Metro Pacific Investments Corporation (MPIC), a leading infrastructure investment company in the Philippines, views the challenges of a developing nation like the Philippines as an opportunity for bold climate leadership.

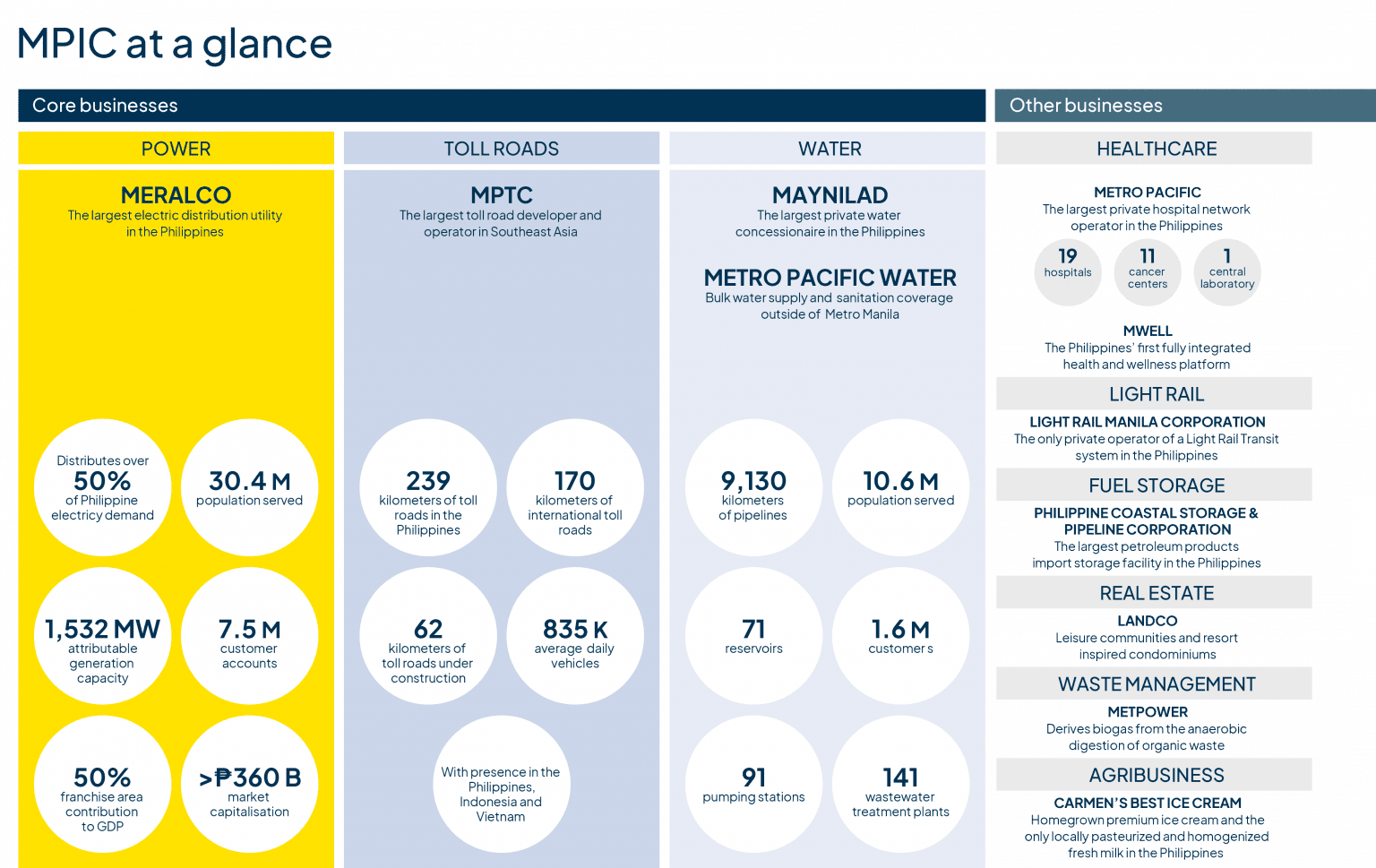

What is Metro Pacific Investments Corporation (MPIC)?

MPIC is a Philippines-based investment holding company with subsidiaries providing water, sanitation and sewage services, and operations in real estate, healthcare, light rail, logistics and infrastructure projects.

For employees at MPIC, this challenge is personal – the Philippines is an archipelagic country subject to an average of 20 typhoons a year, making Filipinos highly exposed to the impacts of climate change. This context cements MPIC’s commitment to embedding climate and sustainability action at the core of its operations. This challenging backdrop has also helped to shape a climate-savvy board able to drive forward the organisation’s sustainability strategy.

Above: MPIC at a glance

The Challenge

As an infrastructure investment company with sustainability at the centre of its business strategy, MPIC explicitly mandates all its holding companies to design, build, and operate with the least environmental and social disruption. This ideal is reinforced in the company’s mission and vision statements, its Business Development and Investments Policy and its Environment and Social Impact Assessment Policy (ESIA). To ensure this ideal became a reality, the challenge for MPIC was to embed sustainability into the top tier of decision-making.

