Sustainability is shaping the way industry leader British Land does business. As one of the largest developers and operators of commercial property in the UK, British Land has found that sustainable buildings let faster, generate higher rents and benefit from premium pricing. Not only does it make business sense, but investors, employees and customers are increasingly demanding that sustainability is central to decision-making. It is also of key importance to the organisation’s board, three of whom sit on its Environmental Social Governance (ESG) Committee.

What is British Land?

British Land is a FTSE 100 property company that creates, owns and manages a diverse real estate portfolio across the UK.

The challenge

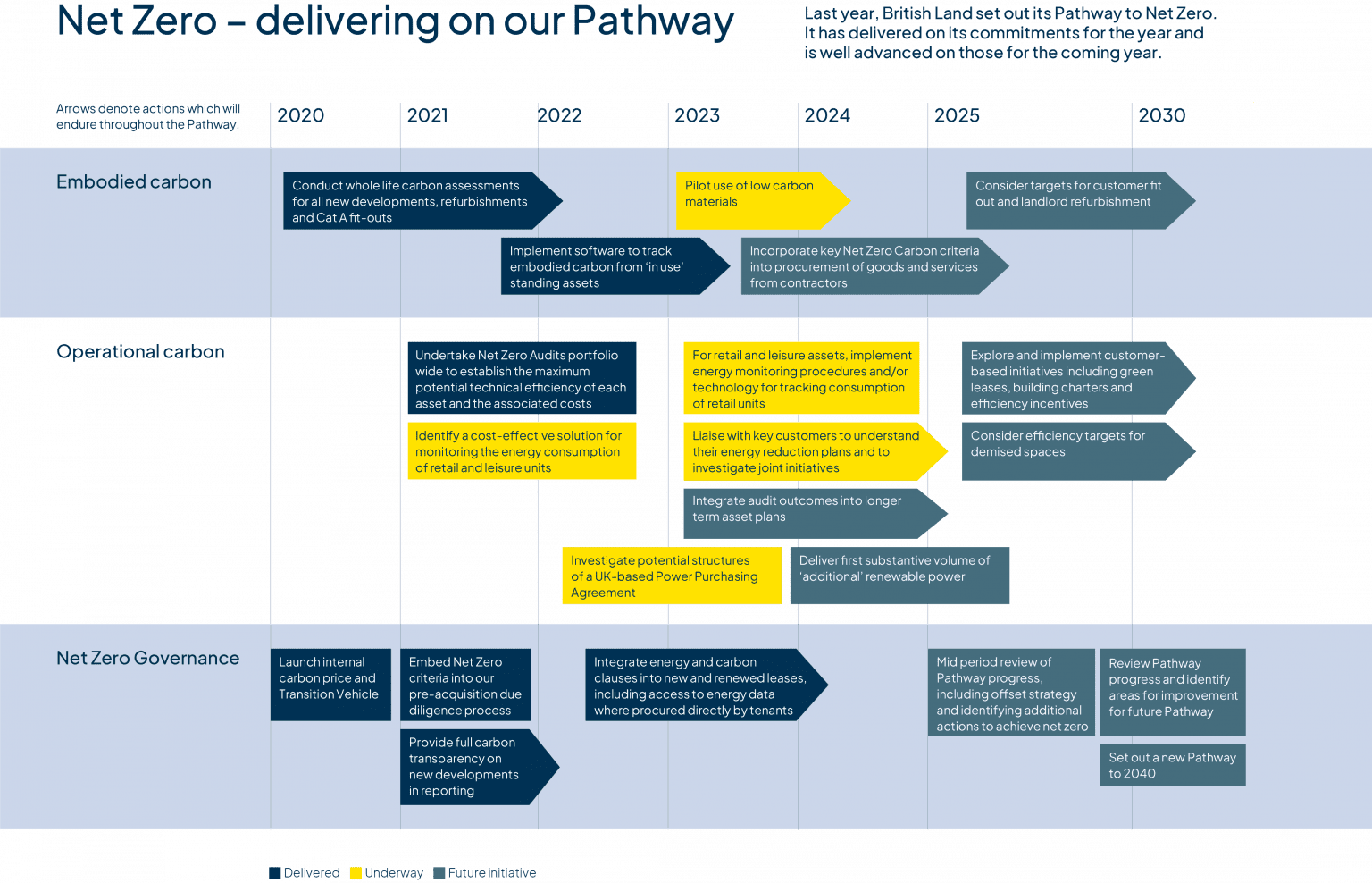

British Land set out a new sustainability strategy in 2020 that focuses on two time-critical areas where the organisation can create the most benefit: firstly, making its whole portfolio net zero carbon by 2030, including a target to reduce embodied carbon in developments to below 500kg carbon dioxide equivalent (CO2e) per square metre (sqm) from an industry benchmark of 1,000kg CO2e per sqm. The second part of the strategy focuses on collaboration to grow social value and wellbeing in the communities where British Land operates.

