Financial System Benchmark 2025: How FS NEDs Can Take the Lead

This is a summary of a Climate Governance Initiative and Chapter Zero webinar that took place on 3 April 2025.

It featured Andrea Webster, Head of Finance System Transformation at the World Benchmarking Alliance (WBA) and Paul Druckman, WBA Supervisory Board Chair and Chapter Zero Fellow. They introduced the 2025 Financial System Benchmark results before an informal conversation around what they mean for NEDs. The presentation slides can be found here.

The financial system is not just one sector among many—it is the “connective tissue” that binds all others. That was a message from Andrea Webster of the World Benchmarking Alliance (WBA), as she introduced their 2025 Financial System Benchmark.

Unlike other initiatives, the Benchmark maps the entire flow of financial decision-making—from asset owners and managers to insurers and banks—enabling a full picture of where influence and accountability lie. WBA is not a standard-setter. Instead, it consolidates existing standards and frameworks into a single methodology, providing a “guiding star” for directors navigating a noisy and fragmented sustainability landscape.

Why this matters?

With political headwinds against ESG and increasing regulatory complexity, board directors need reliable, cross-cutting insights to guide decision-making. The WBA’s benchmarking work offers not just data, but direction.

As we move from voluntary principles to measurable impact, non-executive directors are in a prime position to steer organisations toward long-term value creation—across people, planet, and profit.

Key Insights from the Benchmark

1 - From Commitment to Impact

- 60% of institutions now assign sustainability responsibilities — but few link these to real-world outcomes.

- Boards must move from box-ticking to bold strategy: embed sustainability in core business, not just compliance.

2 - Emerging Markets are Being Overlooked

- Net zero success depends on emerging markets — yet capital is flowing in the wrong direction.

3 - Nature Is Financial

- Finance is ahead of the real economy in assessing nature impacts — a sign the sector sees biodiversity loss as a systemic risk.

- Nature is no longer a “nice to have”—it's a material operational and supply chain risk and strategic priority.

- Goldman Sachs and BlackRock are circling opportunities in nature: as soon as practical roadmaps appear, boards should expect the pace to pick up fast.

4 - Transparency Gaps Undermine Trust

- Big disconnect: Bloomberg says 65% of GFANZ members have transition plans; WBA analysis finds only 3%.

- Boards set the tone. Without public proof of progress, credibility erodes.

5 - Human Rights: Core Business, Not DEI

- Only 25% of institutions claim to respect ILO standards — even fewer show how.

- This is straight up risk management. Think of Sri Lanka’s 2022 political crisis — unstable transitions have consequences.

6 - Geography Shapes Leadership

- The top scorer is Malaysian bank showing that leadership is global.

- Africa’s strong showing reflects disclosure frameworks. LATAM benefits from national taxonomies.

- ESG priorities must fit local ecosystems, economies, and cultures.

7 - Subsector Gaps Reveal Missed Potential

- Pension funds, SWFs, and alternatives lag — surprising, given their long-term outlooks.

- Even top performers score under 50/100. That’s not a ceiling; it’s white space for leadership.

8 - Governance: Low-Hanging Fruit

- Strongest scores are on regulated basics: anti-bribery, grievance channels, etc.

- Boards can immediately tighten executive oversight by using available scoring tools to sharpen their questions.

9 - Strategic Blind Spots = Big Opportunities

- Lagging areas like living wage, just transition, and human rights are ripe for leadership.

- These issues are front and centre at the UN — smart alignment now could unlock major long-term gains.