Board-level Sustainability Committee

In 2020, MPIC appointed a new Chief Finance Officer (CFO) who also serves as the company’s Chief Risk Officer (CRO) and Chief Sustainability Officer (CSO), confirming the organisation’s commitment to directly integrate environmental, social and governance (ESG) principles into top-level financial decision-making.

MPIC also created a board-level Governance and Sustainability Committee and embedded ESG key performance indicators (KPIs) into the performance review process for all of its staff, boosting ESG accountability in day-to-day performance.

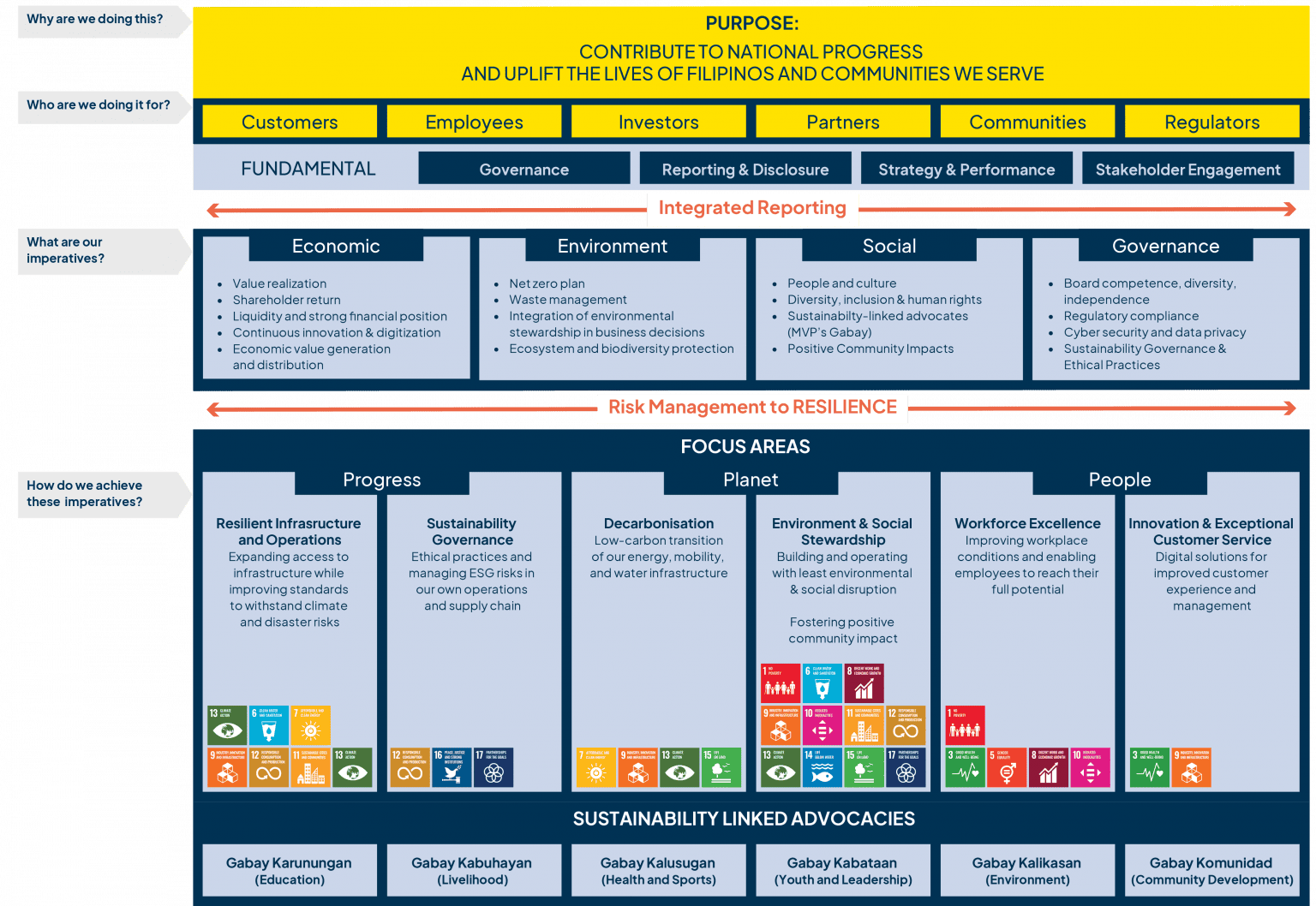

In the same year, MPIC redesigned the company’s Sustainability Framework to focus more on how its businesses contribute directly to solving the country’s most significant challenges mapping its contribution towards the Philippine Development Plan and the United Nations Sustainable Development Goals. This holistic, end-to-end approach to sustainability, covering Economic, Environment, Social, and Governance (EESG) factors, enabled the company to shift from a traditional risk management approach to overall business resilience.

Above: Metro Pacific Tollways (MPT) South’s headquarters, which received a LEED Gold Certification.

