COP28 concluded with significant progress on the energy transition, climate finance, food systems transformation and nature. However, some stakeholders consider that it falls short of the level of ambition needed to limit global temperature rise to 1.5⁰C. This briefing summarises the main COP28 developments that board directors should know to understand the implications for their business strategy and investment decisions.

COP28: The first Global Stocktake and the UAE Consensus

The host of COP28, the United Arab Emirates (UAE), welcomed world leaders from almost 200 nations - the largest number of participants in the history of COP – to conclude the Global Stocktake and confirm the actions of each country to tackle climate change. The ‘UAE Consensus’ provided the final conclusions of the negotiations which includes:

- A transition away from fossil fuels in an orderly and equitable way in line with the science: countries committed to ‘transition away’ from fossil fuels and to maintain the language from COP26 to ‘accelerate efforts towards the ‘phase-down’ of unabated coal power’.

- Tripling renewable energy capacity and doubling energy efficiency by 2030: countries committed to triple renewable energy, and double energy efficiency and to accelerate clean hydrogen and nuclear energy. Carbon capture, utilisation and storage are also potential solutions to reduce emissions, particularly for the hard-to-abate sectors.

- Reducing methane emissions, reducing emissions from transport, and switching to zero and low-carbon fuels by 2050: countries committed to reducing GHG in different industries and phasing out inefficient fossil fuel subsidies that do not address energy poverty or just transitions, but none of these terms are defined.

- Food systems transformation and nature-climate integration to solve the climate crisis: there is recognition of the need for multisectoral solutions such as nature-based solutions, land-use management, sustainable agriculture and resilient food systems. The best available science and Indigenous People’s knowledge are both considered to implement those solutions.

A total of US$85 billion was pledged by governments to support the delivery of these commitments. The capital was divided into nine work streams:

- $61.8 billion to climate finance

- $8.7 billion to lives and livelihood

- $6.8 billion to energy

- $3.5 billion to the Green Climate Fund (GCF)

- $1.7 billion to inclusion

- $792 million to loss and damage

- $134 million to the adaptation fund

- $129 million to the least developed countries fund

- $31 million to the special climate change fund

Countries must now review and set new Nationally Determined Contributions (NDCs), the national action plans under the Paris Agreement, following the call to action of the UAE Consensus.