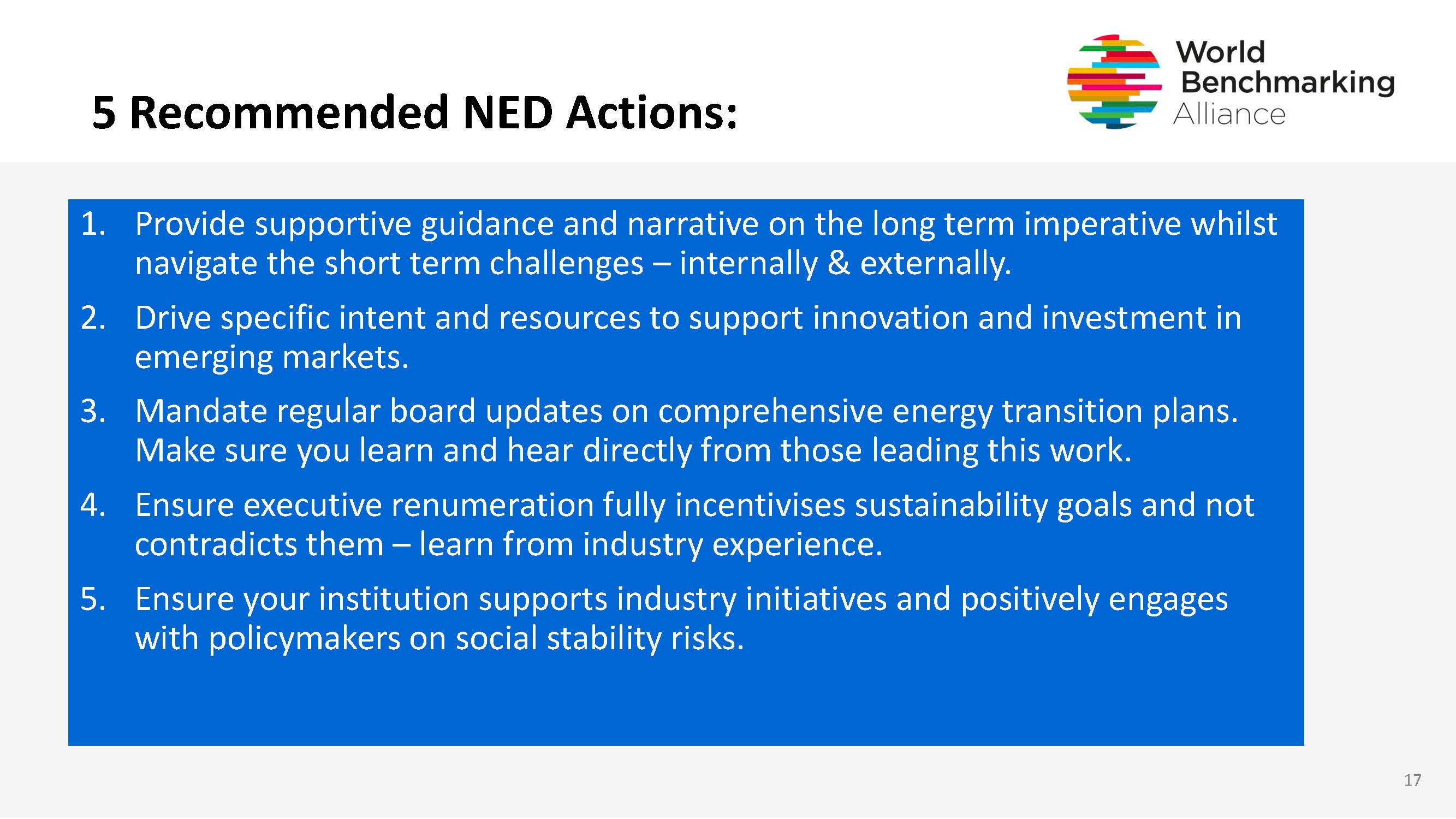

To lead on the strategic integration of sustainability factors, Andrea Webster emphasised the critical link between executive remuneration and sustainability objectives. “It’s natural human behaviour,” she explained. “We’re motivated by incentives.” The upcoming report from her team, due later this month, will delve deeper into these correlations and offer concrete guidance. But for now, the message is clear: executive pay must be aligned with long-term sustainability goals—and, crucially, must not contradict them.

This isn't just a theoretical recommendation. Industry trade bodies are actively defining best practices, learning from what hasn’t worked, and refining what does. Andrea urged board members and stakeholders to ensure these principles are embedded via remuneration committees to drive consistency and accountability from the top down.

Other themes raised by Andrea and Paul in their conversation include:

The Rise of Social Issues

Social issues are rapidly moving up the agenda, with Andrea Webster observing the “largest increase in questions” from financial institutions in this space. Pension funds with dual mandates are already leading, and a rich ecosystem of initiatives exists for others to engage with.

Andrea’s advice: Get involved—with both policymakers and industry groups. Financial institutions bring a critical perspective to investment processes that regulators often lack. With the link between social risk, financial stability, and long-term value now undeniable, this is a strategic priority.

Culture and Narrative

Webinar participants identified “culture and narrative” as a key concern—and Andrea agreed. “The connection between governance, climate, and tone from the top is so crucial,” she said.

Strategy alone won’t deliver change. Unless sustainability goals shape everyday roles and incentives, progress will stall. In highly regulated sectors like finance, defaulting to business-as-usual is common. That’s why bold board signals and empowered mid-level staff are essential.

“It’s about translating sustainability into the language of finance—and giving people permission to think differently.”

Visibility vs. Vulnerability

When asked about CIMB topping the WBA benchmark, Andrea celebrated their leadership. “They’re taking a clear, strategic, board-level approach in a complex region.” She also noted ING’s long-term commitment, despite facing scrutiny and litigation.

But she flagged a structural risk: institutions leading on sustainability often become more exposed, while laggards remain invisible. That dynamic must change. Greater collaboration between progressive institutions and civil society is key to shifting incentives and protecting leadership.

Diverse Regions, Shared Commitment

Paul Druckman highlighted a standout feature of the WBA benchmark—geographic diversity among top performers. Andrea agreed: from Cathay in Taiwan to NAB in Australia, leadership is emerging in diverse regulatory and cultural settings.

