What is corporate climate and nature disclosure?

Climate and nature disclosure are a subset of sustainability disclosure. These types of disclosure refer to the practice of organisations transparently reporting on climate and nature-related topics and criteria. ‘Climate change’ relates to greenhouse gas emissions whilst ‘nature’ is a broad term that refers to ecosystem services and environmental assets (such as biodiversity, water, land, minerals and energy).

Climate and nature disclosure provides a clear and comprehensive view of a company’s natural capital-related risks, opportunities, dependencies, impacts and performance. (Natural capital refers to the value of everything that has come from nature). This information is relevant to multiple stakeholders – investors, shareholders, employees, customers, local communities, and policymakers. Whilst voluntary climate and nature disclosure is encouraged, organisations may be mandated to disclose under a specific framework or standard depending on the jurisdiction(s) they operate in.

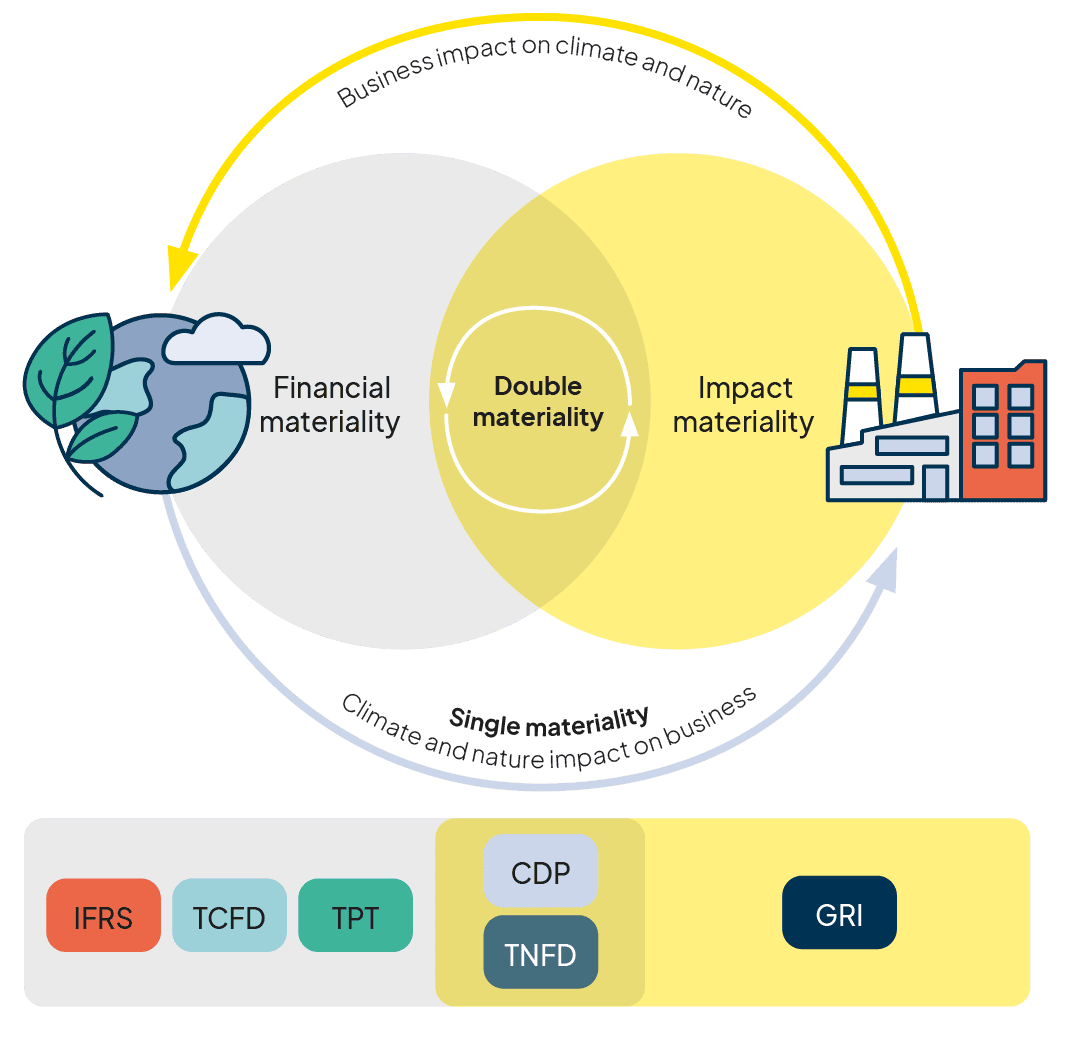

The standards used in climate and nature disclosure can be classified by their materiality approach, which often links to the type of stakeholder that typically uses the disclosed information:

- Standards that focus on financial materiality (single materiality) require organisations to disclose material risks and opportunities that climate and nature have on the business and that could affect its financial health. As such, it is useful for investors, lenders, assurance providers and financial institutions. This type of disclosure, also known as “outside-in” disclosure, includes risks associated with climate and nature dependencies, ISSB is an example of a standard which focuses on financial materiality.

- Standards that use impact materiality require organisations to disclose material dependencies and impacts the business has on climate and nature. This type of disclosure, also referred to as “inside-out” materiality, is relevant to policymakers, Indigenous Peoples and local communities, customers and the organisation’s workforce. It lends itself to ensuring transparency and accountability.

- Financial + impact materiality (double materiality), combines both approaches and provides a comprehensive picture of the organisation’s natural capital-related issues (risks, opportunities, dependencies and impacts), which board directors may find useful to inform strategic business decisions. CRSD, which aligns with the GRI standard, covers double materiality.

Figure 2. Materiality of climate and nature disclosures.