Introduction

CLP Holdings Limited (CLP or the Group) has a clear vision to decarbonise its operations and deliver upon its comprehensive net-zero goal, bringing customers and suppliers on board to accelerate the energy transition. Following the release of its Climate Vision 2050 in 2007, CLP has consistently consolidated its climate leadership in Asia by accelerating its own decarbonisation and financing the energy transition with sustainable sources of capital. The Group was also an early adopter of the double materiality approach to the assessment of sustainability-related risks and opportunities.

Company information and governance structure

CLP is one of the largest investor-owned energy businesses in Asia-Pacific with investments across Hong Kong, Mainland China, Australia, India, the Taiwan Region and Thailand. Listed on the Stock Exchange of Hong Kong, CLP’s business spans the entire value chain from power generation to transmission and distribution, to electricity and gas retail supported by smart energy services.

CLP embeds sustainability governance at all levels of the business, with the CLP Board having overall accountability for ESG reporting and broader sustainability matters, including climate action. A board-level Sustainability Committee is responsible for overseeing the company’s sustainability strategy and practices. This enables the Board to take a longer-term view of issues beyond the three-to-five-year time horizon. Meanwhile, the Audit & Risk Committee retains oversight and responsibility for material risks and reviews the assurance of CLP’s sustainability data.

CLP’s Sustainability Committee is also supported by the management-level Sustainability Executive Committee and the Group Sustainability Department. The Sustainability Executive Committee compiles the business and operational plans detailing how the organisation will reach its climate goals, which are put to the Board for approval. Meanwhile, the Group Sustainability Department coordinates delivery of the sustainability strategy and oversees the regular updating of CLP’s Climate Vision 2050, its materiality assessment, and its sustainability reporting.

Figure 1. CLP’s sustainability governance structure

The challenge

CLP is committed to achieving net-zero greenhouse gas (GHG) emissions across its entire value chain by 2050. This vision requires a full-scale transition away from coal-fired power generation to non-carbon emitting energy generation (including wind, solar, hydro and nuclear energy). The required transition is supported by diversification of core business activities into low-carbon energy infrastructure and services including electric vehicle charging and energy management of buildings. Decarbonisation is part of a three-pronged strategy, alongside digitalisation and workforce transformation, aimed at ensuring the organisation has the skills and technology needed to support the net-zero transition.