2023 commitments: 'Greener Spaces'

British Land has committed to achieving a net-zero carbon portfolio by 2030 and has set out clear targets to reduce both the embodied carbon in its developments and the operational carbon across its portfolios.

Embodied carbon

- 50% lower embodied carbon intensity at developments to below 500kg CO2e per sqm from 2030

- 100% of developments delivered to be net zero embodied carbon

Operational carbon

- 75% reduction in operational carbon intensity across portfolio by 2030 vs 2019

- 25% improvement in whole-building energy efficiency of existing assets by 2030 vs 2019

Making sustainability central to executive decision-making

British Land wants to ensure that sustainability permeates throughout the business and is integral to executive decision-making. All executives have a clear set of sustainability objectives that feed into remuneration. The ESG Committee includes five board members, including three non executives, as well as the CEO and CFO. It also includes the COO, General Counsel and HR Director.

The Corporate Sustainability Team sits within the COO team, reporting directly to the COO but with the CFO having overall board-level responsibility for sustainability. The Corporate Sustainability Team is responsible for sustainability programme management and reporting, including preparation of sustainability accounts and integration of sustainability within the broader organisational narrative. The team delivers key projects to meet the organisation’s 2030 targets (set out in its Sustainability Strategy) and continues to achieve top ratings in key ESG indices.

2023 commitments: Environmental leadership

British Land demonstrates the strong process it is delivering by participating in leading international benchmarks.

GRESB 2022: 4-star rating for Standing Investment, 5-star for Development (sector leader), Green Star

CDP 2022: BA- score

EPRA Rating 2022: Gold

MSCI ESG Rating 2022: AAA

FTSE4Good Index 2022: Top 88th percentile

Science Based Targets: approval in 2021

Full Climate-related Financial Disclosure

From 2022, British Land started reporting in full alignment with the Task Force on Climate-related Financial Disclosures (TCFD) , working with the support of Willis Towers Watson. Its first draft of disclosures were reviewed by the organisation’s Risk Committee, which reports to the Audit Committee. This process was also of interest to the ESG Committee, which was given the opportunity to comment on subsequent drafts.

What sets British Land apart from its peers is its process, which includes conducting physical and transition risk scenario analyses to assess and quantify material climate risks to the business. The organisation believes that its analyses and transparent climate disclosure demonstrates leadership. Many other reporting companies appear to have either not quantified these impacts, or to have not disclosed the outcome of their analyses.

2023 commitments: Thriving Places

British Land’s approach means understanding the most important issues and opportunities in the communities around each of its places and focusing its efforts collaboratively to make the biggest impact at each place.

To deliver on this, British Land works directly with its community partners and collaborates with its customers to identify key local issues where they can make an impact.

It has three key focus areas for community investment, which are identified in its Local Charter:

- Education: needs-based initiatives at places and working with long-term partner the National Literacy Trust.

- Employment: needs-based initiatives at places. Initiatives include pre-employment training, virtual programmes, mentoring, work placements, graduate schemes, internships and apprenticeships.

- Affordable Space: supporting local business through the provision of affordable workspace, such as Thrive at Canada Water.

Reducing carbon emissions by 70%

As part of its approach, British Land introduced a new tool in 2020: an internal carbon price of £60 per tonne. This is applied to the embodied carbon in new developments. Roughly one third of this relates to the expected offset cost per tonne of embodied carbon and therefore £20 of this levy is included within development appraisals. The board approved the internal carbon price as part of the wider sustainability strategy.

The internal carbon price directly affects decision-making by reducing the returns associated with development, which incentivises the development team to identify opportunities to reduce embodied carbon at the planning stage. It also heightens awareness around embodied carbon more generally.

Embodied carbon in developments is a formal metric that British Land reports on annually. Its target is to reduce embodied carbon to 500kg CO2e per sqm from 2030, which represents a 50% reduction against the 2019 industry standard.

Above: British Land’s Pathway to Net Zero, 2020-2030

Sustainable retrofitting

The remaining £40 of British Land’s internal carbon levy is allocated to a Transition Vehicle. This Transition Vehicle provides ring-fenced funding for retrofitting the existing building portfolio for energy efficiency improvement and carbon reduction measures.

