The Role of Board Directors

This article draws on presentation insights and nine discussion take-aways from a workshop hosted by the Climate Governance Initiative’s Financial Sector Programme, part of its "Transition in Action" series. The session took place at Ecosperity in Singapore on 7 May, bringing together directors, executives, and other finance professionals to explore how boards can lead credible, forward-looking transition planning.

Full climate and nature risk assessments and transition plans — which might also be considered ‘resilience plans’ — are critically important for economies like those in South-East Asia, which are highly exposed to climate shocks and rely on carbon-intensive industries and fragile supply chains.

Climate disruption isn’t a future threat — it’s happening now, and transition planning provides a key tool for addressing climate and nature risk and for embracing the business opportunities of a transitioning economy. Transition planning will increasingly shape how companies attract investment, meet investor expectations, and qualify for government licenses, contracts, and trade. Boards directors therefore should consider the oversight of transition planning to be a core part of their current and emerging governance responsibilities

In support, several ASEAN governments are taking action to show global investors that the region is serious about transition. Examples include:

- Singapore’s Green Finance Action Plan 2.0: Through initiatives like the transition taxonomy and MAS’s $2 billion green investment programme, Singapore is creating a clear path for sustainable finance and business transformation.

- Indonesia’s Energy Transition Mechanism (ETM): In partnership with the Asian Development Bank, Indonesia is pioneering early retirement of coal plants, using blended finance to de-risk investment in renewables.

- Thailand’s Climate Finance Strategy: A whole-of-government roadmap aligning ministries to unlock climate investment—showing it’s possible even without formal net-zero laws.

- Vietnam’s Just Energy Transition Partnership (JETP): With $15.5 billion from G7 partners, Vietnam is committing to coal phase-out and energy diversification, but execution capacity and private sector engagement are still needed.

For corporate boards, the case for transition planning is reinforced by legal obligation. For example, in Singapore, a 2021 legal opinion by former Deputy Solicitor General Jeffrey Chan SC and others concluded that directors have a duty to account for climate risks when fulfilling their responsibilities—especially where those risks are material to the company. Failure to ensure appropriate governance and systems around environmental sustainability could even result in criminal liability under local statutes.

See the Directors’ Duties Navigator—developed by the Commonwealth Climate and Law Initiative and the Climate Governance Initiative—for more on legal duties.

Transition Planning: Universal Principles & Specific Application

Each unique company will approach transition planning and financing in its own way. However, there are some core governance tools and principles that can help board members effectively guide and oversee this process. These tools can be useful in both financial institutions and real-economy companies. For example, they can support boards in shaping investment strategies that focus on transition goals, or in assessing the transition plans of companies they invest in or lend to. For businesses seeking to attract funding for their own transition, strong governance around transition planning can help secure investment.

Governance Disclosure

As part of efforts to align global reporting standards, the IFRS has taken on responsibility for the Transition Plan Taskforce (TPT) Disclosure Framework. This framework outlines five key areas that companies should report on:

- Strategic Foundations

- Implementation Strategy

- Engagement Strategy

- Metrics and Targets

- Governance

Under the Governance section, the role of boards is highlighted. It outlines specific

responsibilities and leadership actions boards can take to make sure a company's transition plan is solid and trustworthy. The TPT also provides guidance on implementing each of these governance functions.

(Source: TPT Disclosure Framework P15: disclosure-framework-oct-2023.pdf)

