carbon, water and forests), only 4,100 organisations have a transition plan aligned with a 1.5⁰C future. Moreover, CDP considers that only about 2% of those transition plans are fully credible and compliant with CDP’s criteria(3).

Transition planning is not an easy task but it is essential for the long-term sustainability of businesses and the natural world they depend on. Recently, there has been an increase in frameworks to support organisations to develop and publish transition plans. In the next year alone, around 6,500 organisations are planning to develop transition plans(3).

What is a transition plan?According to the IFRS S2 standard, a climate-related transition plan is ‘an aspect of an entity’s overall strategy that lays out the entity’s targets, actions or resources for its transition towards a lower-carbon economy, including actions such as reducing its greenhouse gas emissions.’(4) The Transition Plan Taskforce (TPT) builds from that IFRS S2 definition, emphasising that a transition plan should articulate the company’s Strategic Ambition. Hence, the TPT suggests companies take a ‘strategic and rounded approach which considers three inter-related channels in designing its transition plan:

Although this definition primarily targets greenhouse gas emissions reduction, the important role of nature, climate adaptation and a just transition are increasingly being acknowledged. CDP refers to transition plans as taking action to also ensure ‘natural ecosystem health is restored’(5) and the TPT recommends they should also ‘avoid adverse impacts for stakeholders and society, and safeguard the natural environment.’(4) |

Transition plans in the boardroom

- Transition planning falls under the board of directors’ oversight as it involves adapting the business strategy to achieve net-zero targets, manage risks and capture opportunities.

- Including climate and nature impacts in risk and opportunity assessment is key to understanding their subsequent impacts on business operations, supply chains, stakeholders and financial performance. This, in turn, provides valuable information for board directors to exercise their fiduciary duty and lead the organisation to success over the long term.

- Transition planning activities should be fully costed and integrated into financial planning and board directors can play an important oversight role in ensuring this takes place. This relies on robust quantification of climate-related risks and opportunities and the assessment of strategic alternatives (in business model and value chain) in financial terms.

- The board has an important role in setting ambitious net-zero targets and a credible plan to achieve them. However, if organisations fail to define the pathways to reach the targets, there is a risk of goal setting being deemed as greenwashing.

- Announcing ambitious climate targets without outlining concrete strategies, investments, and timelines to achieve them can reduce the credibility of the organisation. Stakeholders including consumers, investors, and current and prospective employees, increasingly scrutinise this information to make informed decisions.

- International organisations like GFANZ, CDP, the TPT, and the United Nations provide guidance on the elements needed for a credible transition plan. These initiatives are a useful reference for board directors to support their organisations in developing a transition plan.

- Governance is an important element in transition planning. Transition plans should ensure that the organisation’s culture is aligned with strategic net-zero ambition, which may include the board’s oversight of progress, climate training programmes, or employee remuneration and incentives.