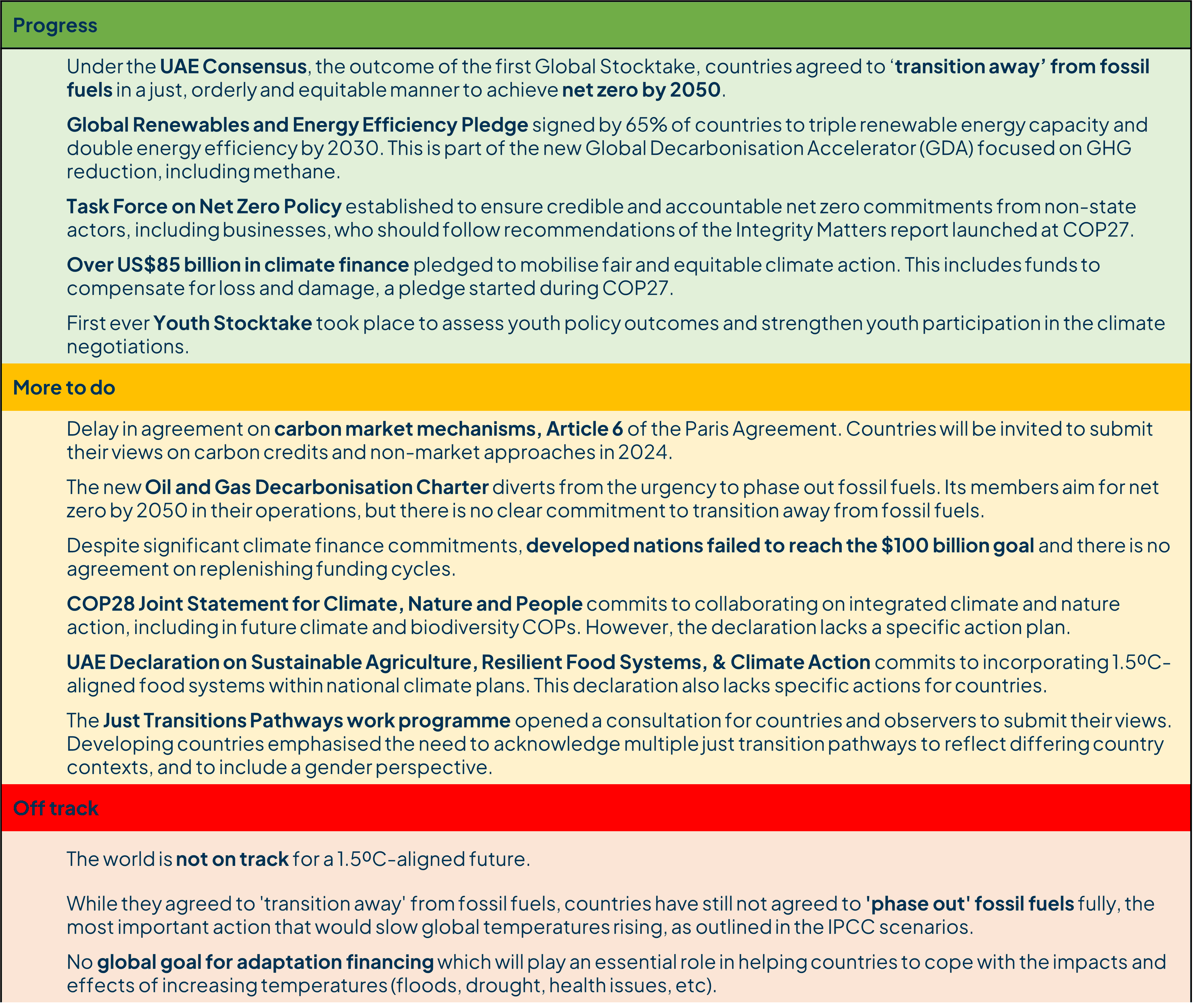

COP28 Scorecard: Progress at a glance

The scorecard offers a summary of the most relevant announcements or actions taken at COP28. Please see the Annex for policies and announcements relating to the scorecard outcomes.

Key messages for board directors

- The world is shifting away from fossil fuels towards low-carbon energy sources with a focus on renewables but recognising clean hydrogen and nuclear energy need to be part of the mix.

- Boards have a clear signal to consider the opportunities and risks of incorporating renewable energy into business operations, either generated on-site or through suppliers. Transitioning to renewable energy will likely be a significant decarbonisation strategy for businesses given the commitment from governments made at COP28. Over 400 organisations have already committed to going 100% renewable providing a great peer group to learn from and share good practices.

- As a result of the COP process, governments may introduce new policies favouring renewable energy business or penalising high-emission industries. Similarly, financial institutions may be likely to prioritise investment in low carbon energy projects over more traditional fossil fuel investment. Board directors will need to keep track of these developments to understand the implications for business strategy and investment decisions.

- Board directors may want to encourage engagement with policymakers to understand how the organisations can contribute to national plans to move away from fossil fuels, and request regulatory and financial support to do so.

- Increased investment in renewable energy and other low-carbon options may impact global energy markets and influence future energy prices. Boards may want to track the cost implications for the business to determine strategies for transitioning to clean energy within the organisation, as well as look at the potential risks and opportunities across the organisation’s value chain.

- The Taskforce on Net Zero Policy, formed at COP28, will support the creation of effective policy and regulatory frameworks to underpin net-zero commitments and accompanying transition plans by non-state actors, including businesses.

- Developing a clear transition plan will be a key tool for organisations to set a clear strategy and delivery plan to decarbonise business operations in line with becoming net-zero and nature-positive. The UN intends to hold non-state entities accountable for emissions reduction commitments and signals towards increasing expectations and requirements for corporate climate transition plans, similar to recent trends for sustainability reporting. Board directors may want to ask their boards what measures are in place to develop and implement a clear transition plan. The transition planning toolkit from Chapter Zero may help with that process.

- Governments, investors and civil society are increasingly demanding businesses to disclose transition plans and climate commitments, now tracked by the Net-Zero Data Public Utility (NZDPU) launched at COP28. The NZDPU, a new global repository of corporate data on climate change is open for public consultation until March 2024.

