The publication of the final Recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD) in September 2023 supports the global trend towards holistic and integrated sustainability disclosures in business and financial reporting. Under the TNFD framework, nature-related issues (dependencies, impacts, opportunities and risks) should be assessed and properly managed by businesses, and made visible to investors and broader stakeholders. The TNFD recommendations are consistent in language and structure with recognised sustainability reporting standards and frameworks including the Taskforce on Climate-related Financial Disclosures (TCFD), the International Sustainability Standards Board (ISSB), the Global Reporting Initiative (GRI) and the European Sustainability Reporting Standards (ESRS) under the EU Corporate Sustainability Reporting Directive (CSRD). This alignment enables integrated climate and nature-related reporting and lends the TNFD Recommendations to be widely adopted in voluntary or mandatory disclosures. The framework gives organisations the opportunity to make impactful changes for the business and for nature, and to respond to growing pressure from investors and broader stakeholders.

Introduction

Nature is more consistently and frequently becoming a part of the boardroom conversation. In September 2023, the Taskforce on Nature-related Financial Disclosures (TNFD) launched its final Recommendations for businesses and financial institutions to disclose their material interactions with nature. The Recommendations are seen as a critical step towards holistic sustainability disclosure. They aim to inform better decision making by companies and capital providers, and ultimately contribute to a shift in global financial flows toward nature-positive outcomes and the goals of the Kunming-Montreal Global Biodiversity Framework. The TNFD promotes transparency and accountability in corporate sustainability reporting by recommending 14 disclosures for nature reporting to promote the provision of clear, comparable and consistent information by companies to investors and other providers of capital.

Key takeaways for board directors

- The TNFD framework can support board directors to guide their organisations’ transition to net zero and nature positive outcomes. By disclosing a more comprehensive picture of the organisation’s opportunities and risks relating to climate change, the use of natural resources and related interactions with society; board directors can equip themselves, and others both within and outside the organisation, to make informed and strategic decisions to improve the future of the business.

- The TNFD Recommendations and guidance enable organisations to assess and manage nature-related issues (dependencies, impacts, opportunities and risks) to support a strategic shift toward nature-positive outcomes. Businesses following the Recommendations should provide consistent and comparable material information to investors and other stakeholders. To support strategic business decision making and provide valuable information to the external investor community, board directors should consider incorporating nature management into their organisation’s governance structures and advising their executive management to accommodate effective nature-related disclosure following the TNFD Recommendations.

- TNFD is consistent in language and structure with other sustainability reporting standards and frameworks such as TCFD, ISSB, GRI and CSRD, lending itself to wider adoption in both voluntary and mandatory disclosures. Board directors may want to consider early adoption of the TNFD Recommendations, which will help their organisation to proactively align with the latest climate and nature-related disclosure trends and adapt to a rapidly evolving disclosure landscape. A list of early adopters of TNFD Recommendations will be shared at the World Economic Forum in Davos in January 2024.

TNFD recommendations and questions to raise in the boardroom

Since the Climate Governance Initiative’s previous update, the TNFD has refined its set of 14 recommended disclosures, structured around four pillars, to enable effective nature-related financial disclosures. These recommendations provide a framework for entities to assess nature-related issues and their impact on different stakeholders. TNFD also provides additional guidance on scenario analysis to explore potential or anticipated opportunities and risks, and their appropriate management. TNFD outcomes can therefore help to inform boardroom decisions relating to risk management, strategic planning, management performance against targets, and corporate sustainability disclosure.

Figure 1. TNFD Recommendations[1]

The TNFD recommendations seek to provide investors and financial institutions, regulators, and other stakeholders with information from corporates on nature-related issues to support informed and robust decision-making. Board directors can support the organisations they oversee by starting an open conversation in the boardroom, and with the executive team, about the implications of nature for the business strategy.

Specific questions to raise this topic in the boardroom are suggested below, aligning with the TNFD disclosure pillars:

Governance

- Does your board oversee and have an understanding of the organisation’s nature-related opportunities and risks?

- Does the board have oversight of the organisation’s engagement with key stakeholders to understand relevant nature-related issues to the business and its stakeholders (e.g. Indigenous Peoples)?

- Is the organisation’s management team empowered to incorporate nature-related considerations into decision-making and strategic planning?