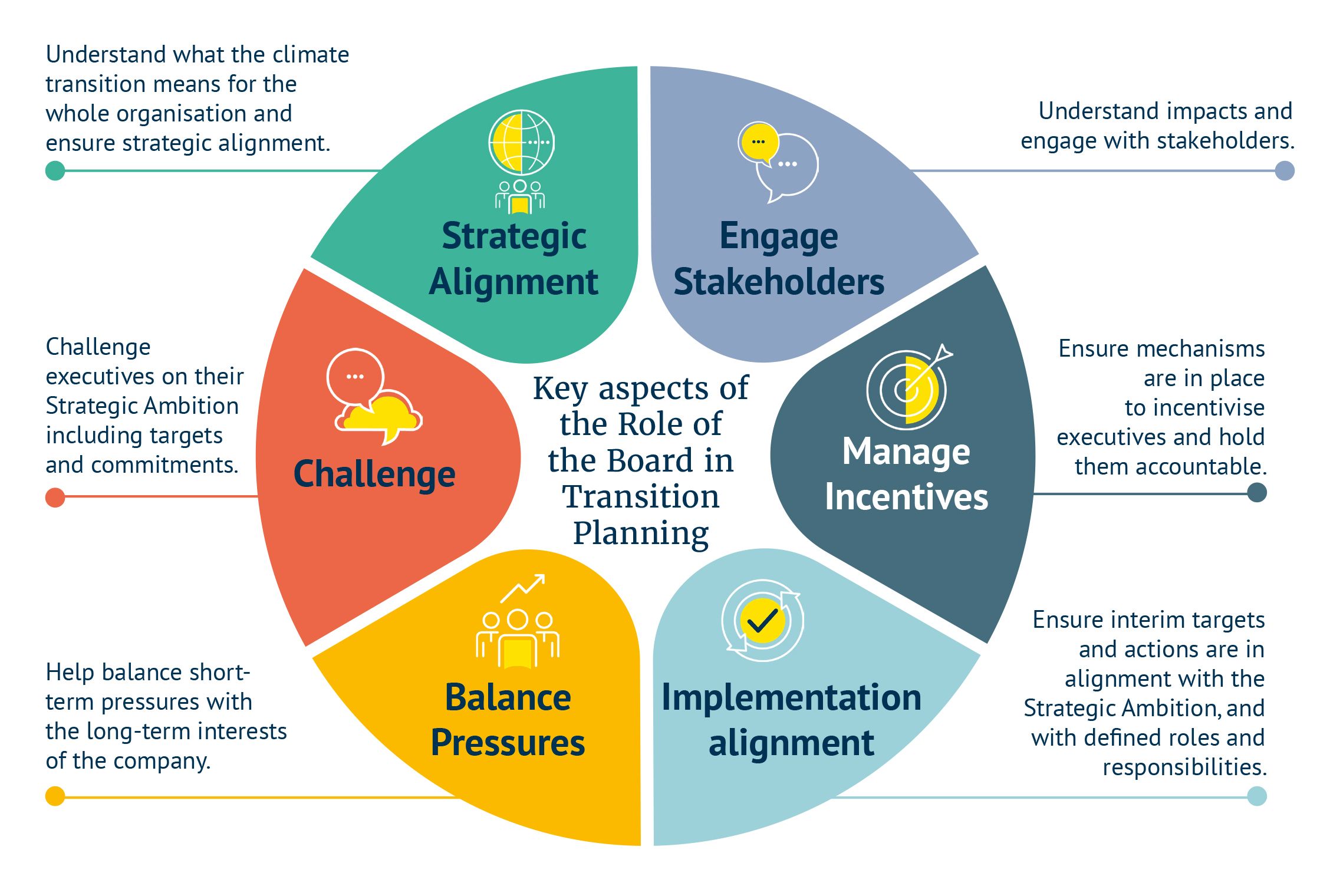

- Board directors can provide stewardship and strategic advice in six areas (Figure 1), enabling governance structures that will support delivery of the transition plan.

- Board directors can provide stewardship and strategic advice in six areas (Figure 1), enabling governance structures that will support delivery of the transition plan.

Figure 1. Key aspects of the role of the Board in transition planning.

Extracted from: Chapter Zero, 2023. Transition Planning Toolkit: Briefing.

Transition planning frameworks at a global level

Frameworks to develop transition plans are in the surge as part of a global effort to facilitate transition planning in the private sector. Consolidated in 2021 at COP26, GFANZ set the lead on transition planning by developing a framework for financial institutions as well as recommendations for real economy transition plans. The following year, the TPT was launched in the UK. The TPT built upon the work of GFANZ and designed a detailed disclosure framework and guidance for businesses, which can be used internationally to develop transition plans that are aligned with the sustainability disclosure standards of the ISSB (IFRS S1 and S2). Both frameworks’ approach is consistent and supports the development of globally comparable transition plans. Further information on TPT is available in Chapter Zero’s transition planning toolkit.