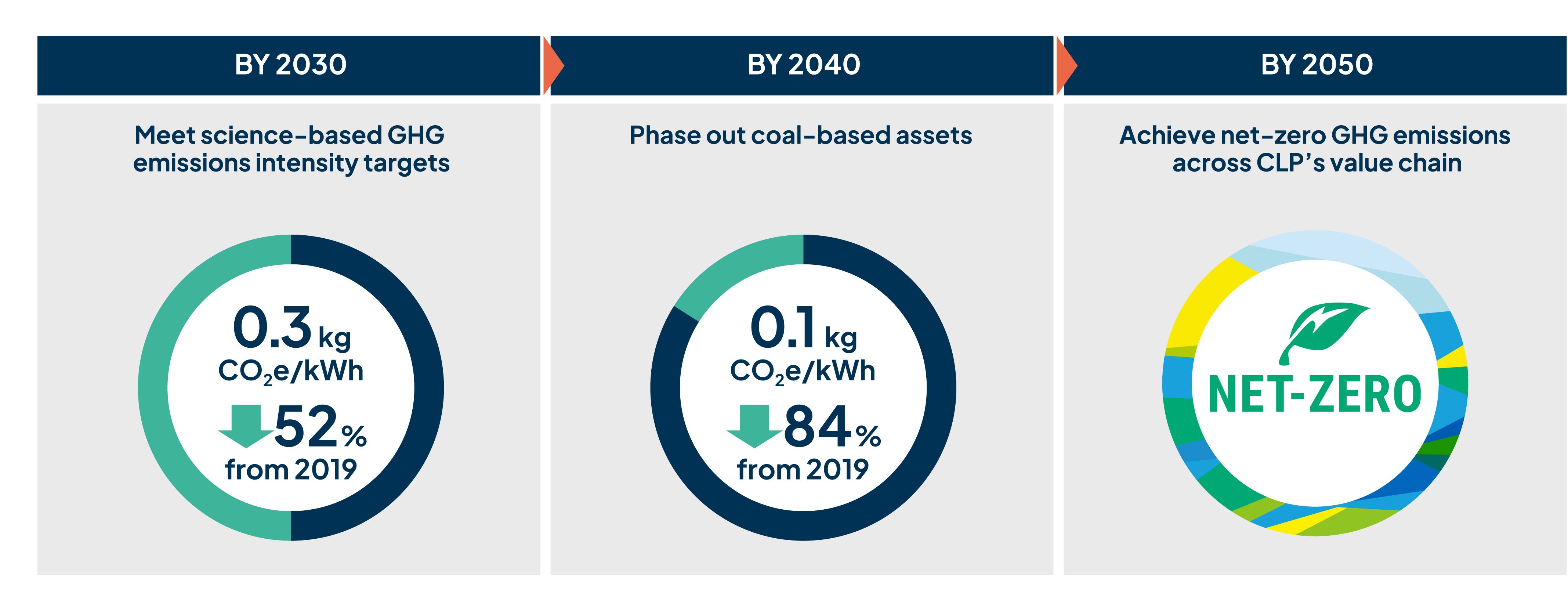

CLP’s Climate Vision 2050 sets out its transition pathway. It was last updated in 2021 to validate and align the company’s 2030 emissions-reduction targets with the Science Based Targets Initiative (SBTi) to limit global warming to well below 2°C above pre-industrial levels. CLP also revised its deadline for phasing out coal-fired power stations from an earlier version of the Climate Vision 2050, bringing it forward by 10 years to 2040.

Figure 2. CLP’s climate targets and commitments

Overcoming the challenges

Longer term view

CLP published its first Climate Vision 2050 in 2007, with a focus on its ambition to decarbonise existing operations while building a renewable energy business. The strategy established the company’s commitment to climate action. However, implementation required CLP to face difficult strategic choices, which could only be addressed if the Board considered a long-term view.

For example, when CLP first began investing in renewable energy generation, it was far from profitable. Even when considering government incentives the investment case did not stack up when compared to further investment in CLP’s existing fossil fuel power stations. There was also the question of whether the organisation should prioritise affordable energy for developing markets, even if that meant extending the use of fossil fuels, over a focus on growing renewable energy which might initially be more expensive for the end user. Despite these challenges, the Board affirmed the need to invest in renewable energy, enabling the business to take action to deliver on the priorities within its Climate Vision 2050 and ensure long-term financial stability.

Clarity of focus

These difficult conversations are ongoing, driven by a board-level ambition to accelerate decarbonisation and strengthen targets under CLP’s Climate Vision 2050 at least every five years. The Group is aiming to update its targets to accelerate its decarbonisation pathway and contribute to international efforts to limit global warming to 1.5°C. The rate of transition must be managed carefully, considering the impact of decommissioning coal-fired power stations on the stability of the electricity grid, energy demand and the affordability of electricity.

The process of updating climate targets and transition plans is a close collaboration between the management team and the Board, particularly the Sustainability Committee. This Committee plays a critical role in scrutinising plans, especially to ensure that they are aligned with the company’s long-term vision. As in many organisations, CLP’s Board can provide a clarity of focus to the organisation by stepping back from the day-to-day operations and, for example, asking why a particular target has been set, or whether an action is consistent with the company’s long-term goals. This board-level scrutiny and ambition ensures the business is not distracted by short-term trends or political issues.

Sharpening understanding of materiality

CLP’s materiality assessment helps the Board and the wider business to determine those sustainability related risks and opportunities that are the most important for CLP in the long term. This process has evolved as technology, global goals, community concerns and policies and regulation change.