This activity helps the organisation to deliver against 2030 sustainability targets, including reducing carbon emissions by 75% across the building portfolio and delivering a 25% improvement in whole building energy efficiency. Progress against both of these targets, amongst other environmental KPIs, is linked to board remuneration. The Long-Term Incentive Plan for Executive Directors includes KPIs linked to the reduction of operational carbon and operational energy and the annual incentive plan is linked to progress on portfolio EPC ratings and performance in GRESB, the international real estate sustainability benchmark.

In addition to reducing carbon emissions, the retrofitting initiatives have the additional benefit of lowering energy costs for customers and also delivering an improved EPC rating, which is important groundwork to prepare for adjusting industry regulation which is likely to stipulate that buildings must be EPC A or B rated by 2030.

2023 commitments: ‘Responsible Choices’

British Land advocates responsible business practices across its operations and throughout its supply chain. Its key areas of focus are:

Responsible employment

- Investing in training and professional qualifications

- Connecting with its people

- Providing a safe working environment

Diversity and inclusion

- Improving gender diversity at all levels; maintaining a minimum of 35% female representation on the Board and reducing the gender pay gap

- Improving ethnic diversity at all levels; targeting a minimum of two Directors from an ethnic minority background and reducing the ethnicity pay gap

- Making its places more inclusive for everyone

Responsible procurement

- Mandatory modern slavery awareness for British Land staff

- Mandating prompt payment

- Responsible procurement standards

A whole-life carbon approach

British Land takes a whole-life carbon approach to the business. For example, it will not replace equipment (e.g. chillers and boilers) until it reaches ‘end of life’ use. This means that associated expenditure is generally part of the organisation’s day-to-day capital expenditure (CapEx), and is also the right thing to do from a whole-life perspective, since replacing equipment in a good state of repair increases embodied carbon emissions.

The additional investment required to improve the sustainability credentials of its buildings is also more than offset by the additional rent the organisation receives from its occupiers, for whom the sustainability credentials of the buildings they occupy is increasingly important. Research from JLL demonstrates that having any sort of BREEAM certification adds on average nearly 12% to rents, compared to equivalent buildings without a rating.

A recent example of British Land’s whole-life carbon approach is at its Broadgate Campus development, which includes its first net-zero carbon development at 100 Liverpool Street. The development retained almost half of the original structure, with more than half of all new materials used in the development from recycled sources, and 99.8% of waste diverted from landfill to date. This amounts to a saving of 40,000 CO2e – enough to offset energy consumption in over 10,000 homes.

| Energy efficiency 53% reduction in landlord energy intensity at Broadgate since 2009 – saving up to 17,850 tonnes of carbon annually.* |

| Renewable power 94% of the electricity British Land buys for Broadgate customers comes from renewable sources, working towards 100%. |

| Zero waste to landfill 100% of the waste British Land manages for Broadgate customers diverted from landfill since 2016. |

|  |  |

Carbon offsetting

In order to deliver net-zero carbon developments, British Land offsets residual embodied carbon emissions through certified schemes. Residual emissions are any greenhouse gas (GHG) emissions that remain after a project or organisation has implemented all technically and economically feasible opportunities to reduce emissions. British Land’s recent offset at 1 Triton Square supported a teak afforestation project in Mexico covering 4,270 hectares, which will expand by an additional 1,2000 hectares each year. The offsetting scheme also supports a Community Reforestation project in Ghana, which works closely with local farmers and plans to expand by 1,000 hectares each year.

1 Triton Square offsetting projects

British Land priorities the re-use of existing materials to minimise embodied carbon as far as possible. Where residual embodied carbon cannot be avoided by design and material choice, British Land offsets this through certified emission reduction projects.

British Land uses nature-based offset credits and, where possible, selects projects that also support biodiversity or have economic benefits for local communities.

| Teak afforestation project, Mexico | Located across the states of Chiapas, Nayarit and Tabasco, this project covers 44,270 hectares and will expand by an additional 1,200 hectares each year. The project delivers c. 390,000 tonnes of emissions reductions each year. |

| Community reforestation, Ghana | Restoring degraded forest reserves in Ghana with teak, indigenous trees and natural forest in riparian buffer zones. The project works closely with local farmers, some of whom are employed on the project and others are able to grow crops. The aim is to expand by 1,000 hectares each year. |

| Forest creation, UK | Supporting the planting of 23,000 trees through the Woodland Carbon Code. This is an additional commitment and not part of the formal offset for the 1 Triton Square projects. |

Impact

Not only do British Land’s net-zero initiatives stay ahead of regulation, but they also provide significant cost savings for its customers through reduced energy consumption.

The introduction of the Transition Vehicle has become an innovative mechanism for both incentivising the business to further reduce carbon emissions, while simultaneously providing funds to manage the retrofitting of older buildings in line with best practice.

All illustrations and tables reproduced from originals provided by British Land. With thanks to British Land for participating in this case study.