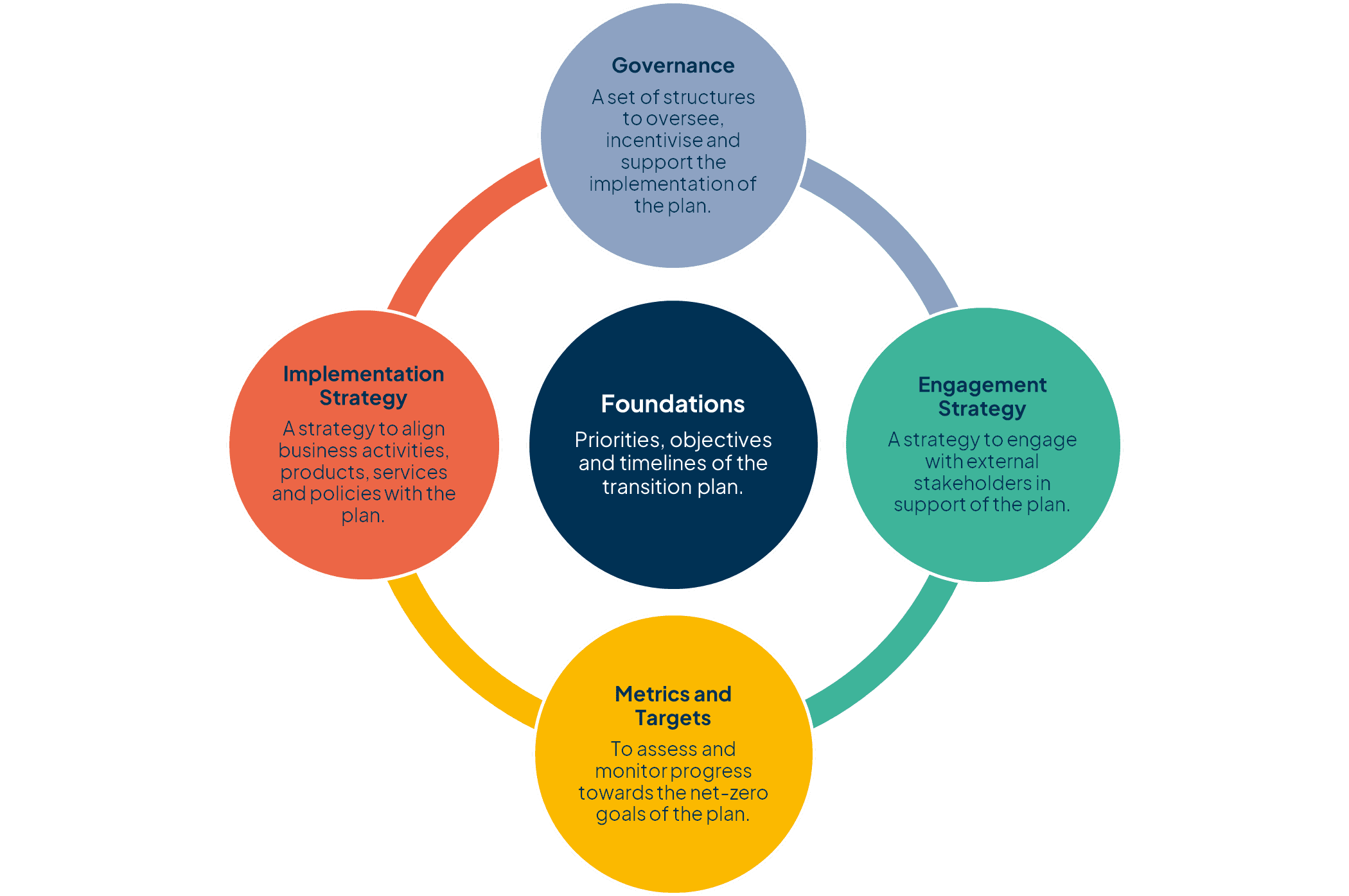

The GFANZ and TPT transition planning frameworks consider five elements that plans should have to be robust, credible and actionable (Figure 2). These elements show that achieving net zero requires transformational change within the organisation and externally with stakeholders' (suppliers, rightsholders, investors, etc) plans.

Figure 2. Elements of a transition plan according to GFANZ and TPT

Adapted from: GFANZ, 2022. Financial Institution Net-zero Transition Plans: Fundamentals, Recommendations, and Guidance. Figure 6, p.22.

Other international organisations have published valuable guidance and analysis that complements the frameworks, such as:

- CDP’s technical note describing six principles for a credible transition plan: accountability, internally coherent, forward looking, time bound and quantitative, flexible and responsive, and complete.

- The UN Integrity Matters report for non-state actors (businesses, financial institutions, cities and regions) on recommendations to deliver transition plans with integrity. It also provides a recommendations checklist with four elements:

- Setting a net zero pledge;

- Preparing the mandatory components of a transition plan;

- Creating a credible transition plan;

- Getting verified by increasing transparency and accountability.

- The Transitions Pathway Initiative (TPI), which provides independent and comprehensive analysis on progress to net zero by corporates and financial institutions, detailed to sector or company level. Investors may use this to inform their funding decisions.

- The Climate Policy Initiative’s guidance to financial institutions for assessing credible transition plans from counterparties.

- The Grantham Institute at LSE guidance to financial institutions on the social aspect of climate action to develop just transition plans.

- WWF’s key criteria for financial institutions for developing their own transition plans.

Transition planning in local regulation

The world is starting to formalise transition plans in the net zero transition landscape. For example, at a global level, the Taskforce on Climate-related Financial Disclosures (TCFD, now consolidated into the ISSB) encourage companies to include aspects of transition plans in their disclosures, but the specific requirements are subject to local market adoption which, for instance, is mandatory in the UK for large companies. Moreover, the creation of the TPT framework may accelerate voluntary and mandatory regulation globally.