- Does your board have oversight of the organisation's existing human rights policies and engagement activities with key stakeholders?

Strategy

- Is your organisation's strategy resilient to its nature-related dependencies, impacts, risks, and opportunities?

- Does your organisation have the relevant expertise and capacity to collect nature-related data and conduct scenario analysis assessments?

- How will your board oversee the monitoring and reviewing of the organisation’s interactions with nature over the short, medium and long term?

Risk and impact management

- Are nature-related risks and opportunities accounted for in your organisation’s risk management processes?

- Does your board have oversight of the key partners or suppliers that could be exposed to nature-related risks that would affect your business?

Metrics and targets

- Does your board have oversight of the organisation’s nature-related targets? Are these aligned with the overall strategy and long-term vision for the business?

- Are your organisation’s nature-related targets and performance easily accessible and transparent to stakeholders?

- Does your board appropriately consider how the organisation’s targets, risks and policies relating to climate and nature interrelate to anticipate potential trade-offs and conflicts?

Background

Established in 2021, the Taskforce for Nature-related Financial Disclosures (TNFD) aims to support Target 15 of the Global Biodiversity Framework (GBF) which calls for businesses to monitor, assess and transparently disclose their risks, dependencies and impacts on biodiversity. The GBF was adopted at the Convention on Biological Diversity’s 15th Conference of the Parties (COP15) in December 2022. Two years after its launch, the TNFD framework is complete and aligns with global policy goals for biodiversity. Its development followed an open collaborative approach between scientific, standards and corporate reporting organisations, market participants, NGOs and civil society organisations.

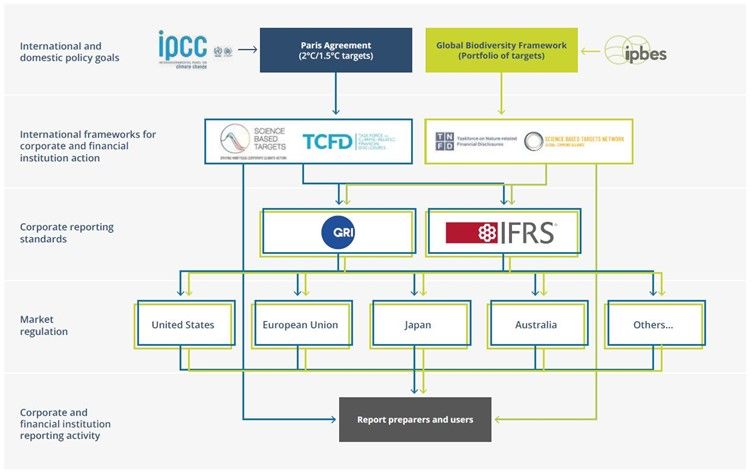

The TNFD Recommendations and guidance are consistent in language and structure with other widely adopted sustainability reporting standards and frameworks including:

- The Task Force on Climate-related Financial Disclosures (TCFD)

- The International Financial Reporting Standards (IFRS) from the International Sustainability Standards Board (ISSB).

- Global Reporting Initiative (GRI).

- The EU’s Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards (ESRS).

This alignment indicates the TNFD’s intention to harmonise with existing climate and sustainability reporting frameworks to enable wider adoption in voluntary or mandatory sustainability disclosure. Investors’ funding decisions are increasingly based on such standards and board directors may want to incorporate TNFD as best practice for their organisations’ financial disclosure. Moreover, stakeholder expectations and the changing regulatory landscape could also drive organisations to adopt TNFD recommendations.

Figure 2. TNFD in the global sustainability reporting landscape[2]

Potential impacts of TNFD Recommendations for board directors

Business strategy and opportunities: As a result of conducting assessments of nature-related issues, board directors may consider arising opportunities including cost savings, increased efficiency, new services or products, or decisions to invest in nature-based solutions. | Risk management: TNFD can help boards to identify and manage nature-related risks which, in turn, can affect financial performance. By understanding their dependencies and impacts on nature, businesses can create more robust risk management strategies. |