This validates the WBA’s rigorous scoring and reinforces a key message: with the right governance and culture, meaningful sustainability leadership is possible anywhere.

The Lending Gap

Paul Druckman spotlighted a persistent weak point in sustainable finance: lending decisions. Andrea agreed—many firms have robust ESG policies, but these often break down when applied to actual portfolios.

“There’s a disconnect between what’s on paper and what’s in the book,” she said. The solution? Don’t reinvent the wheel. Tools already exist, especially from the nonprofit and policy worlds. She recommended starting with the Impact Management Platform and exploring insights from the Alliance for Financial Inclusion. These tools can help boards turn policy into practice.

The Changing Role of the Non-Executive Director

Andrea reflected on her early days as a hedge fund NED: “It was about common sense and compliance.” That’s no longer enough. Today’s NEDs must bring insight, foresight, and the ability to navigate uncertainty.

Paul Druckman agreed. “You can’t just look in the rear-view mirror anymore.” Regular engagement with chairs and stakeholders is critical. “You won’t understand what matters to employees, customers, or regulators if you only rely on executive briefings.”

But should every NED be a sustainability expert? Not necessarily, said Druckman. But baseline understanding is non-negotiable—just like financial literacy.

“You don’t need to know every technical detail, but you must understand concepts like net zero, nature risk, or regulatory change,” he explained. “It’s about knowing what you don’t know—and closing the gap.”

Legal Risk and Lifelong Learning

Both speakers emphasised the need for continuous education. “Earlier in my career, I thought I knew enough,” said Druckman. “Now I know that I don’t.”

He pointed to the UK Corporate Governance Code, which requires boards to promote sustainable success and contribute to society. With groups like ClientEarth increasingly holding directors to account, ignorance is no longer an option.

The Rise of the ‘Neutral’ Board Member

“It’s pretty sad at the moment,” Druckman said candidly. What’s emerging, he noted, is a kind of boardroom ambivalence: “The neutral.” These are board or trustee members who aren’t actively opposing sustainability initiatives, but neither are they championing them. For a time, the momentum of progress carried such members along. Now, in the face of political backlash and corporate caution, their neutrality has started to act more like resistance — a subtle but significant shift.

The once clear divide between “pro” and “anti” has blurred. “Everybody is sort of looking at what they can and cannot say,” Druckman noted, “and whether they want to be bold or not bold.” This hesitation, he warned, is echoing throughout the financial ecosystem — especially through supply chains — stalling collective ambition.

As perceptions of sustainable finance evolve, Paul Druckman reflected on a shift from admiration to skepticism: “It progressed from good to very good to ‘wow’. Now, I think that pedestal is coming down a little.” Still, Andrea Webster noted that leaders like Larry Fink continue to champion a vision of democratised capital and shared prosperity—one that could shape the next chapter.

For Webster, innovation is where resilience will be forged, especially in insurance and risk-driven sectors. “Big institutions are going to create new markets because they have to,” she said, warning that traditional debt structures won’t meet the moment. Her hope? That a common narrative of innovation can emerge, even in an increasingly volatile world.

Boardroom Cultures and Global Complexity

The conversation turned to how NEDS operate across jurisdictions. Druckman cautioned against calling this a conflict of interest— “It’s different priorities and cultures”—and pointed to how local values influence governance.

Integrated reporting, for example, found fertile ground in South Africa and Japan, where leadership and cultural alignment supported its adoption. Europe, meanwhile, remains more fragmented. “It’s hard to guide through a very confusing picture,” he admitted. Still, bodies like the ISSB offer hope by providing a shared language for sustainability.

Both speakers agreed that fiduciary duty is interpreted differently across regions. Webster observed: “In Europe, the language is risk. In Asia, it’s opportunity.” These cultural lenses shape how directors perceive loyalty, prudence, and long-term value.

Druckman echoed this, recalling debates among UK regulators about redefining fiduciary duty to be broader and more proactive. While progress has been made, he warned that there’s a risk of regression. “I dread to think what might happen in the next few years.”

Referencing Professor Robert Eccles’s comparative research, Druckman emphasised that fiduciary concepts remain deeply rooted in local norms—there is no universal law.

The Future

Asked where the financial system is heading, Webster offered cautious optimism. “The narratives are pivoting, but the intent is still there,” she said. Institutions are becoming more selective, she added, and aligning with areas where the economic case is strengthening, such as climate and energy efficiency.

Druckman noted that some firms are actively rethinking their sustainability messaging, asking: “Do we exclude? Do we reframe? Can we keep options open for the future?” Webster sees this as part of a broader evolution: “I’ve lived through CSR and ESG—it’s always changing. But what comes out the other side will be sharper.”

Yet Druckman left a sober warning. Quoting Mark Carney’s “tragedy of the horizon,” he stressed that action is urgent. “Financial services could become unfit for purpose if we’re not careful. The danger isn’t long-term—it’s right in front of us.”