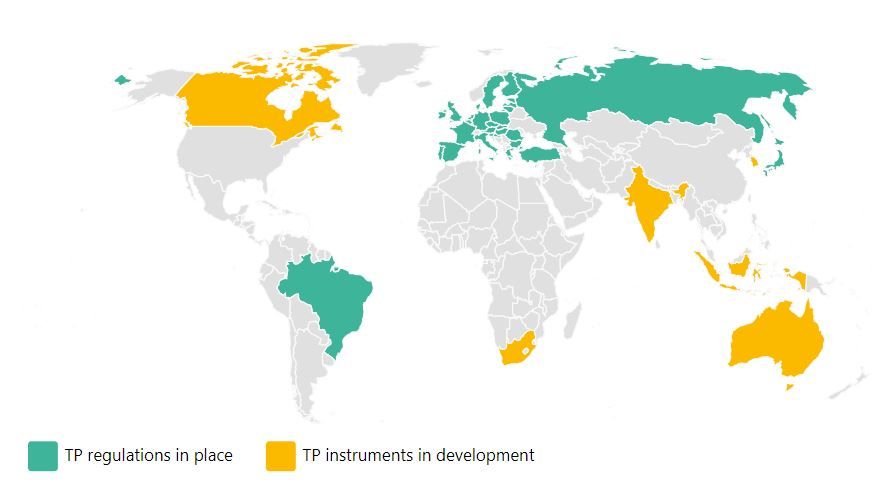

A few countries and regions already have some form of transition planning regulation. A study by Oxford Net Zero found that a third of G20 countries have legal instruments that require organisations to describe their decarbonisations pathways, as shown in Figure 3. Moreover, transition planning instruments are under development in eight other G20 countries, including Italy and Germany within the EU(6).

Figure 3. Global regulatory landscape of transition planning (TP) in G20 countries

Although regulation tends to apply only to listed companies, organisations of all sizes could be impacted by legal requirements for transition planning. Small and medium size enterprises (SMEs) in the supply chain are often significant contributors towards scope 3 emissions of listed companies. Therefore, listed companies may engage with their suppliers to collaborate on their net-zero ambitions and establish collective transition pathways to achieve those goals.

Transition planning in identified jurisdictions (6)

Last updated: March 2024

Brazil - Financial institutions are mandated to outline their decarbonisation pathways, as stated in a resolution from the Banco Central Do Brasil.

European Union – Financial institutions must disclose their transition plan. All listed companies (including SMEs) must disclose transition plans aligned with the Corporate Sustainability Reporting Directive (CSRD), from 2025.

France – The French regulator, Autorité des Marchés Financiers (AMF), published a transition planning guide for businesses.

Japan – Its Corporate Governance Code discusses full disclosure, including decarbonation pathways.

Russia - Federal state companies must outline their decarbonisation pathways. The Bank of Russia issued a methodology for public joint-stock companies and issuers to develop climate transition plans.

Türkiye – Businesses are mandated to formulate and publicly disclose action plans, as stated in the Sustainability Principles Compliance Outline.

United Kingdom –The Financial Conduct Authority (FCA) introduced mandatory rules for listed companies and financial institutions to disclose transition plans. TCFD adoption is mandatory for large companies. In 2024, FCA will consult organisations on alignment of transition plans with the TPT Disclosure Framework; it also encourages early adoption of the framework.

Boardroom implementation of the TPT

Collaboration among regulators, businesses and financial institutions is important to enable the development and disclosure of transition plans. As a tool to foster knowledge exchange, the TPT hosts a collection of examples of corporate disclosure that align with sections of its framework. For instance, TYMAN and NatWest disclosures illustrate information on corporate governance that is relevant to transition planning:

| TYMAN | NatWest |

Sector: International supplier of window and door components for the construction industry. Alignment with the TPT framework: Section 5.2 Management roles, responsibility and accountability. In its sustainability report, TYMAN details the responsibilities of the board and the executive committee regarding sustainability. For instance, TYMAN’s Board is responsible for the oversight of climate-related matters, with the CEO accountable for the management of climate-related risks and opportunities. Moreover, TYMAN disclosed that during the November 2023 meeting, the Board reviewed performance against its previous sustainability plan and sign-off the new plan, which includes a near-term transition plan and actions to achieve it. | Sector: UK-focused banking Alignment with the TPT framework: Section 5.5 Skills, competencies and training. In its 2022 sustainability report, NatWest disclosed information on climate upskilling for its Board. Board directors received a climate training session focused on institutional change, climate measurement and influencing strategy. These sessions are held annually by the Centre of Business, Climate Change and Sustainability from the University of Edinburgh. |

The future of transition planning

In the coming years, the transition planning landscape will likely focus on ambition, transparency, and accountability (voluntary or mandatory). Organisations will be expected to set ambitious targets, implement robust strategies, and demonstrate tangible progress to net zero. The TPT will continue to support organisations globally to develop and deliver their transition plans. In April 2024, TPT published more sector-specific guidance, including for SMEs, and notes on nature, adaptation and the just transition.

Moreover, the role of board directors will continue to be pivotal. Board directors can provide strategic oversight, ensuring that transition planning is integrated into the core of the organisation's strategy and operations. Ultimately, board leadership is essential not only for mitigating climate risks but also for seizing opportunities, enhancing competitiveness, and creating long-term value for stakeholders in the transition to a net-zero economy.