Increased stakeholder expectations: Greater scrutiny from investors, shareholders and regulators may lead board directors to advise and support their companies to increase sustainability commitments to encompass both climate and nature targets (e.g. becoming nature-positive). | Stakeholder relations: TNFD requires stakeholder engagement as part of the assessment process for nature-related issues. Board directors should be ready to oversee how their companies navigate stakeholder engagement and disclose how it happens. |

Regulatory compliance: Mirroring how TCFD disclosure has been increasingly incorporated into regulatory mandates, TNFD may follow a similar path. For instance, the UK intends to discuss how to incorporate TNFD into national policy (end of 2023). Boards may want to consider early adoption of the framework. | Governance and expert knowledge: Boards may need to adapt their governance structures and advise executive management to accommodate for effective nature-related disclosure. Organisations may require expert knowledge outside of their existing capacity to complete TNFD’s assessment and disclosure. |

TNFD reach: nature encompasses more than climate

TNFD understands nature as composed of four realms: ocean, freshwater, land and atmosphere (climate), and puts society’s interaction with nature at the centre of the framework. Nature presents risks and opportunities to businesses; and businesses have dependencies and impacts on nature. These interactions are referred to as nature-related issues by TNFD. The framework suggests using the LEAP approach to assess those nature-related issues (see supplementary information below for further details on the LEAP approach).

Disclosure recommendations based on materiality

Organisations are expected to disclose nature-related material information using the relevant materiality approach of their jurisdiction. In the absence of such guidance, TNFD suggests reporting financial materiality (as a minimum) and supplementing it with impact materiality - reporting against both approaches reflects double materiality. The TNFD framework is, therefore, adaptable to any region and to the progress of individual organisations in their nature-positive journey.

- Financial materiality (baseline): focuses on risks and opportunities from the interactions between nature and business activities that capital providers should be aware of. This materiality approach is consistent with TCFD recommendations and uses the ISSB’s IFRS Sustainability Disclosure Standards materiality definition:

“An entity shall disclose material information about the sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s prospects.”

- Impact materiality: focuses on the impacts the business has on nature, relevant for a large range of stakeholders beyond investors. This materiality approach is consistent with GRI standards and uses its definition:

“The organisation prioritises reporting on those topics that represent its most significant impacts on the economy, environment and people, including impacts on their human rights.”

Resources and examples

Some organisations, like Natura&Co (Brazil) or Kao Corporation (Japan), contributed to the development of the TNFD framework and already introduced its recommendations (pilot version) in their annual reports. Other organisations have set nature goals and announced their intention to adopt TNFD in the short term, such as GSK (UK). TNFD will announce a list of pioneer organisations at the World Economic Forum Annual Meeting 2024 in Davos, who will shortly use the framework to disclose their nature-related issues.

Pension Funds Chair and Trustees - Accounting for Sustainability (A4S), have provided a list of top tips and practical applications of the TNFD processes for pension funds chairs and trustees on how to manage nature risk and invest in the opportunities.

Supplementary information

LEAP approach

TNFD’s LEAP approach supports businesses and financial institutions to assess and manage their dependencies and impacts on nature, as well as, potential risks and opportunities. LEAP stands for ‘Locate, Evaluate, Assess, and Prepare.’ It is consistent with the Natural Capital Protocol and Science Based Targets Network (SBTN). The approach is designed to be flexible and scalable, allowing organisations of all sizes and sectors to assess and manage their nature-related issues. Each phase of the assessment is described below.

Locate your interface with nature. This phase focuses on identifying business interaction with nature. The ‘Locate’ phase also involves identifying the business activities in ecologically sensitive locations.

Evaluate your dependencies and impacts on nature. During this phase, businesses evaluate their nature-related dependencies and impacts at each priority location identified in the previous phase. This process relies on analysing the size and scale of dependencies and impacts (negative, positive, and impact mitigation) and identifying those that are material.

Assess your nature-related risks and opportunities. This involves identifying and assessing the risks and opportunities businesses face due to their nature-related dependencies and impacts. Here, existing and proposed management systems to mitigate risks and create opportunities are discussed.

Prepare to respond to, and report on, material nature-related issues, aligned with the TNFD’s

recommended disclosures. This component focuses on developing a strategy to manage nature-related risks and opportunities. The strategy should include setting targets and measuring performance. This stage also includes identifying and disclosing material information in line with TNFD recommendations and making it accessible to stakeholders.