- The climate reporting landscape is shifting. Board directors should ensure that their organisation is ready to respond to these changes and disclose material information. At COP28, the Task Force on Climate-related Financial Disclosures (TCFD) was officially disbanded, with the IFRS Foundation's International Sustainability Standards Board (ISSB) taking over the TCFD’s responsibilities for corporate disclosure of climate targets, risks and opportunities. In addition to the TCFD recommendations, the ISSB sustainability standards require some additional industry-based metrics and information on corporate carbon credits.

- A global shift to jointly tackle nature and climate is gaining momentum. Policy and finance will increasingly align with this dual focus and businesses are likely to face heightened expectations. A pledge to transform the food systems will also support climate and nature by reducing biodiversity loss and GHG emissions.

- With increasing stakeholder expectations to disclose nature-related corporate information, board directors should consider reviewing whether nature is included within the organisation’s net zero strategy and whether it is a topic to raise in the boardroom. Board directors should also keep in mind that governments may suggest or enforce nature-related disclosure for businesses possibly adopting recommendations from the Taskforce on Nature-related Financial Disclosures (TNFD), which launched its sector guidance at COP28.

- Financial institutions are shifting to an integrated nature and climate response. The Glasgow Financial Alliance for Net Zero (GFANZ) aims to incorporate nature into financial sector transition plans in 2024.

- The global focus on nature alongside climate may impact the skills and competencies expected of board directors. Boards may want to cultivate leadership in addressing and managing climate and nature-related risks and opportunities. It will also be important to ensure there are appropriate skills and capabilities across the organisation to enable effective implementation.

- The unprecedented number of public sector climate finance contributions and pledges at COP28 will help to unlock private finance.

- COP28 recognised that public funds alone will not be sufficient to cover the required climate mitigation and adaptation action needed to deliver the binding commitment of the Paris Agreement. The UAE committed US$30 billion in public funding to mobilise US$250 billion of private funding through a new investment platform called ALTÉRRA. These investments will primarily support emerging markets and developing economies (EMDEs). Board directors may suggest their organisation look at options to access blended financing solutions, particularly in relation to operations in EMDEs.

- Although there were no major breakthroughs on carbon markets at COP28, it remains a pending item that countries will submit their views on in early 2024. Consideration of existing tools to support climate finance such as green bonds and internal carbon pricing may be helpful for boards to review in the immediate term.

Looking to the year ahead

COP28 concluded with agreement on the need to move away from fossil fuels, (the main contributor to climate change), in line with the science with country commitments to translate this into concrete action.

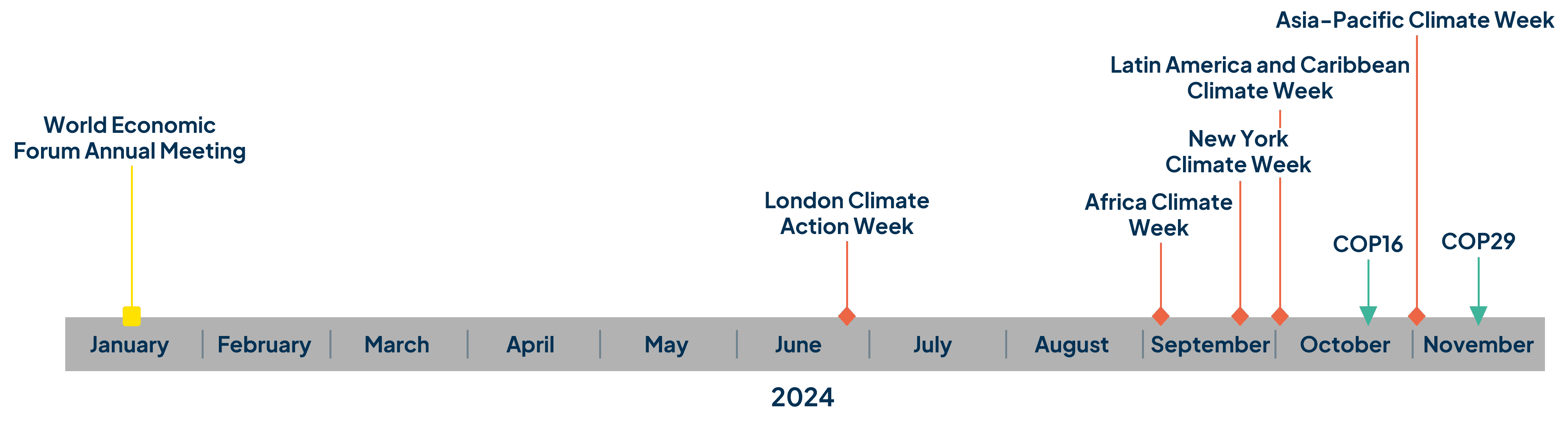

Countries will reconvene in Azerbaijan for COP29 in 2024, which is expected to have a strong focus on climate finance. Countries will also meet at the biodiversity summit, COP16 in Colombia, outcomes from which will be significantly relevant following the joint declaration on climate and nature. In 2025 at COP30, which will be hosted in Brazil, countries will be expected to submit their updated NDCs that should address and incorporate recommendations from the Global Stocktake which was finalised at COP28.