The Governance and Sustainability Committee is very active and involved, meeting formally once per quarter, with regular ad hoc engagement from the board on specific items. It is common for the organisation to require two committee meetings a month for board members to fully understand the sustainability implications of a project, initiative or business decision. As a result, the executive team sometimes has to change its plans to ensure it meets strict sustainability targets before securing the Committee’s approval. Highlighting a specific example: when a proposed infrastructure project, to build a bridge, was discovered to run through a mangrove forest, MPIC decided to increase resource and time costs to divert the bridge around the mangrove forest and align with climate and sustainability goals.

Board training – asking the right questions

One of the reasons the board is so effective at delivering against sustainability targets is that it has secured the necessary skills and knowledge to do so. For example, the Chair of the board’s Sustainability Committee is an environmental economist. Over the last two years, the board has also received between six to eight hours of mandatory training in governance and sustainability issues. This enables the board to challenge proposals and ask the right questions to support sustainability goals. The board also attends an annual MPIC Group Sustainability Summit – running since 2021 – with an impressive line-up of global environmental, social and governance experts to help elevate climate and sustainability issues to the forefront of senior management’s agenda. This enables board members to ask tough questions and make crucial decisions that push MPIC’s sustainability agenda forward. The board fully supported MPIC’s commitment to cease further investments in new coal-fired power plants and to explore liquefied natural gas as a transition fuel, alongside renewable energy sources.

Above: MPIC’s Sustainability Framework

Integrated reporting

Another clear outcome of integrating ESG principles into financial decision-making was the finance and sustainability teams’ shift towards integrated reporting in 2021. After many years of separately reporting on financial and ESG matters, MPIC’s transition into integrated reporting offers investors a more concise presentation of how the organisation creates value. The Integrated Reporting Framework’s rigorous and transparent format enables MPIC to refine its decision-making processes and enhance accountability in its use of financial and ESG-related resources.

MPIC’s Finance Team constantly studies the financial implications and quantification of sustainability-related risks and opportunities. The CFO’s team – including the Financial Controller, Head of Financial Planning and Reporting and their respective units – undergoes training to integrate sustainability into MPIC’s overall business strategy in order to build long-term value. The team conducts financial risk, demand and supply analysis; operational planning; and management of cost impacts and efficiencies to achieve sustainability targets.

Sustainability in practice

Taking an integrated approach to sustainability has underlined how sustainable development is core to MPIC’s business. This is demonstrated in the organisation’s work to strengthen critical public infrastructure whilst expanding access to essential services that improve the country’s economic and developmental outcomes.

For example, MPIC’s Meralco has upgraded, rehabilitated, and installed power infrastructure at a massive scale, enabling reliable and affordable electricity supply benefitting tens of millions of customers, including tens of thousands with no prior access to power services. It is ramping up its green energy projects and developing up to 1,500 MW of renewable projects to serve the country’s energy needs while simultaneously advancing its greater responsibility to society and the planet.

MPIC’s investments in renewable energy sources

| Meralco is committing to securing 1,500 MW of its power requirements from renewable energy sources in the next 5 years. Meralco's maiden solar project, BulacanSol (50 MWac), the country's largest single operating plant, began operations in 2021 and delivered 67 GWh of solar energy in FY2021. |

| METPower derives bio-gas from the anaerobic digestion of fruit waste from Dole’s canneries in South Cotabato to generate clean energy. The ‘Surallah’ and ‘Polomolok’ plants commenced operations in July 2022. |

| Metro Pacific Tollways (MPTC) installed a solar photovoltaic system in the parking and amenities building roof of its MPT South Hub. This will serve 515 kWp – 3% of the total power requirements in that facility- and result in over ₱200 million (US $ 3.6 million) |

| Maynilad energised its newly constructed 1-megawatt photovoltaic solar power farm inside La Mesa Compound in Quezon City. The farm is projected to generate approximately 10% in annual cost savings on electricity consumption of its La Mesa Pumping Station. |

MPIC’s water arm, Maynilad, has rehabilitated an extensive network of old pipes, installed new infrastructure, and connected thousands of low-income customers to potable water services. Beyond power and water, MPIC directly invests in programs that preserve natural resources and generate positive environmental impacts. MPIC’s MetPower Venture Partners was established to enter waste management and renewable energy development, two industries directly impacting the country’s sustainability credentials. MetPower has two waste-to-energy plants that process pineapple waste into biogas. This project qualified under the Asian Development Bank-managed Japan Fund for the Joint Crediting Mechanism (JFJCM) which provides grants and technical assistance for low-carbon technologies in ADB-developing member countries.

Outcome

MPIC has transformed the way the company does business and makes decisions by combining top-level finance, risk and sustainability roles. It has transitioned from a standard risk management process to a holistic end-to-end approach that harmonises financial and ESG parameters instead of viewing them as zero-sum concerns. These decisions have been backed by a proactive board that cares deeply about sustainability.

This transformation has placed MPIC as a leader in the Philippines for climate and sustainability governance, helping to demonstrate to customers, shareholders and investors, the organisation’s commitment to a long-term sustainable business model. MPIC also generally supports the transformation of the investment industry by using its experience to share learnings and best practices with others.

All illustrations and tables reproduced from originals provided by Metro Pacific Investments Corporation. With thanks to MPIC for participating in this case study.