In the 2021 reporting cycle, CLP became one of the first companies in the region to adopt a double materiality approach, which considers issues based on their financial impact on enterprise value as well as their material impact on the organisation’s stakeholders. In the same reporting cycle, CLP also issued a Climate-related Disclosures Report, which aligned with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations. It has since enhanced its methodology to align more closely with global disclosure initiatives including the IFRS S2 Climate-related Disclosures issued by the International Sustainability Standards Board (ISSB) and the new GRI 3 guidance from the Global Reporting Initiative (GRI).

The materiality assessment incorporates a review of the macro environment and expected changes to disclosure requirements and financial risks. A programme of rolling annual updates ensures that all stakeholders are regularly consulted and their views considered.

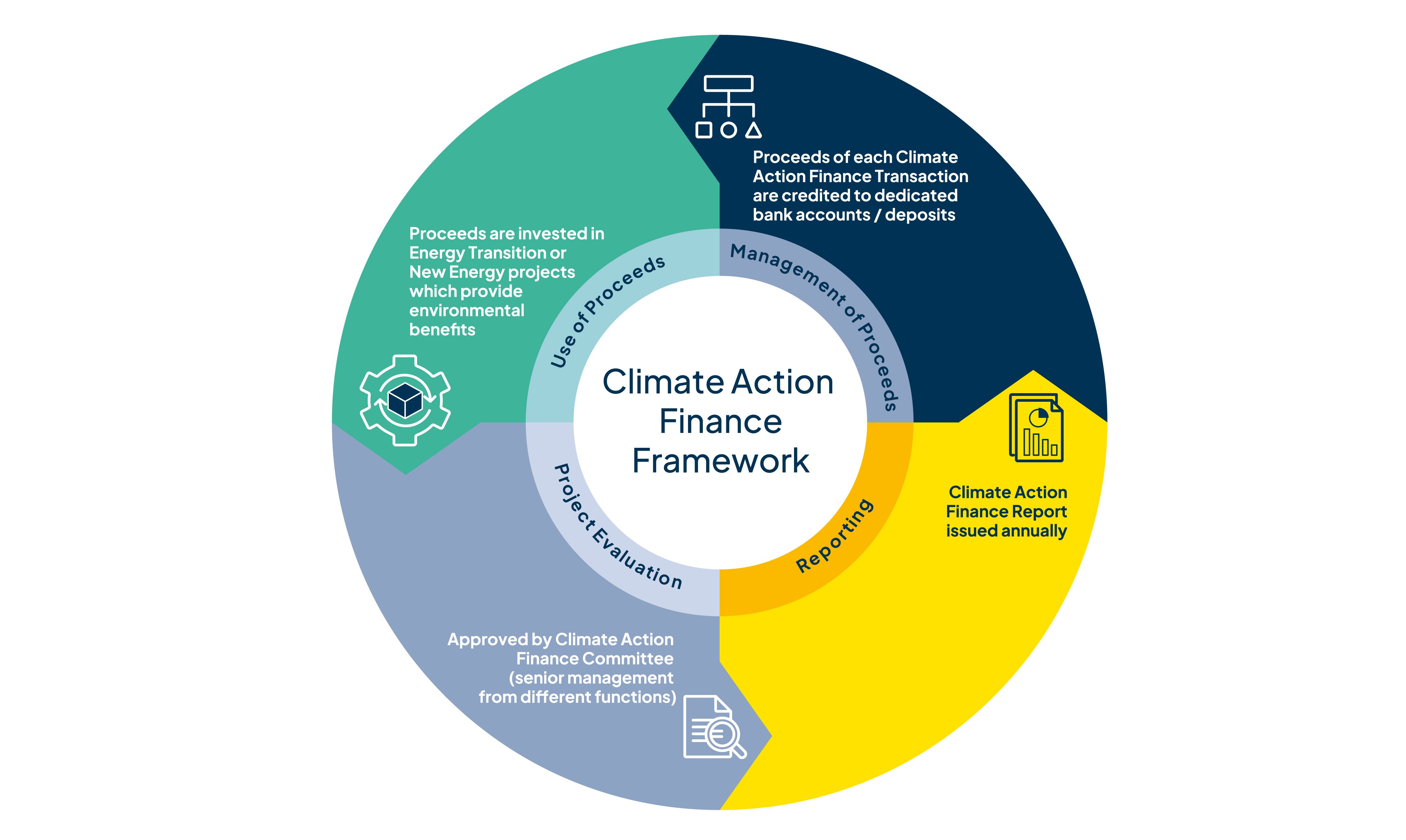

Climate Action Finance Framework

Transformation of the energy grid requires significant investment in infrastructure. Launched in 2017, CLP’s Climate Action Finance Framework sets out the organisation’s methodology to identify and allocate funding streams to invest in projects that deliver climate benefits. The Framework aligns with the Green Bond Principles, a set of voluntary guidelines issued by the International Capital Market Association. It also covers energy transition financing for government-supported investment that delivers significant environmental benefits. Furthermore, the Framework promotes transparency and integrity of disclosures through four core components including project evaluation and selection, use of proceeds, management of proceeds, and reporting. A second party opinion for the Framework was also obtained from DNV GL, an independent consultant and a leading provider of green bond assessments.

The Climate Action Finance Framework is an important part of the organisation’s transition to net zero. By the end of 2022, CLP had approximately HK$19 billion of climate action finance transactions supporting its investments in projects to reduce carbon emissions and increase energy efficiency. The Group also sees the Framework as part of its wider climate leadership ambition. The market for sustainable finance is still in its infancy in large parts of Asia. CLP hopes that its Framework will help to stimulate sustainable finance in the region, demonstrating how projects can be measured for their environmental, as well as financial, return. In addition, since 2021, CLP has incorporated sustainability elements within its banking facilities (which support general business operations in Hong Kong) providing a total HK$10.2 billion worth of bank facilities with performance targets linked to CLP’s emission-reduction targets. This, in turn, should encourage more banks to offer green bonds, loans and other forms of sustainable finance, ultimately delivering more diversified and cost-effective financing for investments that address climate change.