In the meantime, board directors may wish to consider closely observing or participating in the following climate-related events in 2024:

Annex – COP28 outcomes relating to our COP28 Scorecard

Energy

- The Global Decarbonization Accelerator (GDA) was launched at COP28 to fast-track reducing GHG emissions including methane. It is supported by the Global Renewables and Energy Efficiency Pledge, signed by 130 countries. This pledge aims to generate at least 11,000 gigawatts of renewable energy, which requires a tripling of current global renewables capacity, and double the global annual energy efficiency rate.

- The ambition to scale up nuclear energy was supported by 20 countries that signed the Declaration to Triple Nuclear Energy by 2050.

- The Declaration of Hydrogen, endorsed by 37 countries, sets an intention to prioritise clean hydrogen (produced using renewable energy sources) over fossil-fuel based hydrogen.

Net-zero transition

- A Task Force on Net Zero Policy was established to ensure credible and accountable net zero commitments from non-state actors, including businesses, who should follow the recommendations of the Integrity Matters report launched in COP27.

- Creation of the UN Net-Zero Export Credit Agencies Alliance (NZECA) which will support its members to transition to net zero by 2050 or sooner.

- Launch of the Industrial Transition Accelerator (ITA) for heavy-emitting sectors. The accelerator has $30 million to support emission-reduction projects.

Climate and nature

- A vision to tackle the climate and nature crisis together was announced through the Joint Statement on Climate, Nature and People. Future climate and biodiversity COP summits will work together to achieve both the goals of the Paris Agreement (1.5⁰C pathway) and those of the Global Biodiversity Framework (to halt and reverse biodiversity loss) by 2030.

- The intension to transform the food systems was formalised through the Declaration on Sustainable Agriculture, Resilient Food Systems, & Climate Action commits to incorporating 1.5⁰C-aligned food systems within national climate plans.

- The Nature Conservancy and Global Renewables Alliance announced that they will work on a strategy to deliver the aims of the Global Biodiversity Framework whilst working towards the COP28 energy pledge to triple renewables.

- The Taskforce on Nature-related Financial Disclosure (TNFD) released guidance for nine sectors to report on nature-related interactions. This includes guidance for hard-to-abate sectors such as oil and gas, and mining.

- Nine multilateral development banks (MDBs) agreed on nine common principles to define and track nature-positive finance.

Climate finance

- The Energy Transition Accelerator announced the adoption of a new framework for high-integrity carbon credits. The Accelerator aims to attract private capital to support the energy transition in low and middle-income countries.

- The New Global Capacity Building Coalition was created effectively deploy climate finance by assisting financial institutions in emerging markets and developing economies (EMDE).

- The four multilateral climate funds: the Adaptation Fund (AF), the Climate Investment Funds (CIF), the Global Environment Facility (GEF), and the Green Climate Fund (GCF), announced that they will collaborate to harmonise procedures, facilitate blended finance and boost the underfunded AF.

- A fund for loss and damage moved from pledges at COP27 into action at COP28. High-income countries pledged capital amounting to almost $800 million. The fund is expected to be fully operational with the World Bank managing establishment of the fund in the interim.

- Vulnerable countries will be supported by the newly created Task Force on Credit Enhancement for Sustainability-Linked Sovereign Financing. The Task Force will seek solutions to catalyse investment from the private sector and improve access to risk mitigation and credit enhancement.

- A roadmap for the financial sector to support just transitions was released by the UN Environment Programme – Finance Initiative and the International Labor Organisation, referred to as ‘Just Transition Finance: Pathways for Banking and Insurance.’

Recording: Key takeaways from COP28 for the boardroom

Watch the recording of our post-COP wrap-up webinar where an expert panel explore the key discussion points from COP28 and how to take these learnings into the boardroom.