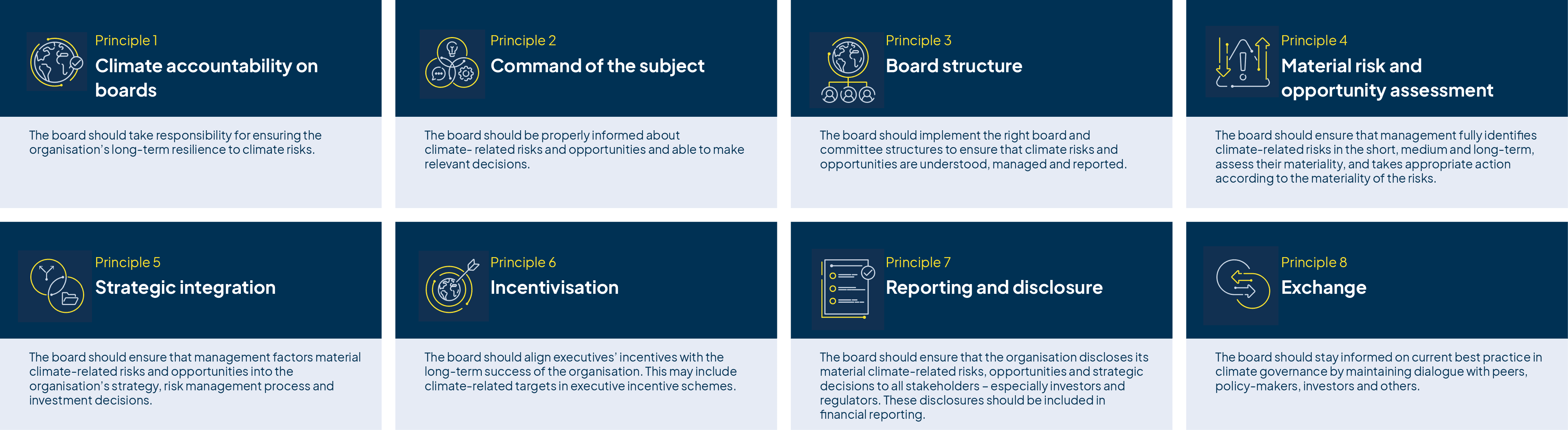

Using the WEF Principles for Climate Governance

The World Economic Forum’s principles for effective climate governance can further support boards in this area. Used alongside the TPT governance tools, these principles offer helpful guidance and practical questions boards can ask to make sure they are actively guiding their company’s transition efforts.

Nine Actions for Directors

At our Ecosperity workshop, participants worked in groups using the frameworks to explore where board leadership matters most. They identified nine ways directors can help companies assess climate risks, plan their transition, and build more resilient, value-driven strategies:

1. Align Leadership, Foster Collaboration and Create a Shared Vision

- Ensure alignment between the Chair, the board, and the executive team.

- Encourage collaboration across departments and with external stakeholders.

- Build a common sense of purpose around the transition journey and shared long-term vision.

2. Align Culture and Incentives

- Incentivise climate action internally to motivate staff and leadership.

- Use incentives tied to long-term goals, not just short-term performance.

3. Start with a Full, Expert Assessment

- Conduct a comprehensive baseline assessment of transition risks and opportunities.

- Bring in outside expertise where needed to support depth and objectivity.

4. Ensure Transparency and Accountability

- Report progress regularly to maintain board and stakeholder accountability.

- Set clear timeframes and expectations—use them as accountability mechanisms.

5. Improve Risk Quantification

- Quantify transition risks and ensure integration into risk management.

- Use external support if necessary to build capacity in risk assessment.

6. Embed Long-Term Thinking

- Avoid the “tyranny of the urgent”—the board must champion long-term resilience.

- Consider forming or updating sustainability committees with:

- Clear terms of reference (e.g. for effective oversight of risk assessments and transition planning)

- A mandate for longevity

- Flexibility to adapt to new information

7. Strengthen Board Leadership and Oversight

- Directors must see themselves as guides and tone-setters for transition.

- Upskill the board and executive teams—many may lack confidence or knowledge.

- Boards can support, pace, and coach rather than demand instant results.

8. Build a Roadmap for Disclosure

- Develop a transition disclosure roadmap aligned with evolving standards (e.g. ISSB, jurisdictional taxonomies).

- Link disclosures to broader strategy, risk, and capital allocation plans.

9. Upgrade Risk Systems

- Redesign Enterprise Risk Management (ERM) frameworks to:

- Fully integrate climate and transition risk

- Address historic blind spots where climate has been overlooked.