Figure 3. CLP’s Climate Action Finance Framework

Board-level climate education

Board-level education has been a fundamental enabler of climate action for CLP. A rapidly evolving climate landscape and increasing stakeholder expectations make it challenging for board members and senior executives to stay up to date. CLP regularly invites external experts to present at board meetings on the latest climate science or emerging regulatory trends. Importantly, presentations also focus on why investors care about these issues and the latest thinking on how businesses should respond to the climate emergency.

These presentations provide board members and management with important knowledge that supports a long-term view of key issues. They also enable board members to effectively review company plans in context, highlighting where operational plans appear to conflict with the organisation’s long-term strategy; for example, in deciding whether it would be more appropriate to shut down, or sell, a coal-fired power station rather than maintaining it.

The presentations also provide space for a broader debate around the implications of emerging trends for the organisation than might be possible within the confines of daily business operations. This is particularly helpful for establishing and reviewing the organisation’s strategic position on key issues.

Progress and impact

CLP has systematically worked to operationalise sustainability within its business, achieving its target to reduce the carbon intensity of its generation portfolio to under 0.8kg CO2/kWh by 2010 and under 0.6kg CO2/kWh by 2020. CLP has since reduced its GHG emissions intensity further, reaching 0.55kg CO2e/kWh in 2022. CLP has also brought forward its target to phase out coal-fired power stations by a decade, to 2040, in its latest Climate Vision 2050.

Meanwhile, renewable energy generation capacity has grown steadily, accounting for 16% of the company’s capacity in 2022, up from 14% in the previous year. Looking forward, CLP will continue to explore new opportunities to expand its clean energy portfolio, in particular in Mainland China and India.

Conclusion

CLP has set ambitious targets to decarbonise its operations and support its customers’ transition to a net-zero future, forcing it to confront some difficult strategic choices. A clear vision and mandate from the Board has been instrumental in delivering progress against the organisation’s climate goals.